- The total exchange reserves of stablecoins also steadily increased.

- At the time of writing, Whales held almost 55% of the total stablecoin supply.

Bitcoin [BTC] This week, the stock bounced back from a range-bound move, posting an impressive 9.61% gain. As of this writing, King Coin is consolidating near its 2021 high of $70,000, according to CoinMarketCap.

As excitement returns to the market, brace for more volatility and price spikes over the coming week.

Will the pump come again?

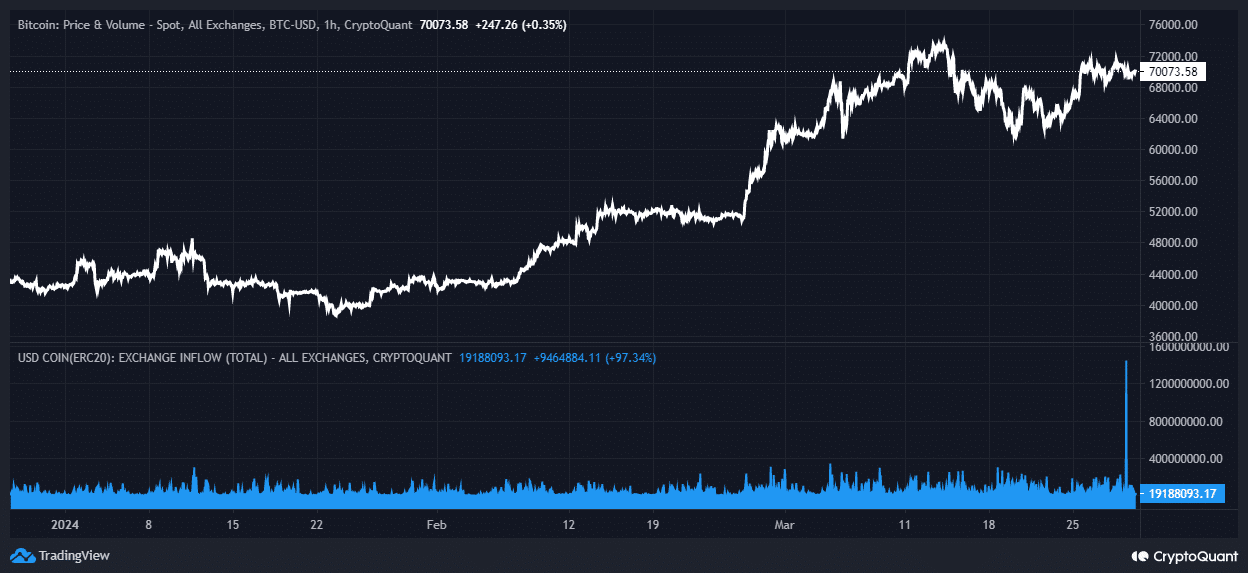

JA Maartunn, a verified author at on-chain analytics firm CryptoQuant, reported the largest USDC transfer in history to the exchange, totaling $1.4 billion. This event overshadowed the previous Bitcoin high in January 2023, when $1.3 billion USDC was deposited.

Source: CryptoQuant

A large increase in stablecoin deposits typically precedes a large spike in Bitcoin prices and is interpreted as a bullish signal. In fact, the aforementioned USDC transfer in January 2023 also led to a rally from the coin’s cyclical low of $16,800.

Traditional investors use stablecoins as a vehicle to enter the crypto market and use it to buy other volatile, high-yielding coins. Additionally, the latest transfer took place on Coinbase, a popular place to buy Bitcoin among US institutional investors.

Whales increase stablecoin holdings

AMBCrypto investigated further and discovered that the exchange reserves of all stablecoins have increased sharply in recent weeks. According to CryptoQuant, over 20 billion stablecoins are held in exchange wallets at the time of writing, his highest amount since March 2023.

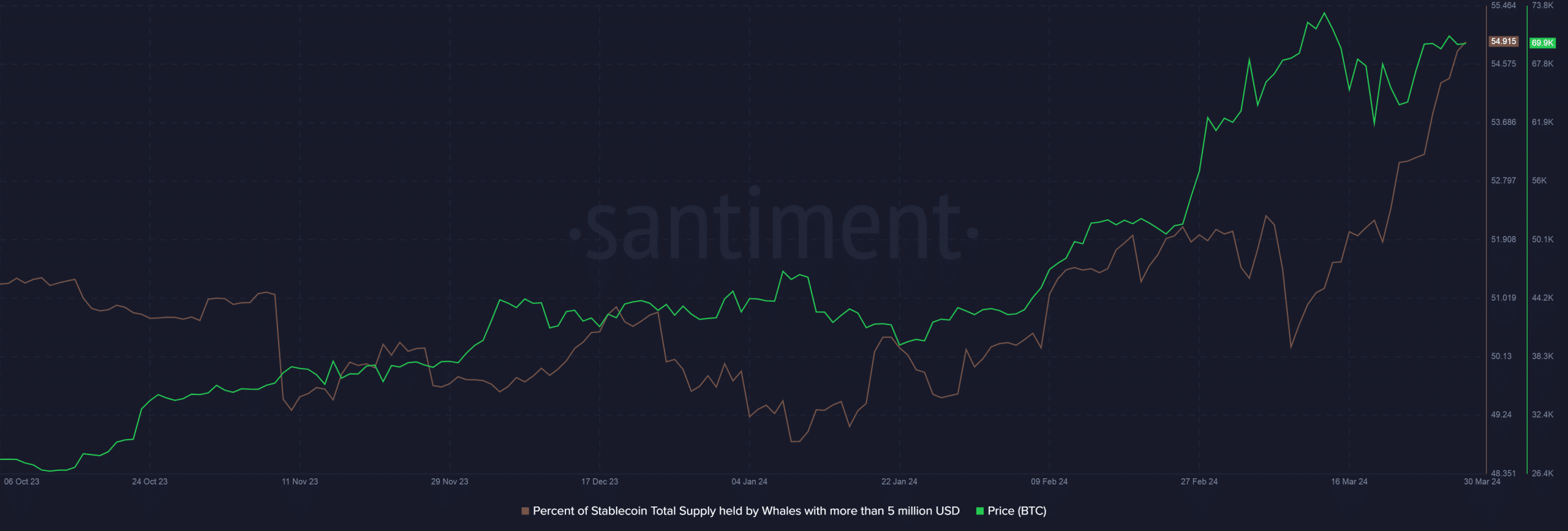

Buying pressure was also seen in a steady increase in stablecoin holdings by whale investors.

AMBCrypto analyzed Santiment data and found that at the time of writing, wallets worth more than $5 million accounted for nearly 55% of the total stablecoin supply, up from 51.88% as of March 20th.

Source: Santiment

Read BTC Price Prediction 2024-25

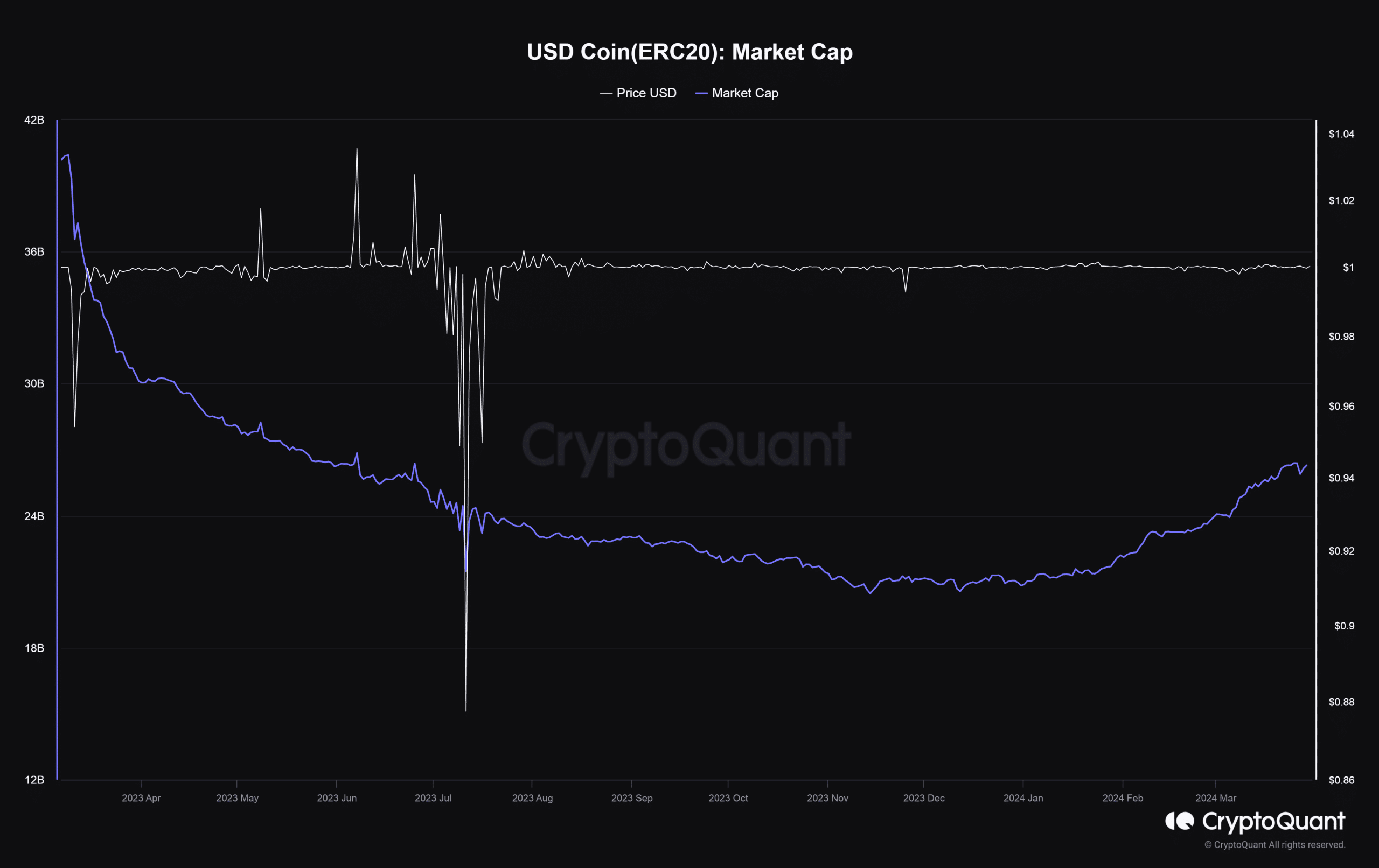

2024: The year of USDC revival?

When it comes to USDC, the second-largest stablecoin will see a dramatic change in its fortunes in 2024.

After being hit hard by the US banking crisis last year, the cryptocurrency's market capitalization, which was pegged at $1, has increased by 30% to $26 billion (year-to-date).

Source: CryptoQuant