Bitcoin price rallied to a key resistance level as investors adopted risk-on sentiment following the dovish interest rate decision.

Bitcoin Bullish Factors

Bitcoin (BTC) has surged to the crucial $64,000 level for the first time since Aug. 9, surging more than 20% from this month's lows and entering a technical bull market.

The price movement was mainly due to the Fed's decision on Wednesday to cut interest rates by 50 basis points and signal the possibility of further rate cuts later this year.

The yen strengthened after the Bank of Japan kept interest rates unchanged despite domestic inflation remaining high. The BOJ's rate cuts sparked concerns about the unwinding of the Japanese yen's carry trade, which pushed down most asset prices in August.

Meanwhile, institutional investors and countries continue to buy Bitcoin and ETFs, with net Bitcoin ETF purchases exceeding $567 million over the past five trading days.

MicroStrategy continues to buy coins, bringing its total holdings to over 252,000. The company's Bitcoin holdings have generated unrealized gains of over $5.95 billion.

The government of El Salvador currently has 5,800 coins in its possession and continued to accumulate this week, while Bhutan has coins worth more than $800 million, a significant amount for a country with a GDP of $3 billion.

Bitcoin also rose as the Fear and Greed Index moved out of the fear zone into neutral territory at 46. Cryptocurrencies often do well when the index is rising.

Bitcoin faces significant resistance

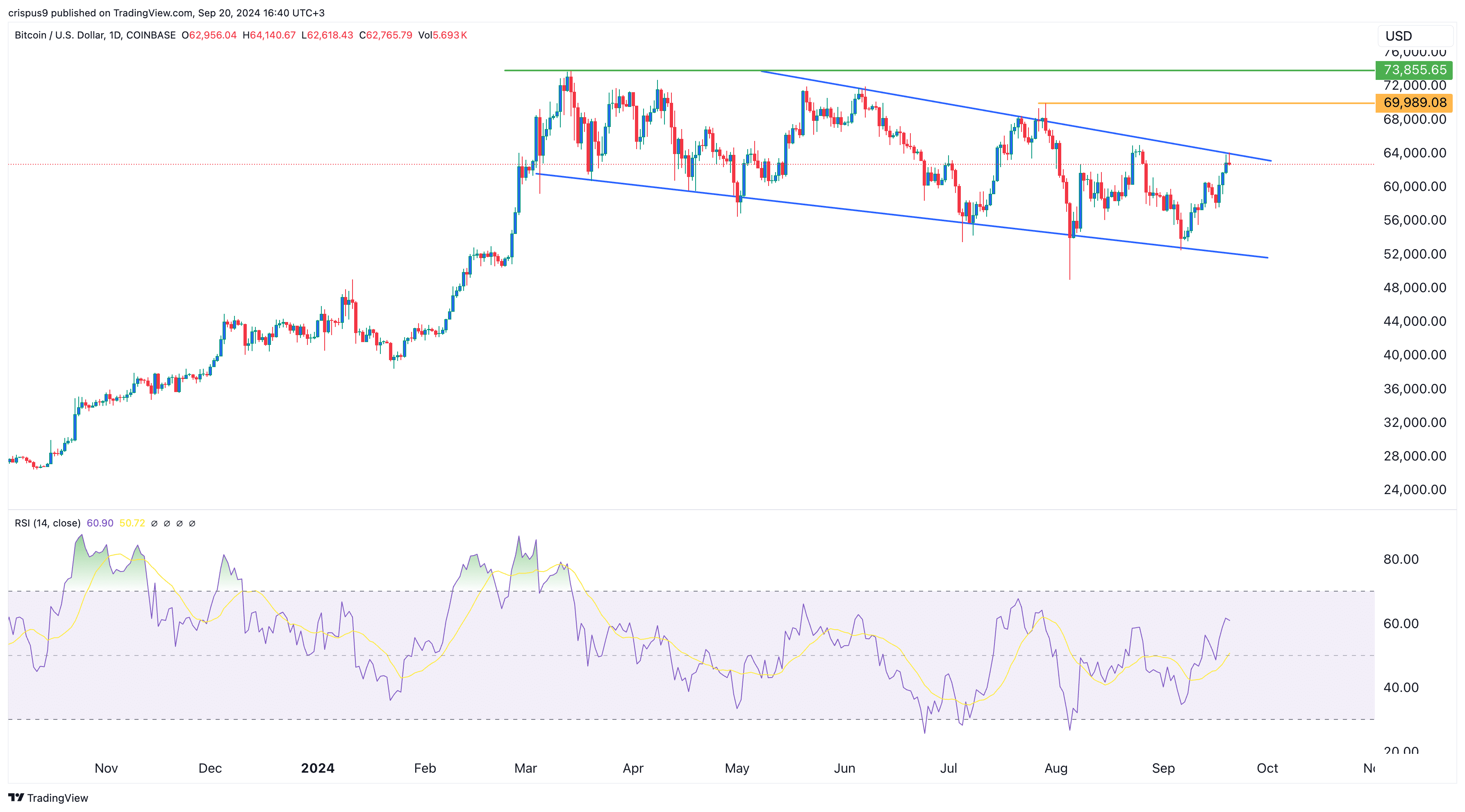

On the daily chart, Bitcoin rose to a key resistance level at $64,000, where the price coincided with a descending trendline connecting the highest prices since June 7. Previous attempts to surpass this level in July and August encountered significant resistance.

Therefore, if bulls fail to push Bitcoin above that level, it is at risk of experiencing a sharp reversal. The likely trigger for this pullback would be a triple witching event on Wall Street, where more than $5.1 trillion in options expire on September 20. Historically, stocks have often fallen in the week following this witching event. A significant stock market pullback would likely trigger a similar price movement in Bitcoin.

Conversely, a strong bounce above this resistance will increase the chances of Bitcoin rising to its psychological July high of $70,000. A full bullish breakout would only be confirmed if Bitcoin rises above its all-time high.