- The order book for Bitcoin futures remains loose.

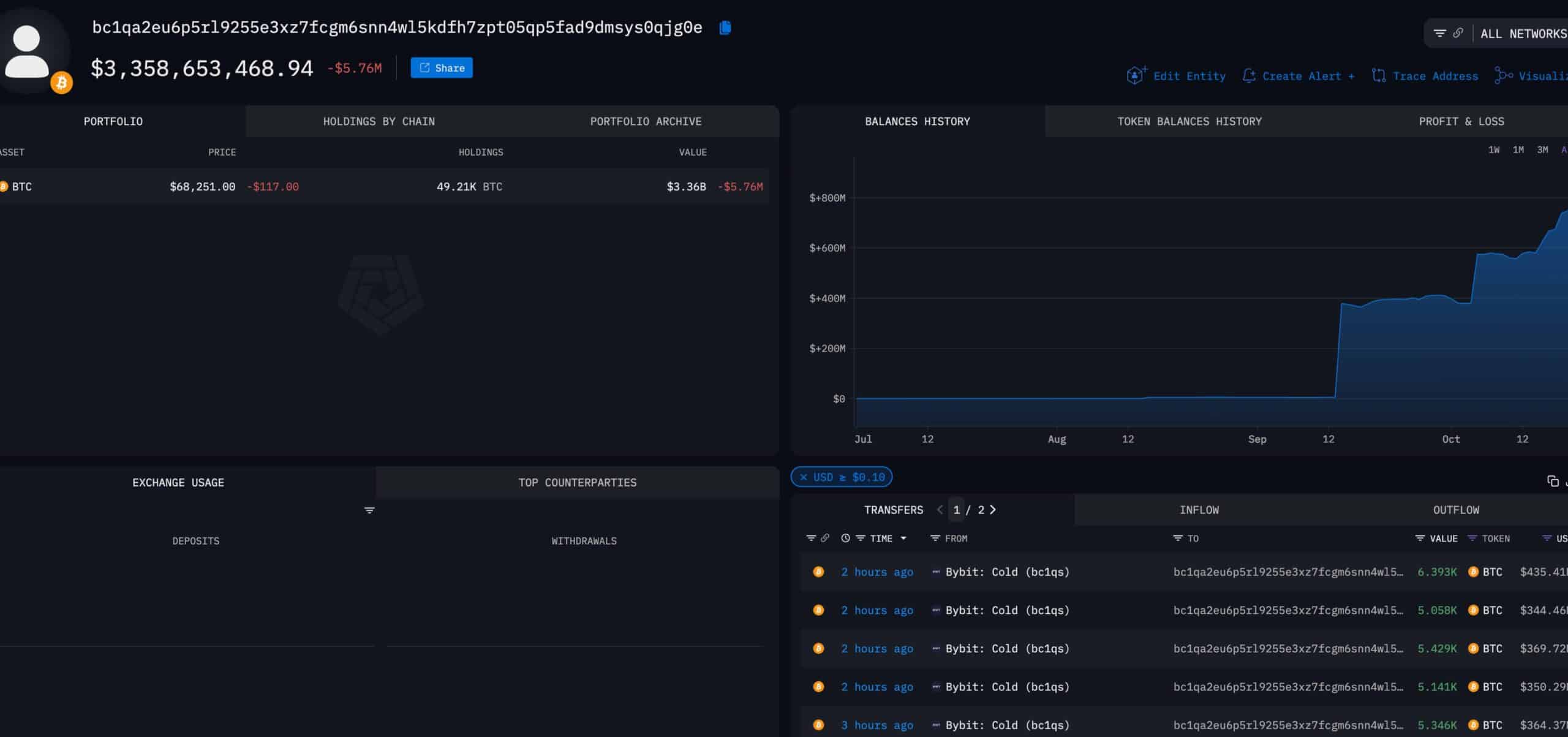

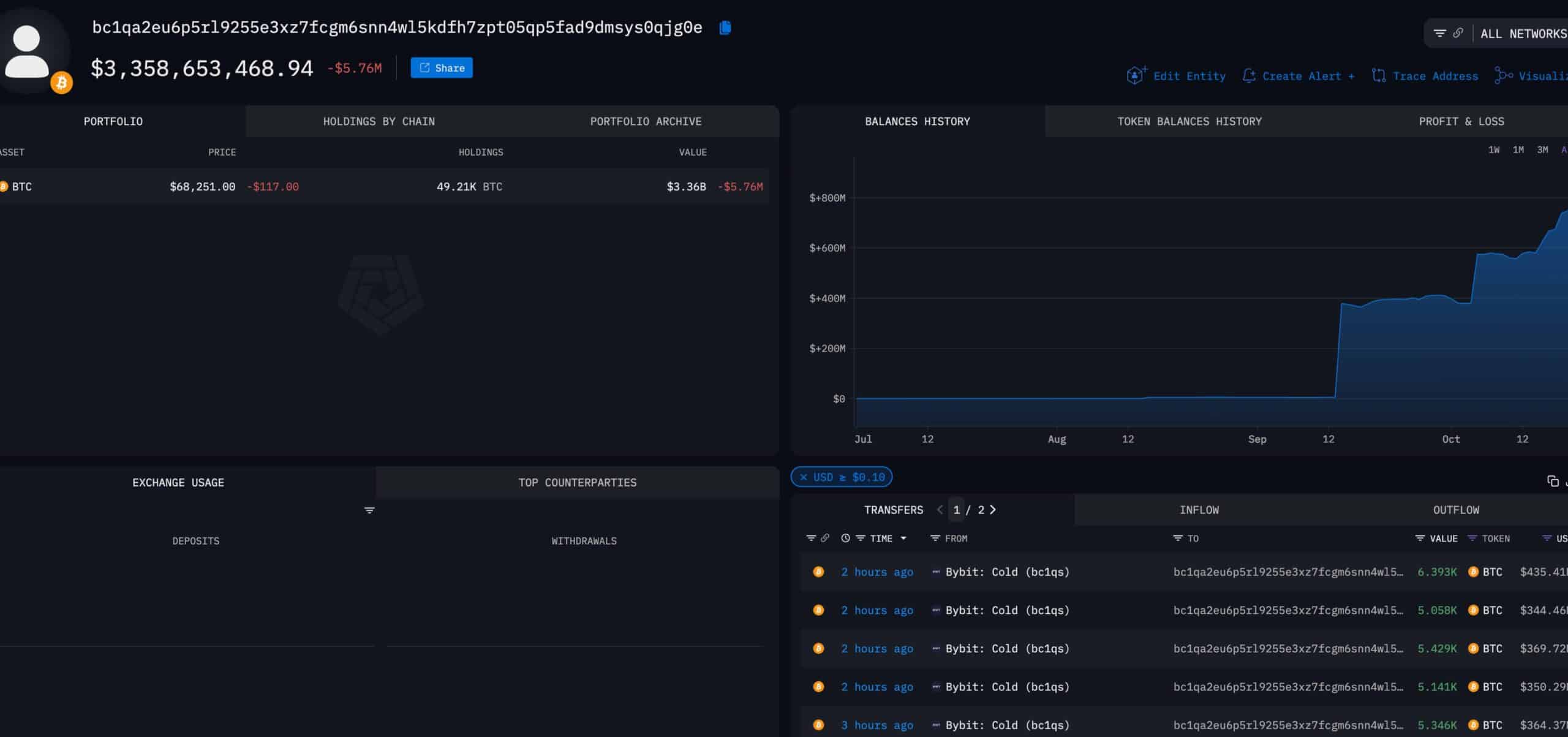

- Bybit moves $3.3 billion worth of BTC to new wallet.

Bitcoin price movement [BTC] The futures order book remains loose, creating a dynamic environment.

Recent data from the Bitcoin Liquidations Heatmap shows increased activity, suggesting possible liquidations that could cause price fluctuations.

This creates a playground for large companies to influence price movements in the zone between $67,500 and $69,500, which signals volatility.

Because of competing futures positions in these zones, even relatively small amounts of capital can cause the price of Bitcoin to rise and fall rapidly.

Source: Coinglass

If Bitcoin fails to sustain above the key Fibonacci retracement level, the $63,000 key support level could be tested. However, long-term holders may take comfort in strong support from the 180-day and 120-day moving averages.

Approximately 49,000 BTC has been moved from Bybit's cold storage to the new wallet, and some investors are paying close attention to these significant moves.

Such large trades can indicate market changes, and the Bybit team's internal asset movements should be closely monitored, especially if a liquidation is occurring.

Source: Arkham

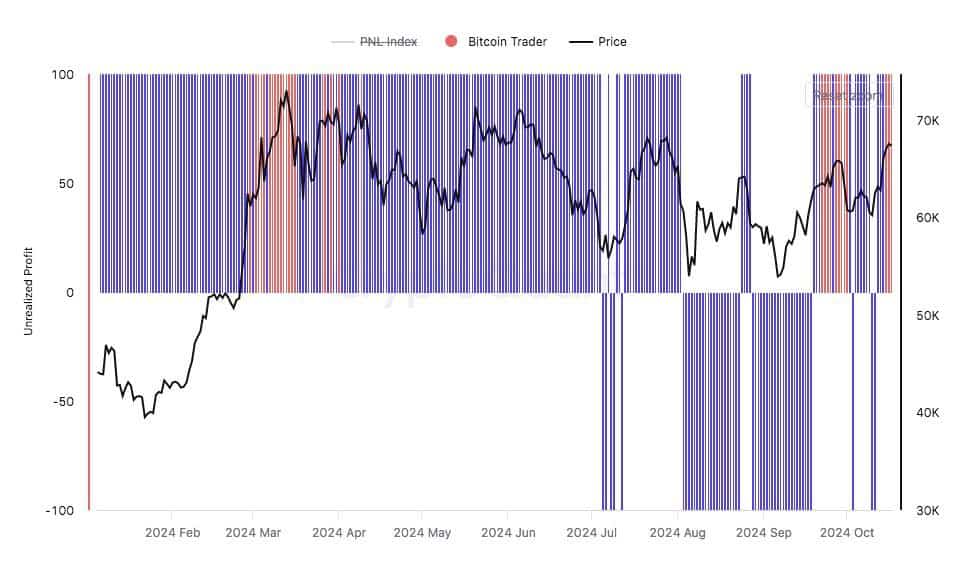

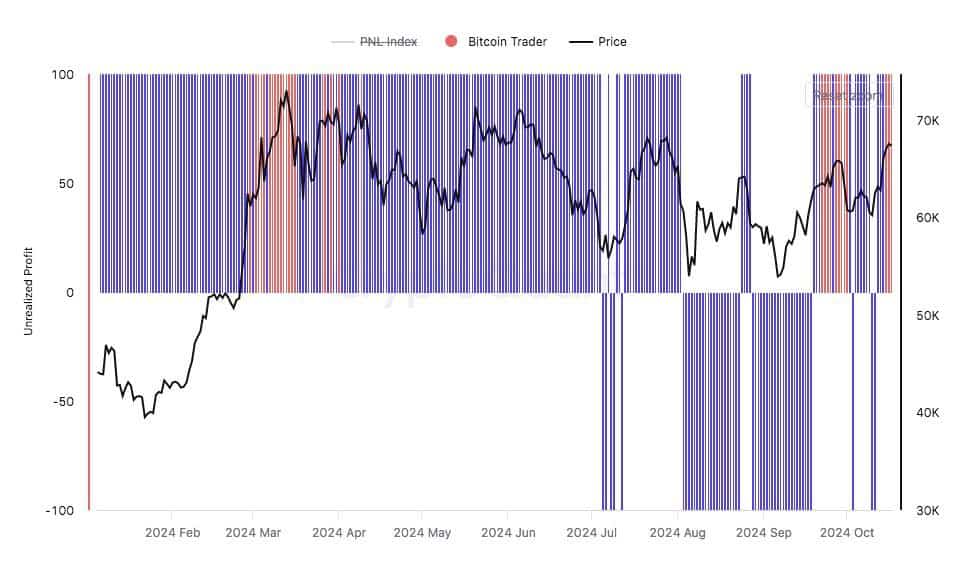

BTC Local Top and Sentiment

In terms of price prediction, Bitcoin is approaching the $70,000 resistance level and CME futures are slightly above the current price.

Market participants will be watching to see if BTC can break through this resistance or face rejection.

Bulls should defend the $68,000 support level as it is important to hold this price to prevent a deeper decline.

Historically, when unrealized gains increase rapidly, as they do now (over $7 billion), traders tend to cash out, increasing selling pressure and potentially triggering a local top before a pullback. There is.

Source: CryptoQuant

Additionally, sentiment surrounding Bitcoin has turned more positive after a period of pessimism. There has been a noticeable shift towards bullish sentiment on social media.

Buying in fear and selling in exhilaration has historically been profitable for traders. This trend boosts confidence for companies looking to take advantage of current market dynamics.

read bitcoin [BTC] Price prediction for 2024-2025

Traders should pay attention to changes as Bitcoin moves through its volatile price range and major resistance levels. Volatility is likely to increase in the coming weeks as major players influence the market through strategic trades.

The key question is whether Bitcoin will rise further or face a short-term correction before the next rally. Price movements are expected within the two major liquidation zones, creating opportunities for both futures and spot traders.