- Bitcoin rainbow chart entered the “buy” zone after the 2020 and 2024 halvings.

- Market indicators pointed to a decline in prices over the coming days.

Investor confidence Bitcoin [BTC] Bitcoin price has dropped slightly as the king of cryptocurrencies failed to surpass $69,000. However, a Bitcoin rainbow chart revealed that BTC is indeed mimicking 2020 trends after the halving.

Does this mean BTC is ready to start climbing?

When is the right time to buy Bitcoin?

Bitcoin price volatility has been declining in recent days, which is creating problems for BTC, which has struggled to rise above $69,000.

However, investors should not be discouraged as BTC is mimicking the 2020 post-halving movement.

According to AMBCrypto’s analysis, a few months after the third halving, the Bitcoin rainbow chart revealed that the coin entered the “buy” zone. After staying in that zone for a few months, the price of BTC skyrocketed.

A similar trend was observed on BTC's 2024 rainbow chart, showing that the coin is in a buy zone.

Considering that, this could be the last opportunity for investors to buy BTC at a low price before the price rises and enters the accumulation and HODL zone.

Source: BLOCKCHAINCENTER

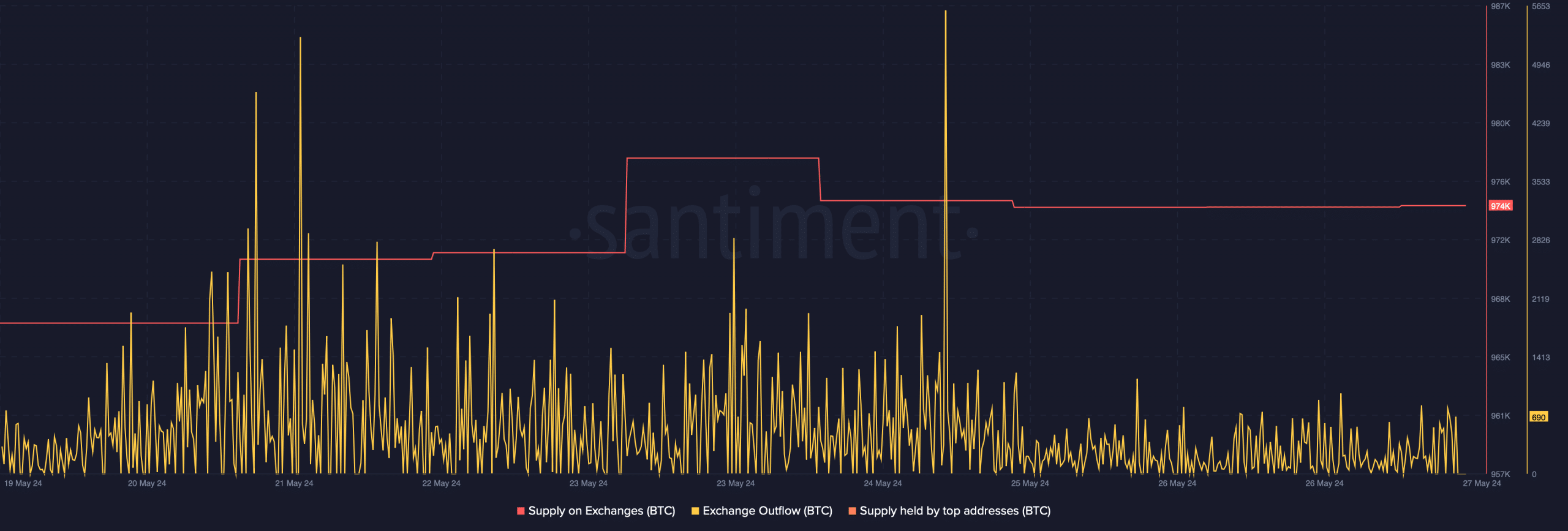

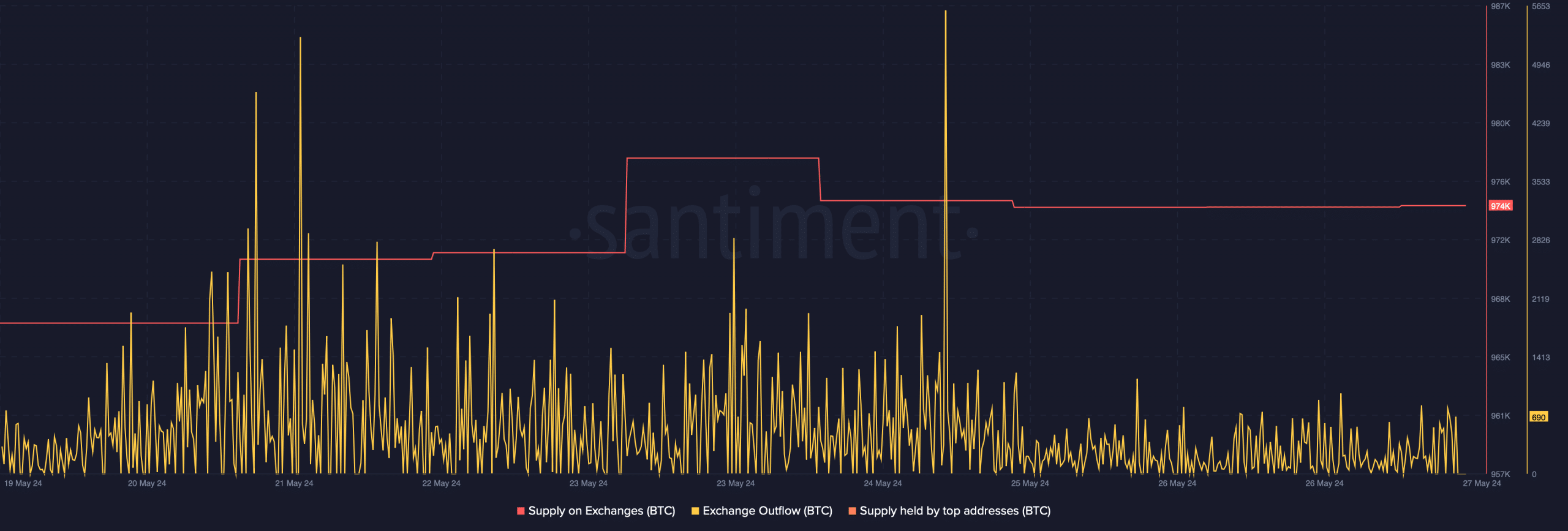

AMBCrypto then analyzed BTC’s on-chain metrics to see if investors considered buying BTC as suggested by the rainbow chart.

We saw outflows from exchanges decrease over the last week after spiking on May 24. As supply on exchanges increased, investors chose to sell.

Source: Santiment

CryptoQuant data It was revealed that net deposits on exchanges for BTC are higher compared to the average over the past seven days, further suggesting increasing selling pressure.

Separately, Coinbase Premium was in the red, implying selling sentiment prevailed among US investors.

Bitcoin's problems aren't over yet

AMBCrypto then waited to see if the increased selling pressure would lead to a price correction.

We could see that investors were not following suit as aSORP on the Bitcoin rainbow chart was red, suggesting that more investors were taking profits and selling, which if we are in the midst of a bull market this could signal a market peak.

At the time of writing, BTC Fear and Greed Index The value is 74, which means the market is in the “greedy” phase. When the indicator reaches that level, it indicates a price correction.

Source: CryptoQuant

Is your portfolio green? BTC Profit Calculator

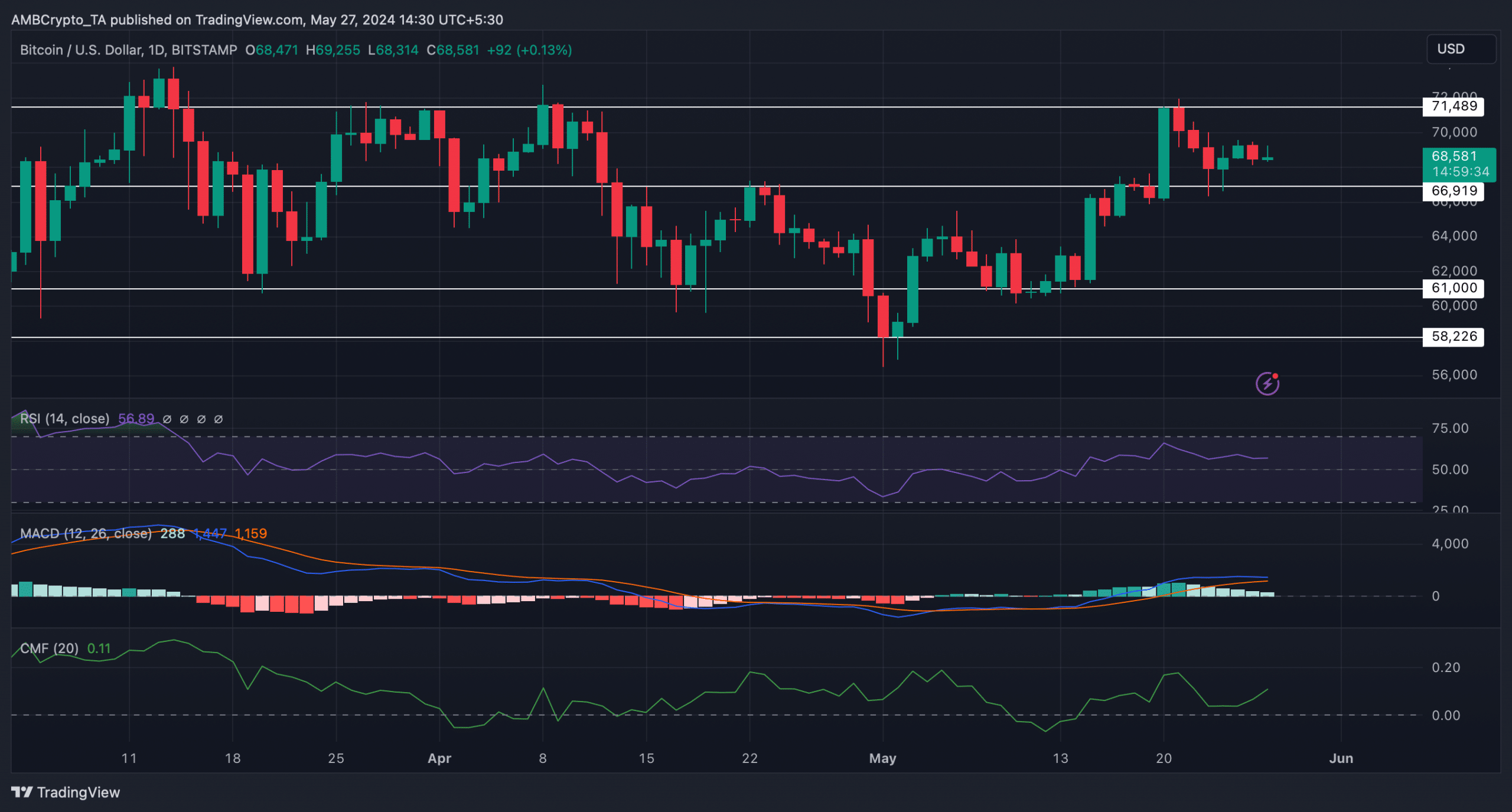

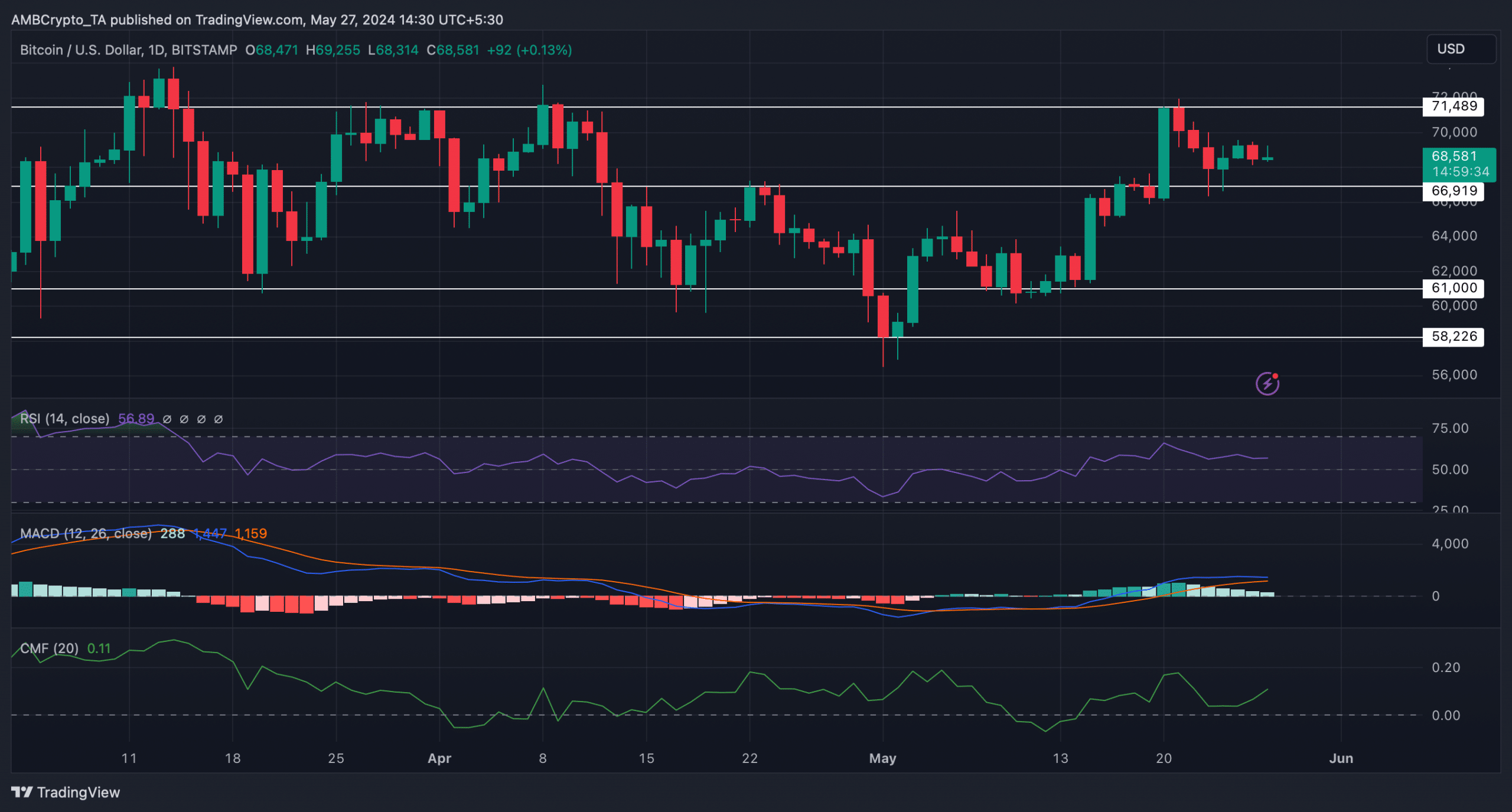

Like the indexes, most of the technical indicators also showed a bearish trend. For instance, the MACD showed a possible bearish crossover.

The Relative Strength Index (RSI) recorded a decline, indicating that the price will soon fall. Nevertheless, Chaikin Money Flow (CMF) rose and maintained its bullish trend.

Source: TradingView