Analysts at ARK Invest say three indicators are currently showing bullish signs for Bitcoin (BTC).

ARK analyst David Puel told his 68,900 followers on social media platform

He also said that Bitcoin appears to be exhibiting a bullish pattern on the daily time frame.

“Bitcoin has rebounded from its 200-day moving average and short-term holder cost base. [On Friday]It appears that we are emerging from a wedge that has been widening since March of last year. ”

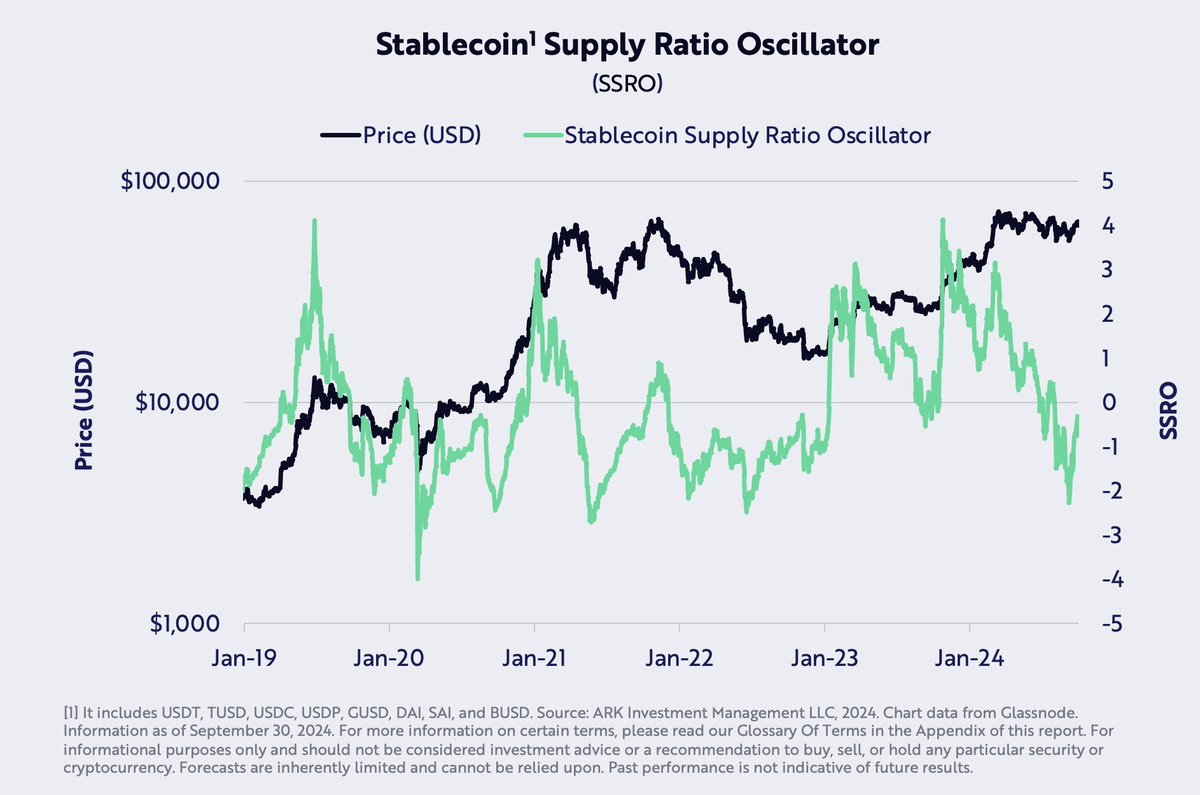

Analysts will focus on trends in the Stablecoin Supply Ratio (SSR) metric, which is the ratio of Bitcoin supply to stablecoin supply. When the SSR is low, the current stablecoin supply has a relatively large ability to purchase BTC.

“The stablecoin supply rate oscillator is at its lowest since mid-2022, suggesting a situation in which Bitcoin is oversold relative to the purchasing power of stablecoins.”

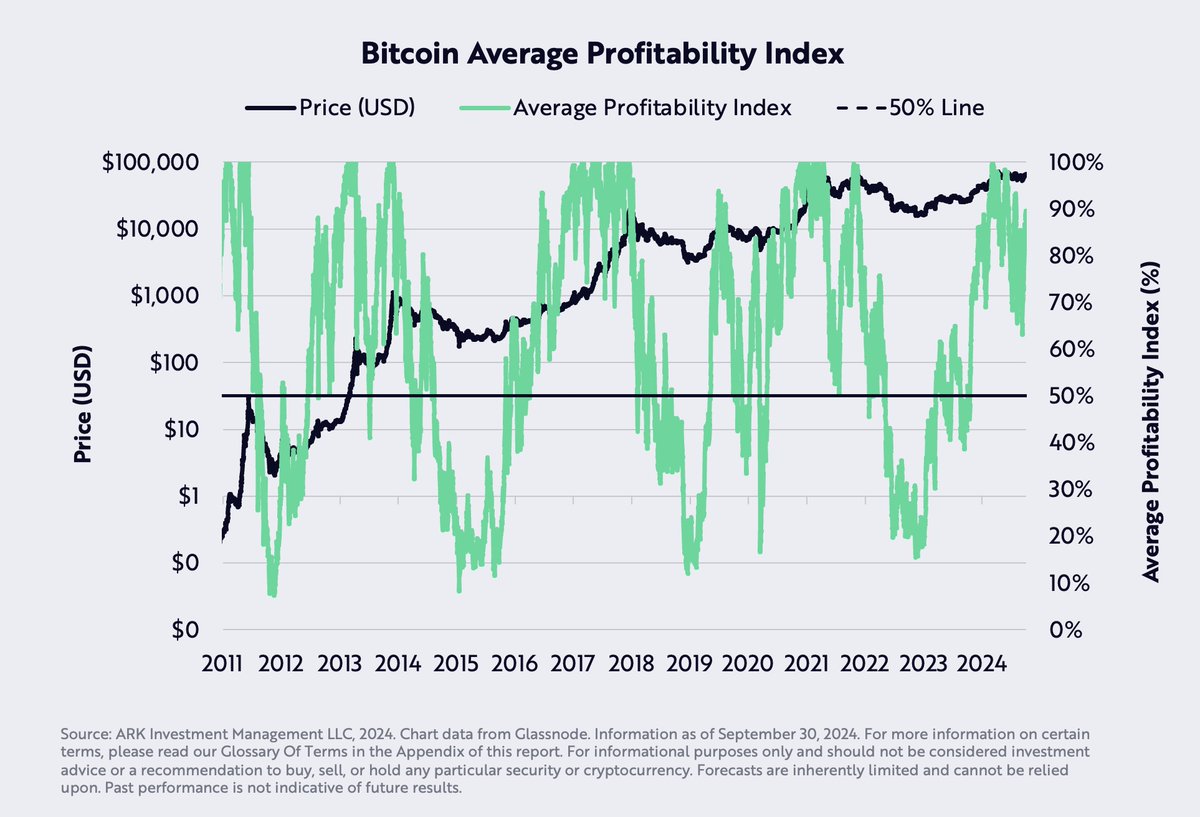

Next, the analyst states that Bitcoin is showing the usual signs of a market uptrend based on one of ARK's proprietary indicators.

“ARK’s proprietary Bitcoin average profitability index (a multiple of percent supply and percent network profitability in profits) has consistently remained within the parameters historically expected in a broad bull market.”

Finally, global money supply (M2) is increasing, which could be a bullish catalyst for Bitcoin, he said.

“September saw a strong recovery in Chinese stocks, one of many signs that global M2 liquidity is impacting markets. I believe there is potential for sexual benefits.”

At the time of writing, Bitcoin is trading at $67,260.

Never miss a beat – Subscribe to get email alerts delivered straight to your inbox

Check price action

follow me ×Facebook and Telegram

Surf the Daily Hoddle Mix

Disclaimer: The opinions expressed on The Daily Hodl do not constitute investment advice. Investors should perform due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that transfers and transactions are made at your own risk and you are responsible for any losses you may incur. The Daily Hodl does not recommend buying or selling any cryptocurrencies or digital assets. The Daily Hodl is also not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: Mid Journey