Thursday, May 9, 2024 ▪

6

Minimum read time ▪ up to

Since the creation of Bitcoin 15 years ago, we have faced several cycles. All these cycles had some similarities that have been repeated over the years. However, there are currently some discussions that suggest future cycles may have a different impact on Bitcoin's behavior. This is especially true these days, with him achieving ATH before the halving event. Let's take a closer look at the various reasons that explain the possibility of different cycles.

Bitcoin movement during halving

The half-life is programmed to occur every four years. This process cuts the supply in half. Therefore, regulating supply over the years will help reduce Bitcoin's inflation rate. Since its inception, the price of Bitcoin has tended to rise after the halving process and reach the ATH. This is illustrated below.

However, this cycle was different as Bitcoin reached its ATH before the halving.

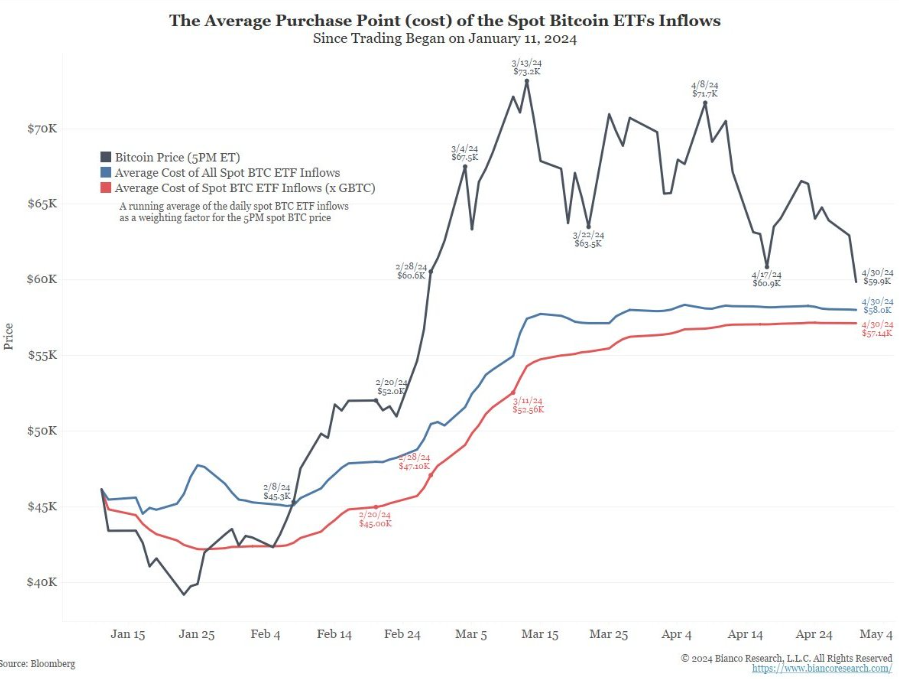

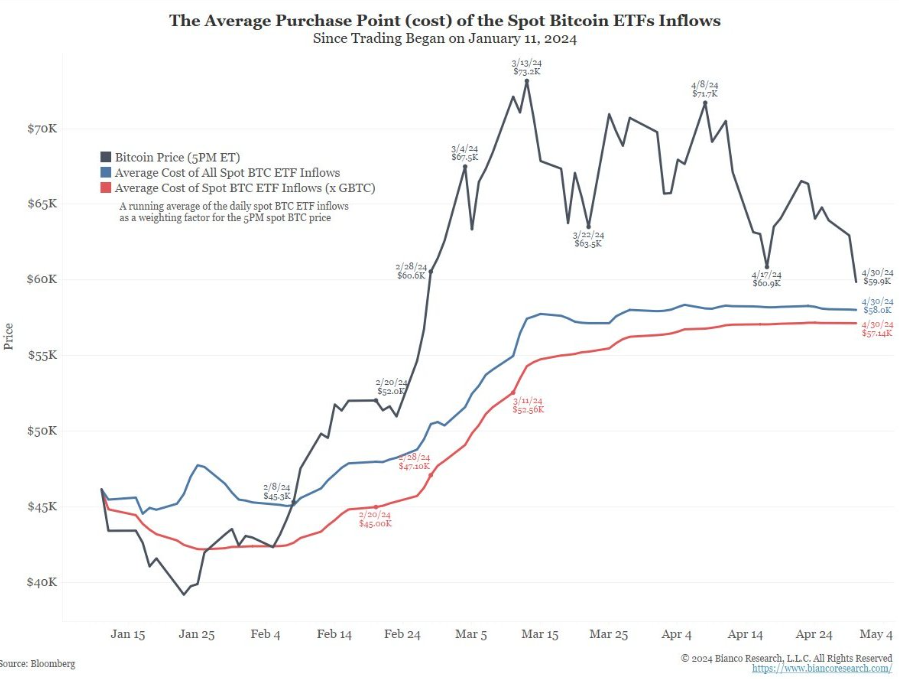

Additionally, it is worth noting that Bitcoin's correction during the rally is completely different. Previously, he was used to seeing more aggressive corrections during bull market momentum, around 40-50% corrections, but this cycle he sees 15-25% declines. You can This can be explained by the greater involvement of institutions and the increased liquidity of Bitcoin. Furthermore, we see that the average price of Bitcoin ETF inflows at the beginning of the year is around 57,000. Therefore, this remains a significant level 22% lower than his ATH at the end.

Bitcoin cycle and business cycle

Bitcoin was created in 2009 at the same time as a liquidity injection aimed at recovering the American economy after the financial crisis. For this reason, the creation of Bitcoin is also considered a hypothetical counterattack against the Fed's decision to inject liquidity. The creators of Bitcoin probably had a good understanding of economic cycles, the functioning of monetary mass and its effects. why? Initially, Bitcoin was born at the bottom of the economy, which is probably no coincidence of timing. Second, its supply is limited (compared to an unlimited money supply) and it is reduced every four years to combat inflation.

The four-year halving cycle is no coincidence, as it is also close to the average duration of the five-year economic cycle. In another context, within an economic cycle, cycles of economic growth acceleration (bull runs) and economic growth decelerations (often bear markets) last approximately 18 to 24 months. This means that these two cycles add up to roughly four years.

These are averages, so your cycles may be shorter or longer in some cases. As a result, there is a possibility that abnormalities may occur in a four-year cycle. When we talk about irregularities, it can mean, for example, that before the half-life he has an ATH.

Bitcoin institutionalization, a key element for future cycles

The highlight of this year is undoubtedly the approval of the Bitcoin Spot ETF. This event contributed to the credibility and democratization of Bitcoin. Additionally, ETFs are centralized products, making it easy to integrate Bitcoin into your portfolio. Strong demand can be seen in the inflows into ETFs at the beginning of the year.

As a result, this event was a key catalyst for Bitcoin to achieve ATH before the halving event.

Performance becomes less and less important with each cycle

Due to the large market capitalization of Bitcoin, the performance is low. It follows the same principles as traditional markets. That is, smaller equity tends to be more volatile in both directions than larger equity. Not only does the supply of Bitcoin halve every four years, but it also has an impact on business performance. Below is a comparison of Bitcoin's performance after each halving over the past few years.

The following graph shows various half-lives. We can see that until 2020, the progression of the curve was rather vertical. From 2024 onwards, it will gradually level off.

This also applies to Bitcoin's performance, which has moved from a vertical mode to a more horizontal mode. Also, when it comes to volatility, the correction is less aggressive as the movement is more horizontal.

Past performance is not indicative of future results, and this is especially true for Bitcoin. Overall, Bitcoin remains structurally bullish over the long term. However, the fact remains that Bitcoin's growth is expected to move closer and closer to more traditional performance in the coming years. This is explained both by the institutionalization of Bitcoin (increase in volume) and the structure of Bitcoin itself with its halving process. Finally, criticisms regarding Bitcoin's volatility should decrease over time.

Maximize your Cointribune experience with the Read to Earn program! Earn points and access exclusive benefits every time you read an article. Sign up now and get rewards.

4 Avoirs Travail Pendant 7 Banks Canadienne, who has 5 bank accounts, tells Portefeuil.com Analyst to quit the financial institution that carries out his fraudster's plans. Although it is Monday, the democrat will provide viewers with financial market information, coin tribunes from various aspects, macro analysis, analytical techniques, mutual analysis…

Disclaimer

The views, ideas and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Please do your own research before making any investment decisions.