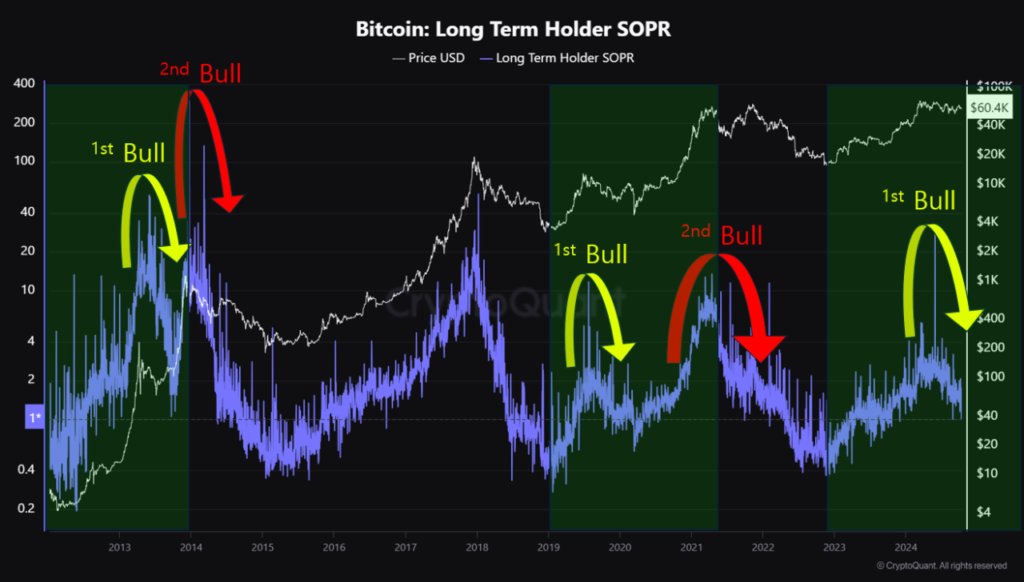

Bitcoin's current market trends indicate that the bullish cycle is still underway.Analyst of CQ Korea, . In a post on CryptoQuant, Dunn highlights the historical pattern of the 2013 and 2020 cycles, showing two upswings where long-term investors realized profits twice before reaching the peak. Unlike 2017, when there was no period adjustment, the current market more closely resembles these earlier cycles, he argues.

His chart of CryptoQuant's long-term holder expense return (SOPR) supports this outlook, showing a similar trend to previous bullish cycles.

SOPR is an indicator that measures whether long-term holders (those who have held BTC for more than 155 days) are selling their Bitcoin for a profit or a loss. Values greater than 1 indicate long-term holders are selling at a profit; values less than 1 indicate they are selling at a loss.

Dunn points to interest rate cuts globally and believes it could take months to a year or more to significantly increase market liquidity. However, investor expectations often move prices ahead of such changes, suggesting a potential positive move by 2025.

Investing with a long-term perspective, rather than focusing on short-term fluctuations, can yield more favorable results. Expectations for improved liquidity and historical cycle analysis indicate that the bullish momentum in the cryptocurrency market continues.

This analysis supports other arguments that suggest the bull market still has room to grow despite its early peak.