Biden's stance on cryptocurrencies appears to be softening as the US elections approach. What's behind this decision and what can the crypto community expect?

Cryptocurrency-related events in the United States may indicate that President Joe Biden is entering the race to capture the attention of the crypto community. In the near future, the Biden administration is likely to change its aggressive rhetoric against cryptocurrencies. How will it impact the U.S. cryptocurrency industry?

Vote to repeal SEC directive

Last week, the Senate passed a resolution to repeal the U.S. Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 (SAB 121), which addressed accounting standards for financial institutions that hold cryptocurrencies.

SAB 121 establishes accounting rules for companies that hold cryptocurrencies held by their customers. The bill requires financial institutions to classify digital assets as liabilities and include them on their balance sheets.

The SEC says SAB 121 will protect investors. But the crypto industry doesn't agree. In their opinion, such rules could lead to banks and other financial institutions being less willing to work with virtual currency companies. This could slow down the growth of the crypto industry.

Supporters of the digital asset industry responded very positively to this vote. A representative from the Blockchain Association called the results “amazing.”

It is noteworthy that the Blockchain Association links the Senate decision to the upcoming elections in the United States. Experts believe that the current government is hoping to win the votes of young people in this way.

“The president's veto threat denies the growing recognition among voters, especially young people, that cryptocurrencies are something our elected officials should care about.”

blockchain association

Fit 21

The House is also scheduled to vote on the 21st Century Financial Innovation and Technology Act, known as FIT21 or HR 4763. The bill aims to establish a consistent regulatory framework for all digital assets in the United States.

One important aspect of this legislation is to clarify the regulatory responsibilities of the Futures Trading Commission (CFTC) and the SEC. This division is strictly necessary as it determines whether a digital asset is treated as a security or a commodity.

Supporters of FIT21 argue that the bill provides needed regulatory clarity while allowing the industry to continue operating in the U.S. They believe greater regulatory clarity will help cryptocurrency companies build public trust, develop valuable products, and ensure accountability for bad practices.

Spot Ethereum ETF

The possibility that Biden will change his tune is also heightened by rumors regarding the approval of a spot Ethereum ETF. Baron previously reported, citing anonymous sources, that the SEC was leaning toward approving a spot Ethereum ETF.

The agency is asking potential issuers to update their Form 19b-4 filings in preparation for launching a fund.

Bloomberg analyst James Seifert also noted that at least five companies have sent updated documents to the SEC, including Fidelity, VanEck, Invesco/Galaxy, ARK Invest/21Shares and Franklin Templeton.

In parallel, the Spot Ethereum ETF (ticker ETHV) proposed by VanEck was placed on the DTCC asset list. The Franklin Templeton Foundation (EZET) was also added to the list.

Bloomberg ETF analyst Eric Balchunas also revised his prediction on the likelihood of Spot Ethereum ETF approval, raising it to 75%.

“We've heard chatter this afternoon that the SEC may do a 180 on this (an increasingly political issue) and now everyone is panicking (we thought everyone else would be denied, just like us).”

Eric Balchunas, Bloomberg ETF Analyst

He and his colleague James Seifert have become one of the leading sources of information on the Spot Bitcoin ETF, accurately predicting its approval and launch in January. Seifert also wrote that he supports the analysts' opinion, adding that the information came from multiple sources.

The filing deadline for VanEck's Form 19b-4 is May 23, and for the ARK Invest fund managed by investor Cathie Wood, May 24. For BlackRock, the most prominent company vying to launch an Ethereum ETF, the Form 19b-4 filing deadline is August 7th.

Biden's main rival starts accepting payments in cryptocurrency

Another turning point in Biden’s policy shift could be the fact that presidential candidate Donald Trump accepts political donations in cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), USDC, XRP, Dogecoin (DOGE), Shiba Inu (SHIB), Apecoin (APE), Bitcoin Cash (BCH), Dai (DAI) and Litecoin (LTC).

About two weeks ago, at an event promoting his NFT collection, the Republican candidate pledged support for the NFT industry, contrasting the policies of incumbent President Joe Biden's administration.

Now, Trump is once again appealing to the cryptocurrency community for support amid strict regulations from Biden supporters.

“Biden's representative Elizabeth Warren says she is assembling an 'anti-crypto army' to attack cryptocurrencies and limit the right of Americans to make their own financial choices. Now… With new crypto options, MAGA supporters will build a crypto army and lead the campaign to victory on November 5th!”

Donald Trump's election website

Should the cryptocurrency community be taken into consideration?

The number of cryptocurrency asset holders in the United States is on the rise, and the upcoming presidential election could have a major impact on the cryptocurrency industry.

A recent Digital Currency Group poll also found that more than 20% of respondents in several states believe cryptocurrencies are an important issue in the upcoming US election.

According to the survey, 40% of respondents want candidates to expand discussion of digital assets, while 20-25% want elected officials to focus on regulating the industry and protecting investors.

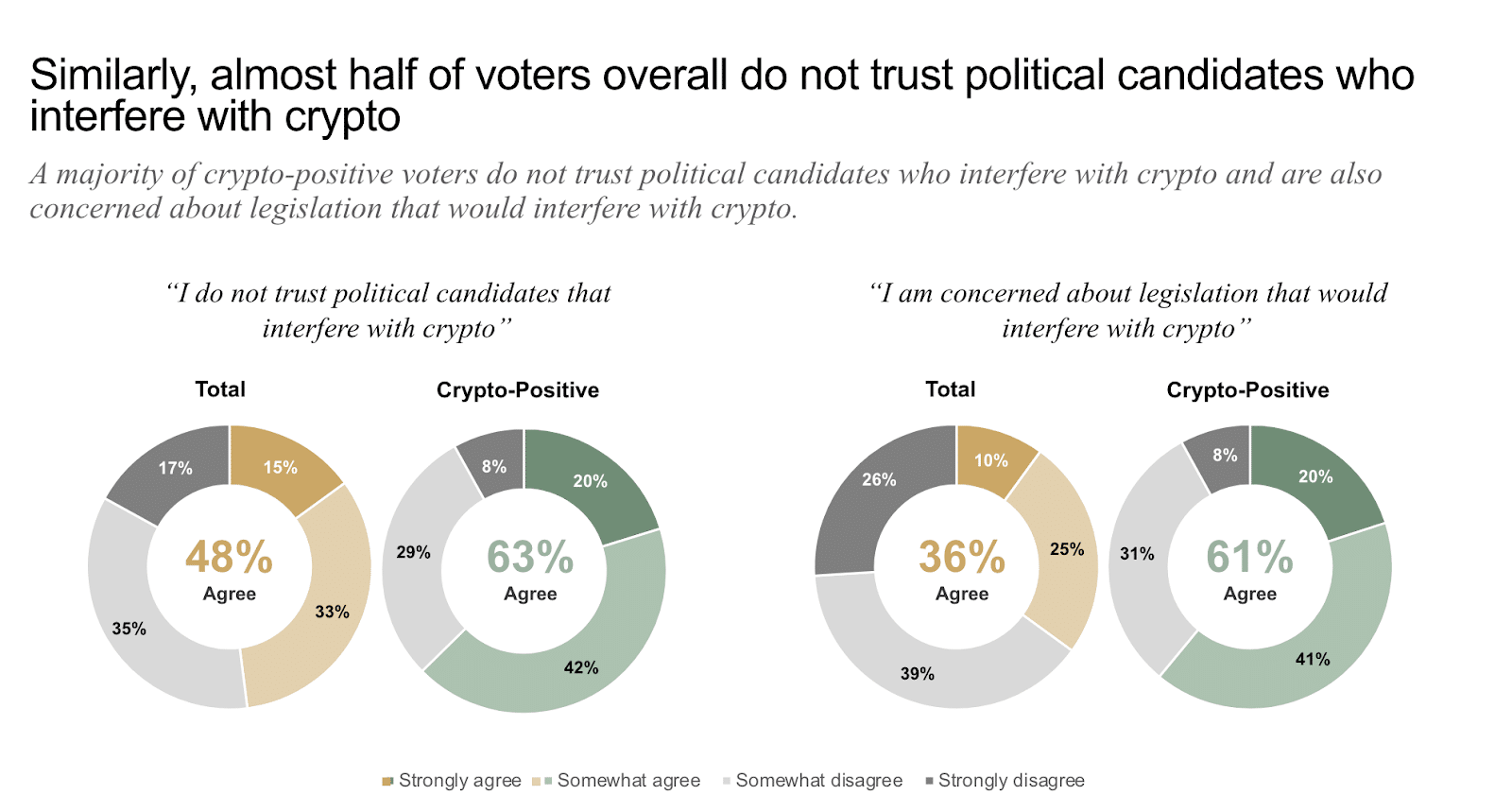

48% do not trust candidates to intervene in the digital asset sector, and 30% are willing to support crypto-friendly politicians.

Paradigm's research shows that the crypto community is increasingly distrustful of Biden. Approximately 48% of voters with digital assets plan to vote for Donald Trump in the next US presidential election. But only 38% support Biden.

What is behind the US authorities' softening of policy?

The cryptocurrency industry has increased its presence in Washington in hopes of influencing the upcoming U.S. election, spending unprecedented amounts of money to support crypto-friendly candidates and educate lawmakers.

While the crypto industry’s previous efforts to influence national elections have largely failed and, in the case of former FTX CEO Sam Bankman Freed, even amounted to criminal activity, the crypto industry’s political influence now appears to be growing and more durable.

Therefore, the Biden administration may soon replace aggressive rhetoric against cryptocurrencies with friendly rhetoric, catching up in this direction with President Trump, who turned cryptocurrencies into an electoral weapon.