In the early morning hours of October 11, Bitcoin fell below $59,000 for the first time since September 18, triggering a prolonged liquidation across the crypto market. Earlier in the week, on Monday, October 7th, Bitcoin reached a local high of $64,400, but by Thursday, October 10th, it had fallen to $61,200.

It fell to $58,800 overnight, but has recovered to $60,700 at the time of writing. The digital asset is currently down 5.8% from this week's high.

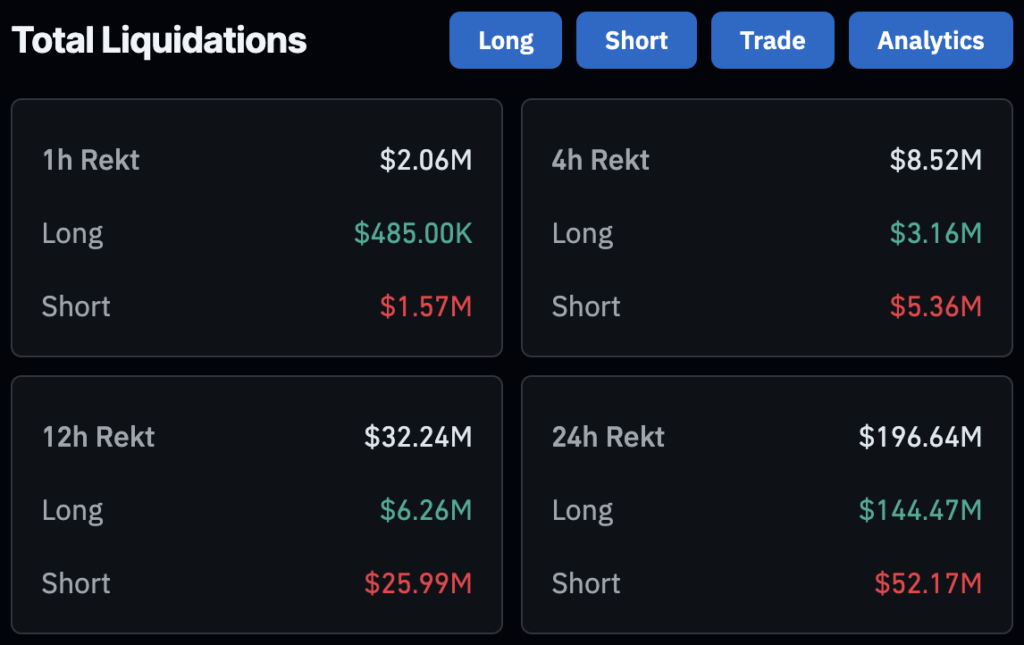

According to data from Coinglass, 58,176 traders were liquidated in the past 24 hours, bringing the total liquidation amount to $196.65 million. The most significant single liquidation order was worth $10.51 million and occurred on the BTCUSDT pair on Binance.

Bitcoin had the highest liquidation amount at $67.99 million, followed by Ethereum at $39.05 million, Solana at $8.39 million, and Sui at $5.85 million. The amount liquidated in other cryptocurrencies was $19.54 million.

Long positions accounted for most of the liquidations, with long positions worth $144.47 million and short positions worth $52.17 million in the past 24 hours. On Binance, long-term liquidations amounted to $27.62 million, accounting for 91.36% of the exchange's total liquidations. A similar pattern was observed on OKX and Bybit, where long positions accounted for over 90% of liquidations.

Price declines and liquidations highlight the current volatility in the crypto market. Traders using leverage faced losses as prices moved against their positions.