Activity on the Bitcoin (BTC) network is near historic lows, with traders significantly slowing trading in the two months since Bitcoin hit a new all-time high.

Insights from data analytics firm Santiment reveal that on-chain activity on the Bitcoin network has slowed over the past few months, underscoring the current state of the cryptocurrency.

In a May 11 update on X, Santiment highlighted that on-chain activity on the Bitcoin network is at its lowest since 2019. This observation stems from a visible downward trend in various metrics including transaction volume, daily active addresses, and whale transaction counts.

Santiment said Bitcoin's on-chain transaction volume is nearing its lowest level in a decade, while the number of daily active addresses is at its lowest since January 2019.

Additionally, the analytics firm's data shows that whale trades, typically worth more than $100,000, have slowed significantly, mirroring levels last seen in December 2018.

While the decline in on-chain activity may seem alarming at first glance, Santiment analysts believe there is a direct correlation to the impending BTC price decline, as witnessed in recent weeks. This suggests that there may not be.

Rather, they attribute the decline to “crowd fear and indecision” among traders, highlighting the complex relationship between on-chain activity and market sentiment.

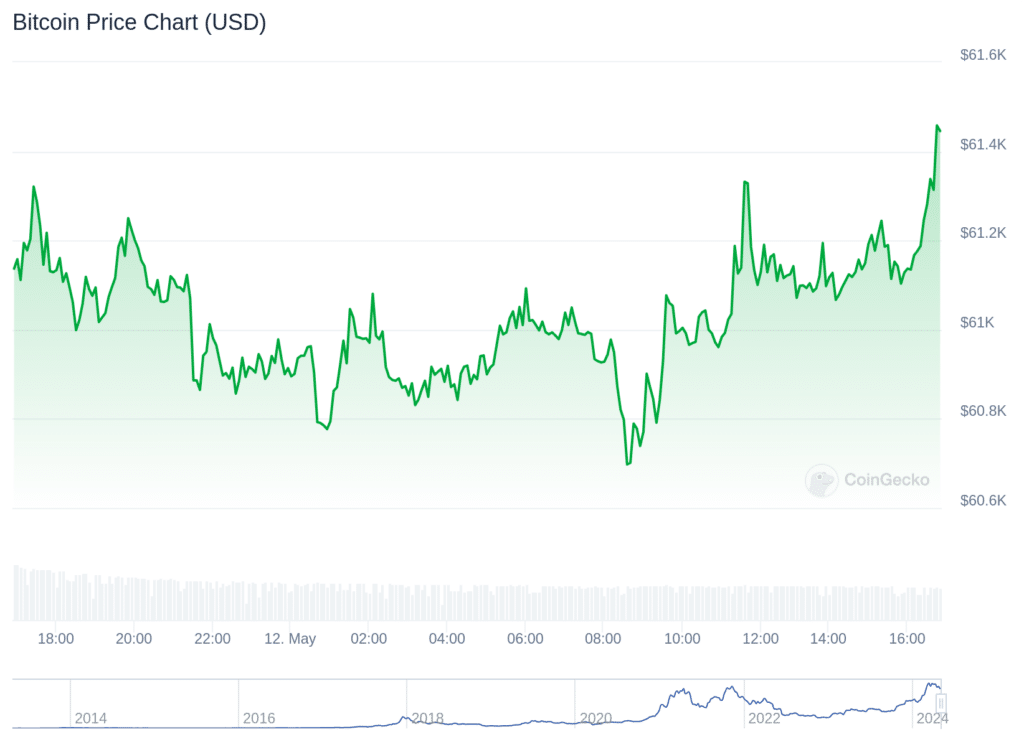

Despite these challenges, Bitcoin's price remained relatively stable at the time of writing, hovering just above $61,000, and rising just 0.1% in the past day.

The coin's 24-hour trading volume hit $12.67 billion, down more than 37% from the previous day.

According to data from CoinGecko, the price of Bitcoin fell by 4.6% in seven days, underperforming the global cryptocurrency market, which fell by 4.2%.

Market sentiment and broader economic factors are likely to play a pivotal role in shaping Bitcoin’s trajectory in the coming weeks as investors navigate this period of consolidation and subdued on-chain activity. .

Bitcoin, Rune Protocol

Bitcoin's Runes protocol has collected $135 million in transaction fees on the cryptocurrency's largest blockchain, according to Dune Analytics' dashboard.

According to on-chain data, tokens issued under this standard incurred costs of over 2,100 BTC within a week after the halving.

Since then, activity has slowed. According to the Dune analytics dashboard cited by The Block, the Runes protocol saw its lowest level of activity on Friday, May 10th.