(Bloomberg) — Bitcoin surged to a two-week high as mixed reactions to China’s latest stimulus package intensified bets that speculators would chase cryptocurrencies rather than the country’s stocks.

Most Read Articles on Bloomberg

The largest digital asset rose as much as 3.5% on Monday, netting gains to $64,900 as of 7:19 a.m. New York. Smaller tokens such as No. 2 Ether and top 10 coin Solana also rose.

China is trying to revive its economy, but a highly anticipated weekend policy conference failed to specify exactly how much fiscal stimulus the government plans to deploy. Economists are unconvinced that government officials are doing enough to overcome deflation, and the rally in Chinese stocks, one of the world's highest, is beginning to fray.

Caroline Moron, co-founder of liquidity provider Orbit Markets, said, “The market is probably anticipating that capital rotation from Bitcoin to Chinese stocks has long been understood to be weighing on crypto prices.'' “People will probably take China's disappointing stimulus package as positive news for Bitcoin.” For trading in digital asset derivatives.

The US presidential election could provide new props for digital assets. Prediction markets have reversed in the past few days, making pro-crypto Republican candidate Donald Trump more likely to win than his Democratic rival, Vice President Kamala Harris.

Meanwhile, the bankrupt Mt Gox cryptocurrency exchange last week postponed by one year the deadline to repay creditors for its remaining assets, which Arkham Intelligence estimates to be around $2.9 billion, to October 31, 2025. The delay allays fears of an oversupply as creditors try to sell the returned bitcoins.

“The recent improvement in Trump's approval ratings will increase market receptivity and any good news will have a positive impact on prices,” said Benjamin Selemager, co-chief investment officer at Magnet Capital. “Good news, such as Mt. Gox's delayed repayment plan, will be received more favorably.”

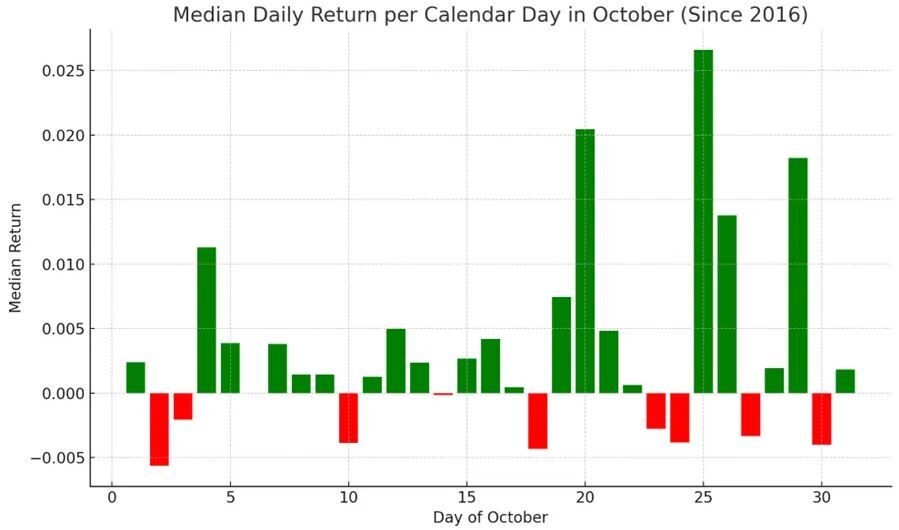

Bitcoin was little changed in October after a weak start to the month where it gained an average of 20% over the past decade, according to data compiled by Bloomberg.

“Historical data shows that seasonal strength in the crypto market in October is typically skewed toward the second half of the month,” said Sean Farrell, head of digital asset strategy at Fundstrat Global Advisors LLC. I'm writing it in a memo.

–With assistance from Sunil Jagtiani.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP