- Bitcoin experienced two major outflows from Coinbase last week.

- Correspondingly, the exchange's premium index also surged.

April 1st, Bitcoin [BTC] According to data from CryptoQuant, it was the second-largest outflow from major cryptocurrency exchange Coinbase.

According to the data provider, 17,000 BTC worth about $1 billion was removed from exchanges that day. Prior to this, on March 28th, the amount outflowed from Coinbase reached a total of 16,800 BTC.

Large outflows from Coinbase often indicate that large institutional investors are moving large amounts of their BTC holdings.

There can be several reasons for this, including diversification and allocation to other investment vehicles.

In the same opinion, CryptoQuant analyst Burak Kesmeci pointed out that the recent spike in BTC outflows from Coinbase could be “related to institutional investors or spot ETFs.”

Coinbase Premium Retrace

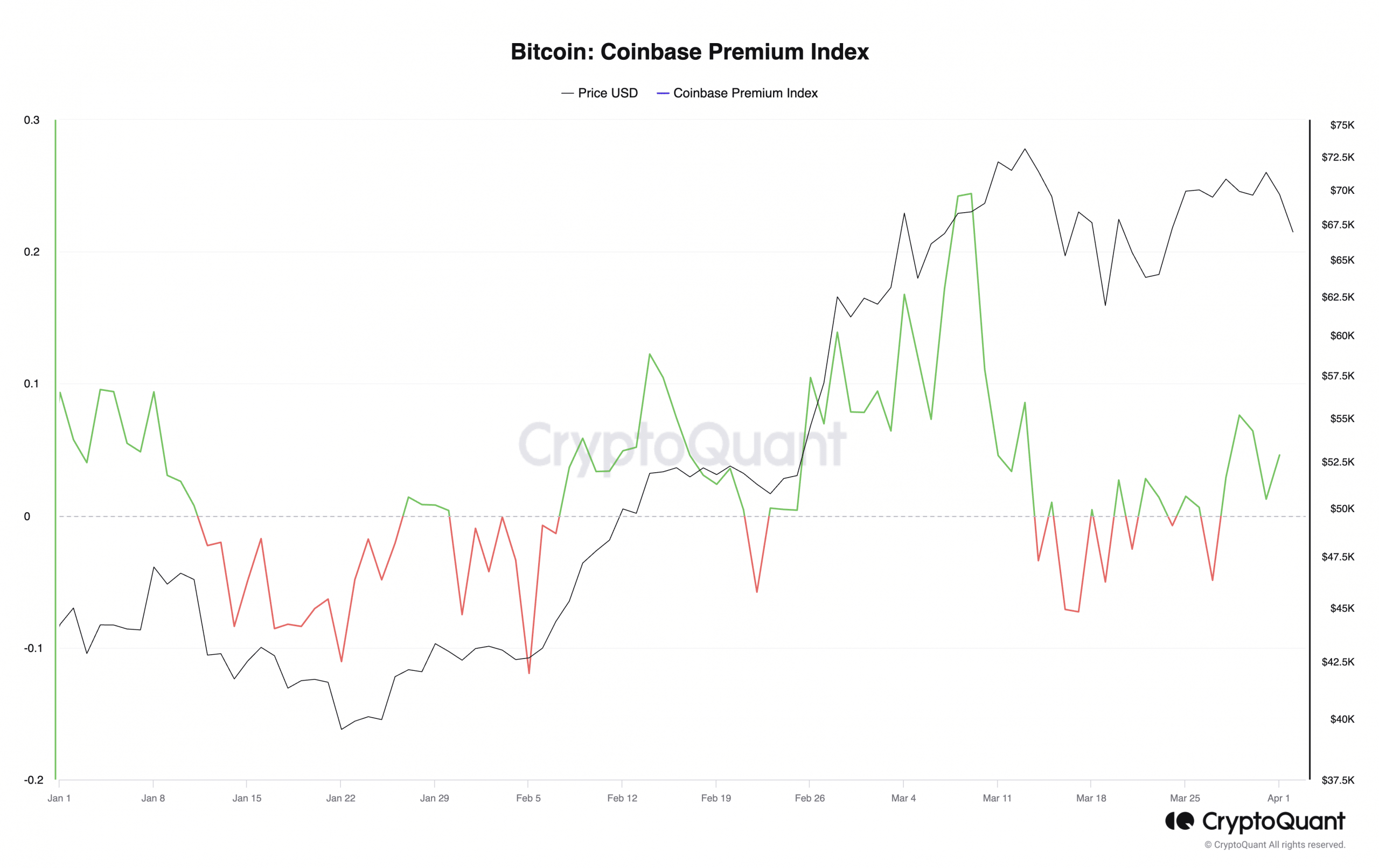

The mass removal of BTC from Coinbase on April 1 coincided with a reversal in the coin's Coinbase Premium Index (CPI).

On that day, the coin's CPI was about to fall into negative territory again, but changed its trajectory and trended upward.

Source: CryptoQuant

This indicator measures the difference between the price of BTC on Coinbase and Binance. An increase in its value would suggest significant buying activity on his Coinbase by US-based investors.

Conversely, a decline into negative territory would indicate a decline in trading activity on US-based exchanges. At the time of writing, BTC's CPI was 0.045.

Between March 31st and April 1st, this increased by more than 250%.

Confirming the resurgence of activity among US-based coin holders, BTC’s Coinbase Premium Gap also increased by over 200% in 24 hours.

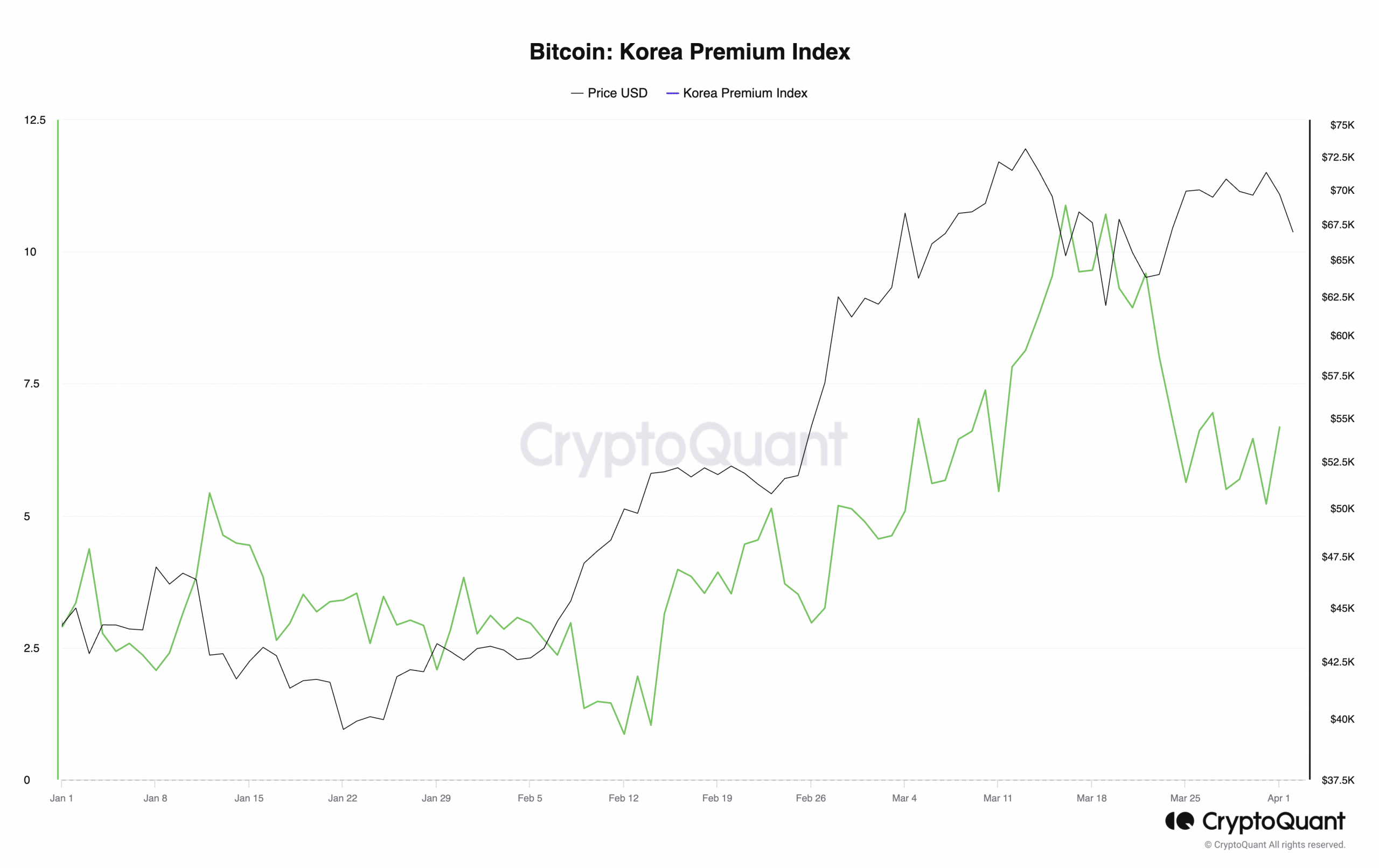

Asian markets followed a similar trend during the window under study, but BTC's Korea Premium Index (KPI) rating indicates that it will remain positive in 2024 despite multiple declines. was shown.

At the time of writing, BTC's KPI was 6.68.

Source: CryptoQuant

read bitcoin [BTC] Price prediction for 2024-2025

This indicator measures the BTC price difference between Korean exchanges and other global exchanges.

A positive index value suggests that the demand for Bitcoin within the Korean market is increasing compared to other markets.