- Despite the price rise, market sentiment around BTC has turned bearish

- If a price correction occurs, BTC could plummet to $63,000

Bitcoin's [BTC] The price once again gained bullish momentum and continued trading above $70,000. However, the situation could turn bearish in the short term as the price of the king of cryptocurrencies remains within a parallel channel.

So let's take a closer look at the state of BTC and see how it ends this week.

Bitcoin is inching towards $71,000

according to coin market cap, BTC price surged over 6% last week, gaining bullish momentum. In fact, in the past 24 hours alone, BTC has risen by more than 2.4%.

Thanks to the uptrend, BTC comfortably surpassed the $70,000 psychological support level. At the time of this writing, BTC was trading at $70,768.46 and had a market capitalization of over $1.39 trillion.

However, investors should not start celebrating yet as the trend could reverse.

Popular cryptocurrency analyst Crypto Tony recently said, Tweet It highlighted that the price of BTC is fluctuating within a parallel channel. If that is true, BTC will soon witness a price correction followed by another bull market.

According to the tweet, an upcoming price correction could push the coin’s price down towards the $63,000 level.

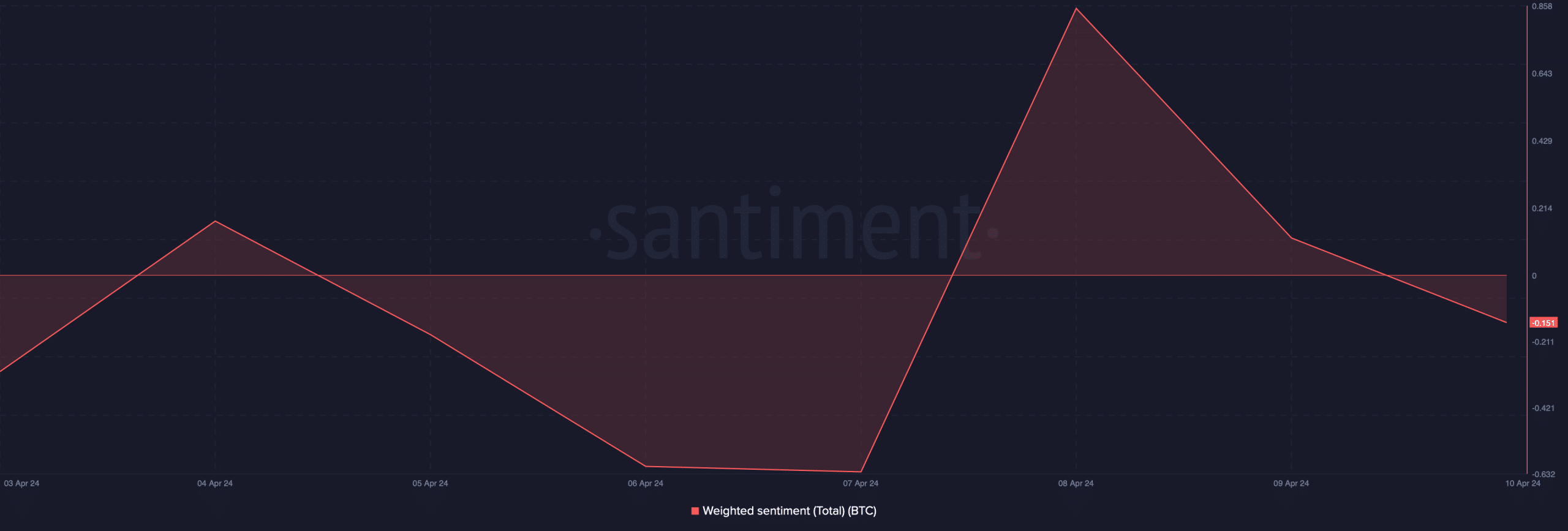

Investor sentiment surrounding BTC was already bearish. Analysis of Santimento data reveals that BTC’s weighted sentiment has entered the negative zone after a sharp spike.

Source: Santiment

What the indicators suggest

To see how likely it is that BTC will turn bearish again, AMBCrypto looked at on-chain indicators. According to CryptoQuant analysis; dataBitcoin's aSORP is red, meaning more investors are selling at a profit.

During a bull market, it can indicate a market ceiling.

Another bearish indicator was NULP, which indicated that investors were in the belief stage of high unrealized gains.

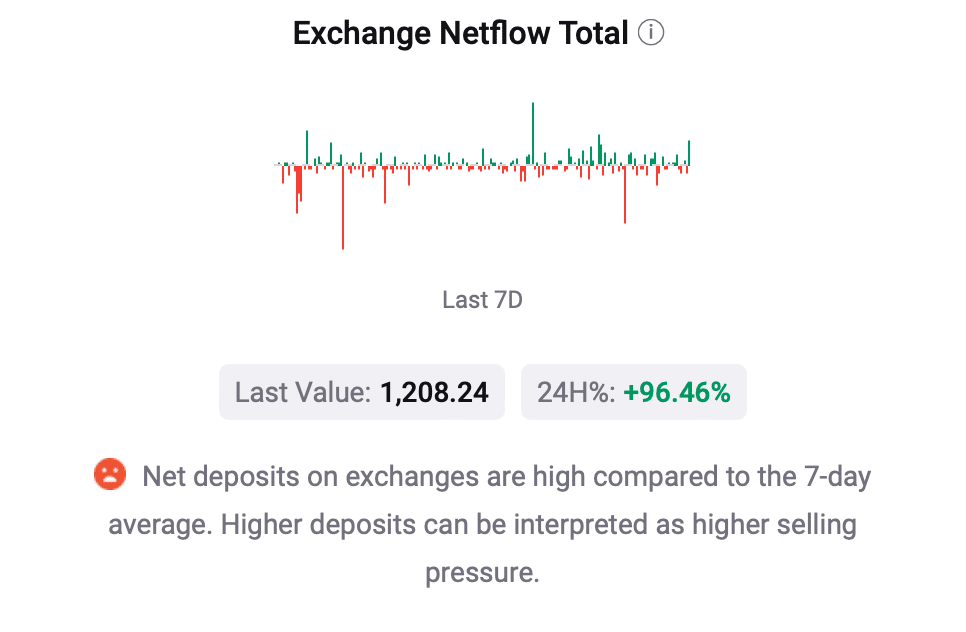

Selling pressure on BTC was also increasing as BTC net deposits on exchanges were higher compared to the past 7-day average.

Source: CryptoQuant

read Bitcoin's [BTC] price prediction 2024-25

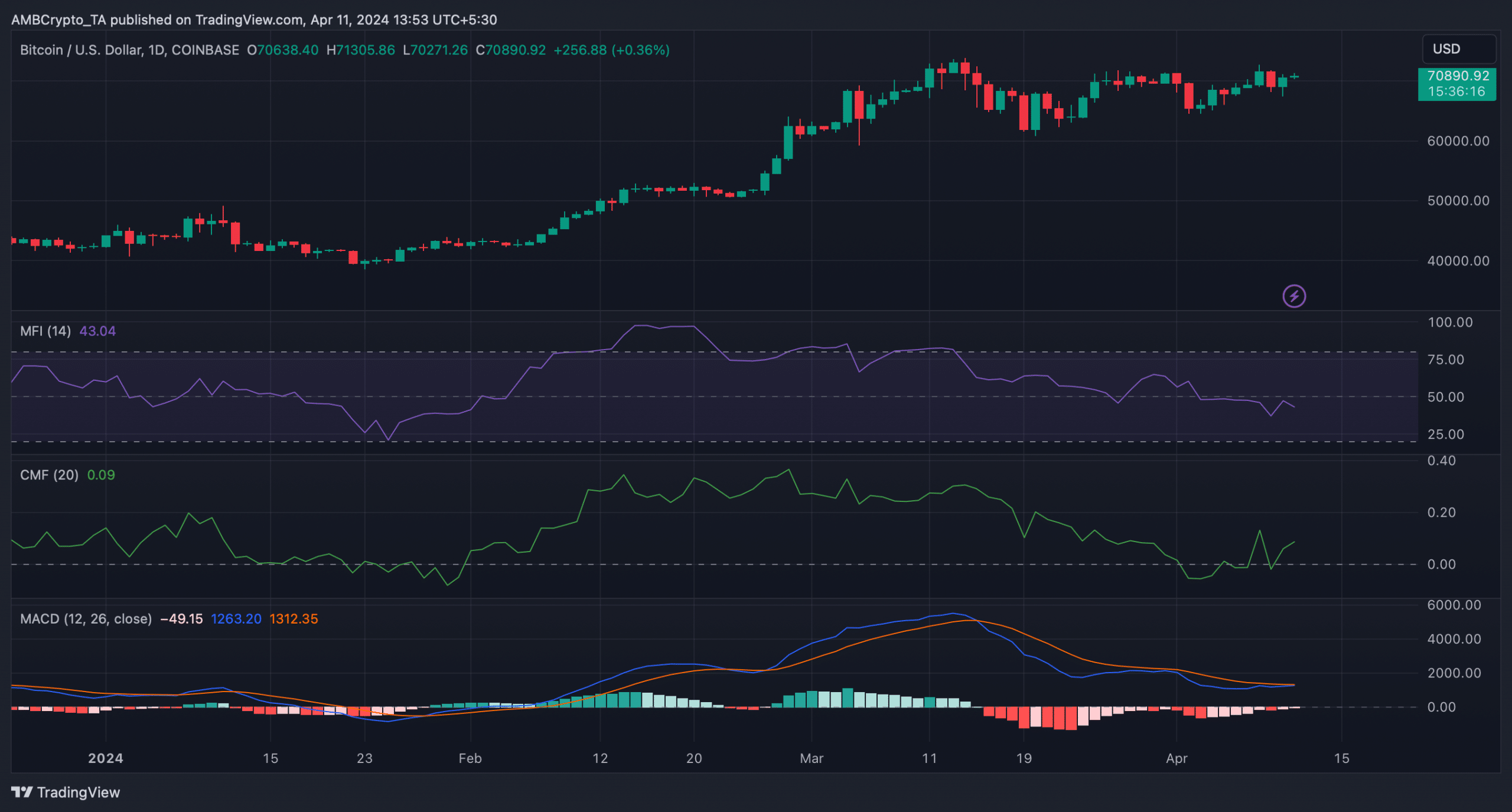

AMBCrypto then analyzed the daily chart of BTC to better understand which way BTC is heading. The coin’s Money Flow Index (MFI) recorded a decline, indicating that a price correction is likely.

Nevertheless, the MACD showed a bullish crossover. Furthermore, Chaikin Money Flow (CMF) also supported the bulls moving north.

Source: TradingView