- The increase in difficulty has increased miners' daily earnings.

- With many miners cashing out their BTC, the price of the coin may fall.

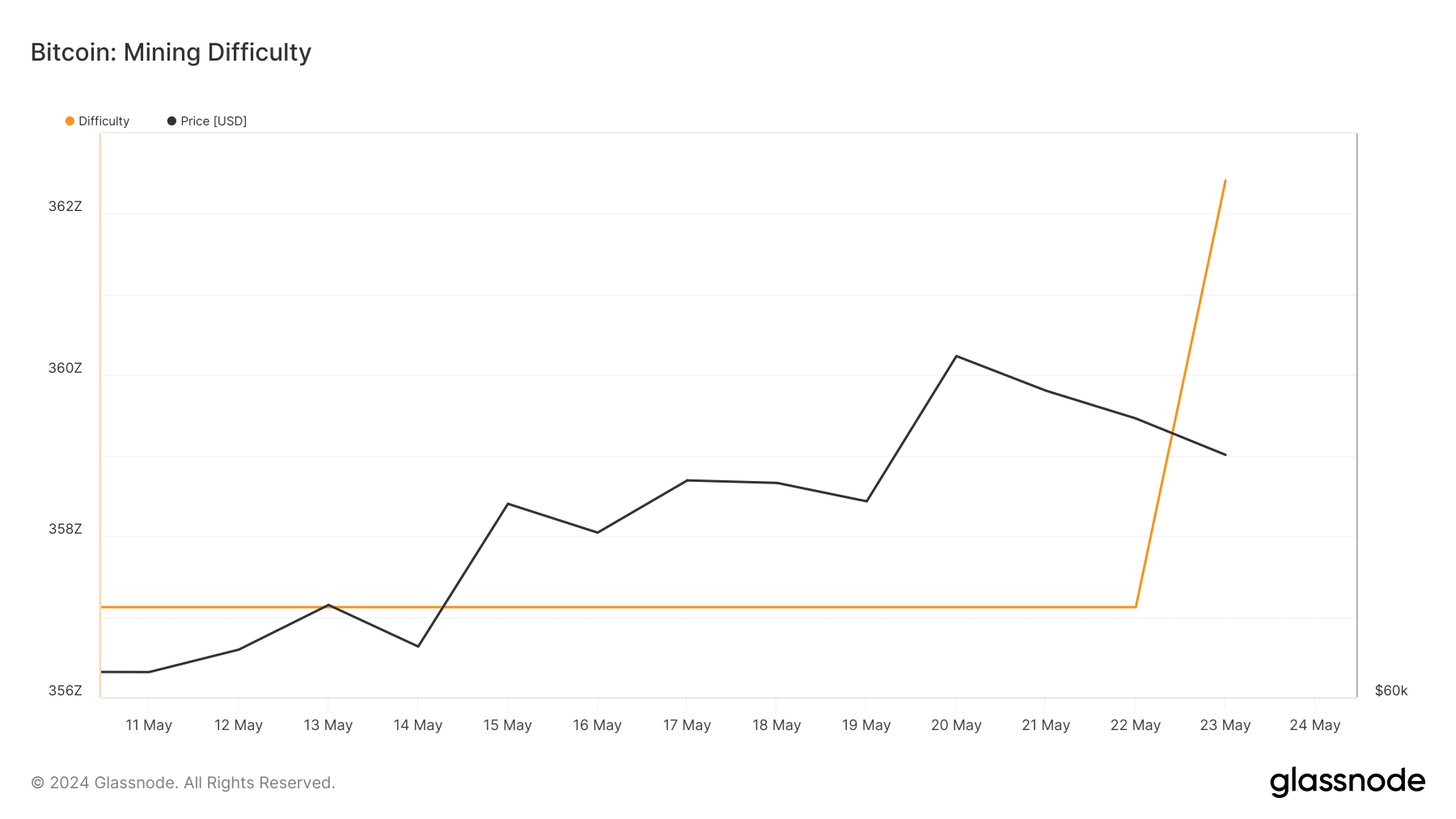

According to Glassnode's on-chain data, Bitcoin [BTC] Mining difficulty has increased significantly since its low on May 22. Bitcoin mining difficulty measures how hard and time-consuming it is to find the correct hash for each block.

Mining difficulty does not necessarily affect the value of BTC, but it does affect its value and rarity. When difficulty increases, hashing power skyrockets. As a result, blocks are not solved as quickly and block times can take as long as 10 minutes.

In terms of price, an increase in this metric could be bullish as it may attract miners to validate more transactions on the network.

Source: Glassnode

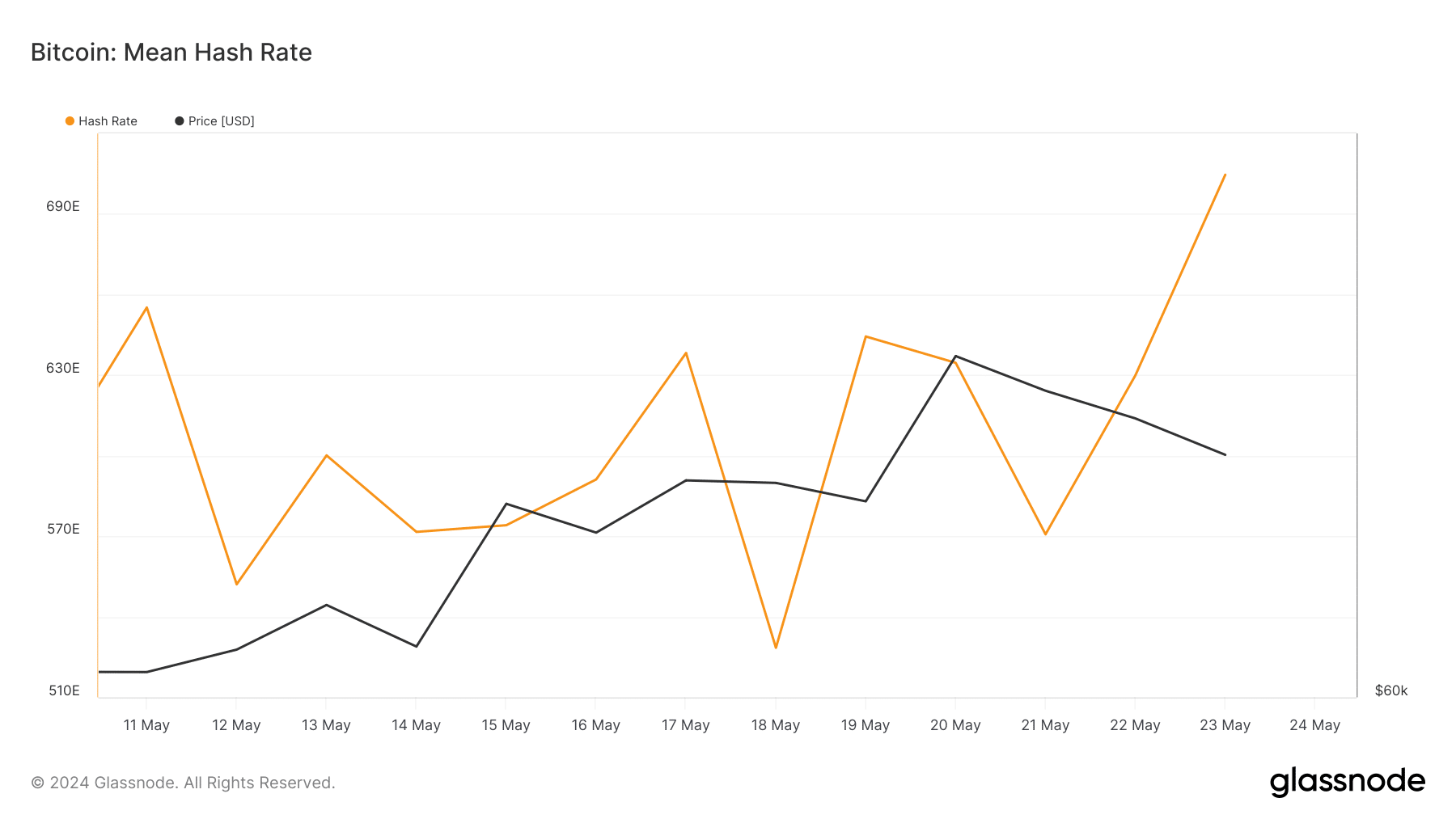

However, mining difficulty was not the only metric that spiked on the network. In fact, another metric that followed suit was Bitcoin’s hash rate.

The higher the difficulty, the higher the profits

When Bitcoin hash rate is high, it indicates that the network is safe and healthy. For investors, this rise provides reassurance that buying BTC can be profitable in the long run. However, this condition only works if the market is in a bullish phase.

On the other hand, a significant drop in hash rate indicates changes or risks to the network, which may make it harder for miners to profit from their operations.

Source: Glassnode

As expected, the impact of the increase in mining difficulty and hash rate was reflected in miner revenues. Indeed, at the time of writing, on-chain data shows that miner revenues stood at 558.057 BTC.

This appears to indicate that operators have made an effort to see more new transactions on blocks compared to May 21.

Not everyone is HODLing

AMBCrypto also looked at changes in miner net position. At the time of writing, this metric stood at -2.748.69 BTC. Miner net position change tracks the 30-day change in the bitcoin supply held in miner addresses.

When this metric is positive, it means miners are accumulating more coins, however the recent decline, which has occurred over the past two weeks, means miners are cashing out their holdings.

This could make Bitcoin more difficult to mine, which, given the price trend, could force the cryptocurrency to fall further.

At the time of writing, BTC was valued at $68,291, up less than 1% after a sideways 24-hour period. Price action will be worth keeping an eye on as Bitcoin holders may look for alternative opportunities to cash out in the coming days.

Circulating BTC is declining

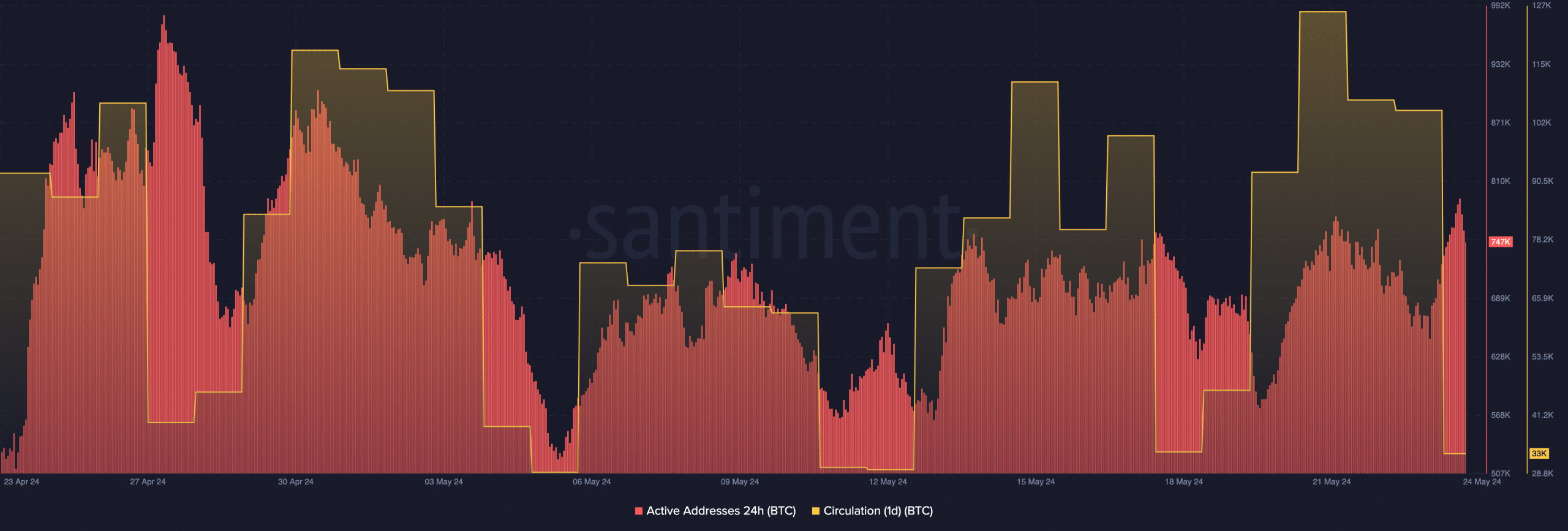

From an on-chain perspective, AMBCrypto also looked at 24-hour active addresses: According to Santiment, there were 747,000 24-hour active addresses on Bitcoin’s network.

This suggests a significant increase from the metric on May 23. Active addresses measure daily user interactions on the blockchain, meaning the number of Bitcoin transactions has increased since then.

Price-wise, increased activity can drive the coin's price higher, but that metric alone cannot determine BTC's next direction, so it's worth considering the volume in circulation as well.

Source: Santiment

At the time of writing, the daily circulation has fallen to 33,000, meaning fewer coins are being used in transactions.

Is Your Portfolio Green? Check out our Bitcoin Profit Calculator

Considering the increase in Bitcoin mining difficulty and the activity on the network, the cryptocurrency's price is likely to rise in the medium term, with a goal of seeing its value recover towards $73,000.