The Bitcoin Spot ETF saw significant inflows on Monday, with more than $556 million inflows, the most since the first week of June.

Fidelity ETF (FBTC) led the way with $239 million in inflows, while Bitwise ETF (BITB) contributed $100 million. Additionally, the Ethereum Spot ETF saw net inflows of $17 million, reflecting increased institutional investor interest in the crypto market, according to SoSo Value data.

Of the 12 funds, WisdomTree and Hashdex Spot Bitcoin ETFs had no inflows. However, none of the ETFs experienced outflows.

Bitcoin was trading at $65,780 as of Tuesday morning European time, up 2.5% on the day after hitting a high of $66,486 earlier in the session. Ethereum also saw notable gains, trading at $2,620, up 3.5%, according to CoinGecko data.

A total of $183 million in liquidations occurred in the crypto market in the past 24 hours, the majority of which were due to short positions. CoinGlass data reveals that $136 million of shorts were liquidated, while $47 million of longs were also affected.

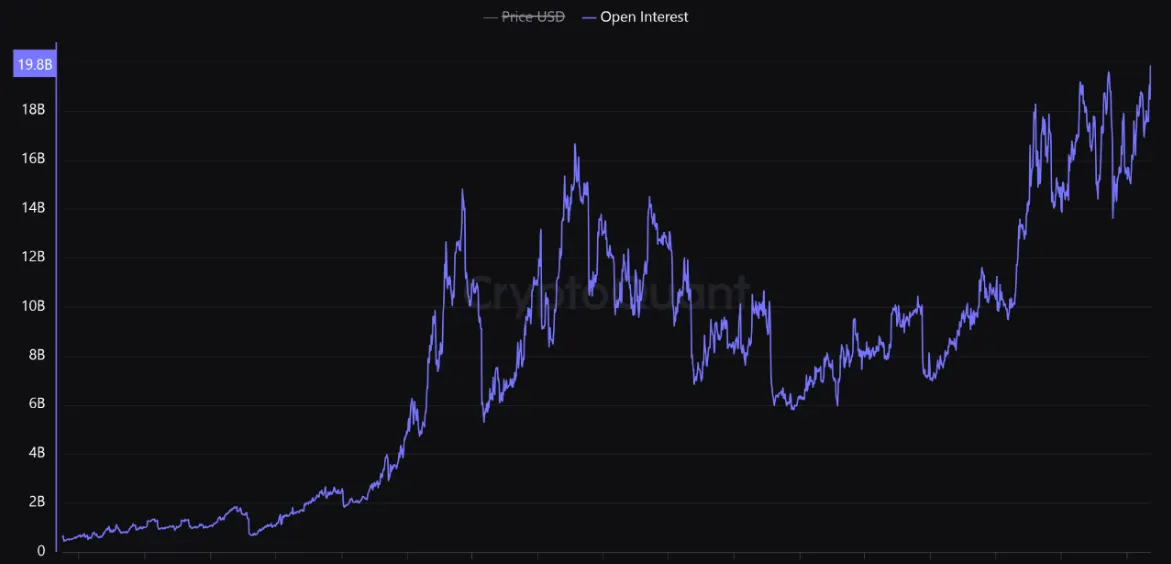

According to CryptoQuant contributor EgyHash, Bitcoin open interest in the derivatives market has reached an all-time high of $19.8 billion.

They write that the surge in open interest signals an influx of liquidity and increased attention to the crypto space. Additionally, funding rates have reached their highest positive levels since August, indicating that a large portion of this open interest is being driven by long positions. All of this indicates that market sentiment among traders is bullish.

Market analysts are closely monitoring Bitcoin's price movement as it hovers around key resistance levels, predicting further upward momentum if certain conditions are met.

In a memo sent to decryption10x Research writes that Bitcoin is showing signs of a bullish move. Open interest in Bitcoin options was $18.3 billion, lower than the $21 billion to $22 billion level seen when Bitcoin tried to break its downtrend earlier.

This drop in interest indicates room for a potential surge, especially as call buying increases. Additionally, BTC's 25 delta skew (a measure of the difference in implied volatility between puts and calls) has decreased. This shows that interest in bullish call options is increasing.

“With Bitcoin recently breaking above the $65,000 resistance level, we may see aggressive traders selling puts to buy calls, targeting further upside potential.” 10x Research pointed out.

They also employ strategies such as traders selling $60,000 puts and buying $75,000 calls at near-zero premiums, creating upside room for the November 29, 2024 expiration. He emphasized that there is. Experts say if Bitcoin breaks above seven-month downtrend resistance, its next target could be $70,000, potentially pushing it to new all-time highs as the US presidential election approaches. I think there is.

The Fed's dovish stance last month, along with interest rate cuts by other central banks such as the ECB and Asian central banks, is expected to push liquidity into positive territory. These actions are likely to support Bitcoin price in the short term. Analysts at 10x Research said: “The next 48 hours will be crucial to ensure Bitcoin breaks through resistance. It seems like it's within reach.”

Edited by Stacey Elliott.

daily report meeting Newsletter

Start each day with the current top news stories, plus original features, podcasts, videos, and more.