Bitcoin has been solid, recently trending above $71,200 and easing past regional resistance levels, much to the delight of holders. But for on-chain analyst Willy Wu, the current rally is just the beginning.

Bitcoin Rise Begins: Analyst

Wu, who has maintained a bullish outlook for the world's most valuable coin, was bold about X: claim Bitcoin's current rally is only half of its welcome bullish journey.

Sharing the chart, the on-chain analyst noted that Bitcoin's VWAP oscillator has just bottomed out from the oversold territory and is currently at the zero mark, which is in the middle. While Woo is optimistic and expects further upside, the analyst did not reveal when or at what level the price will peak.

Still, analysts called for a period of consolidation below all-time highs. Wu said the integration could allow users to stock up on Bitcoin before it reaches new highs in a “second phase.”

Looking at Bitcoin’s daily chart, this “second leg” is expected to be the moment of a breakout that will send Bitcoin above its March highs.

At the time of writing, Bitcoin is still in a bull market. The rally above $68,000 and last week's high were pivotal in defining the trend. Furthermore, the breakout bar on May 20th is wide and the trading volume is high, so the trend continuation is likely. With the bulls confirming the May 20 rally, Bitcoin will likely break above $73,800, matching Wu’s prediction.

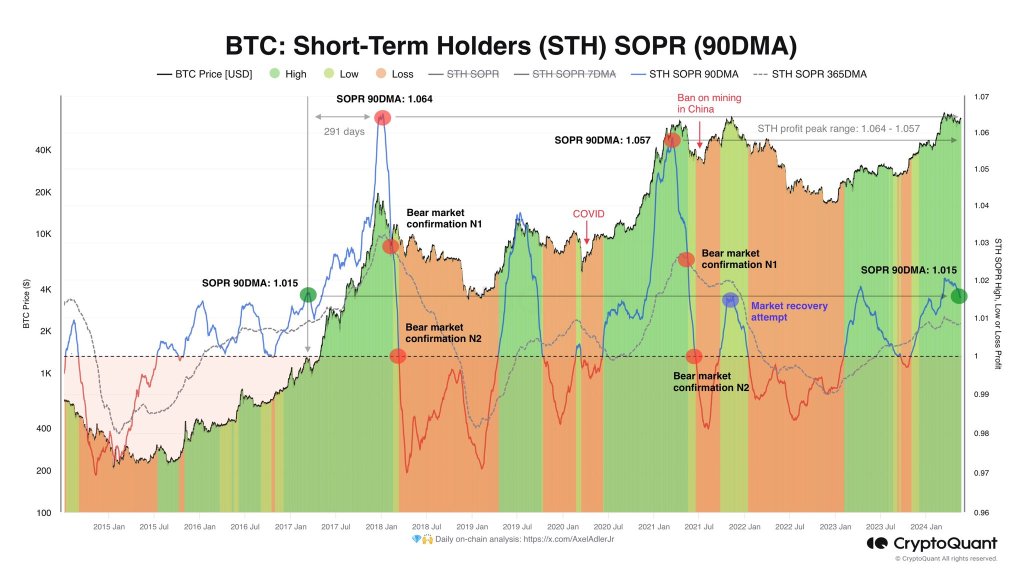

BTC bull run will last 300 days if there is no black swan event

Besides Wu, another analyst To tell of Bitcoin's uptrend is in full swing. Traders who shared the charts warned of unexpected disruptions, such as Selection subjects If the exchange goes bankrupt, the current bull market would likely be extended for another 300 days.

This forecast is based on short-term holder (STH) P&L analysis using a 90-day moving average. Currently, STH is down, but relatively high. Analysts use he STH to determine market sentiment from short-term price fluctuations and traders' speculation.

As sentiment improves and prices recover, the pace at which the coin rises will depend on external factors. In addition to the impact of the US Federal Reserve and its monetary policy pronouncements, inflows into spot Bitcoin exchange-traded funds (ETFs) will be important. After a period of lull, demand has rebounded, helping to propel the bull market.

Featured image from DALLE, chart from TradingView