22:45 ▪

Four

Minimum read time ▪ up to

Investors are scrutinizing signals from the crypto market as Ethereum's price stabilizes around the key $3,000 support. Between the resilience of long-term holders and the fear of short-term speculators, ETH could have some surprises in store.

Ethereum provides important support for short-term holders

Ethereum (ETH) price is currently fluctuating within a narrow range around the key psychological level of $3,000. This threshold also corresponds to 100-day and 200-day moving averages and is being watched by all players in the crypto market.

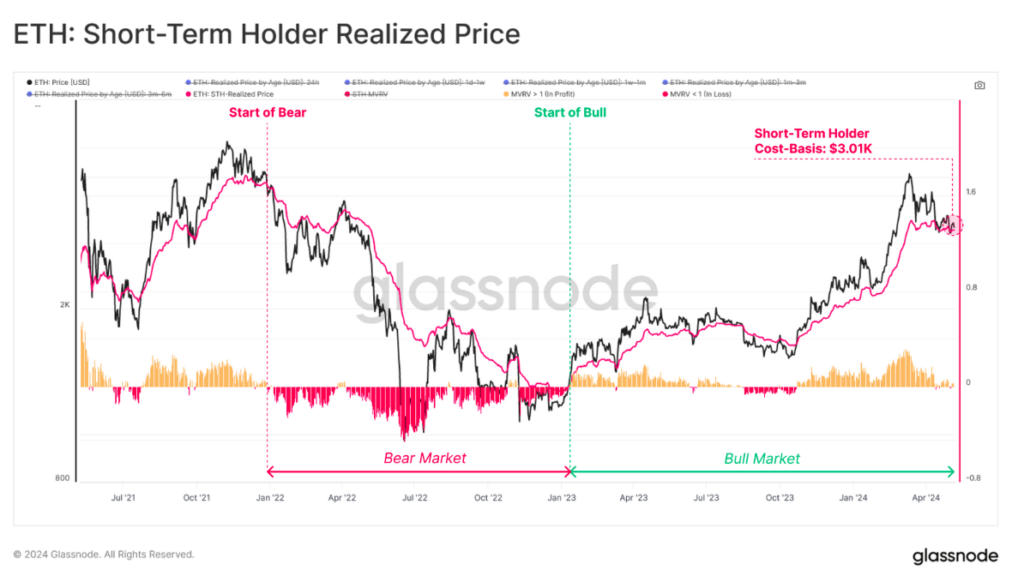

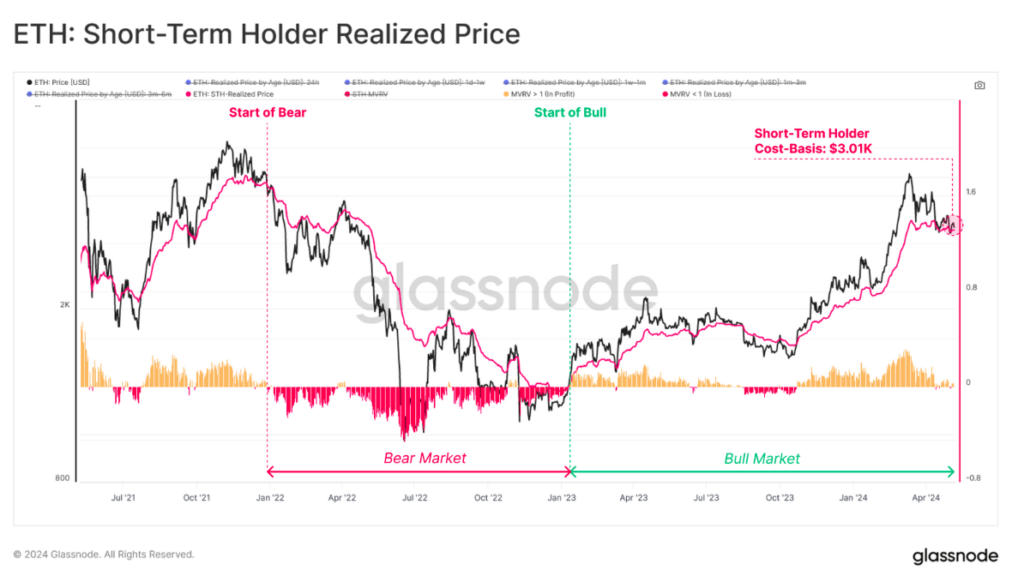

According to Glassnode, the average cost basis for short-term holders (STH) of ETH holding less than 155 days is just $3000. An apparent breach of this support could cause panic selling among these investors and result in unrealized losses for immediate buyers.

The MVRV (market value versus realized value) metric, which estimates potential gains or losses, highlights the vulnerability of this group. Because the premium is so low, even a small increase in bearish volatility could push his MVRV into negative territory and increase selling pressure.

Long-term holder in waiting

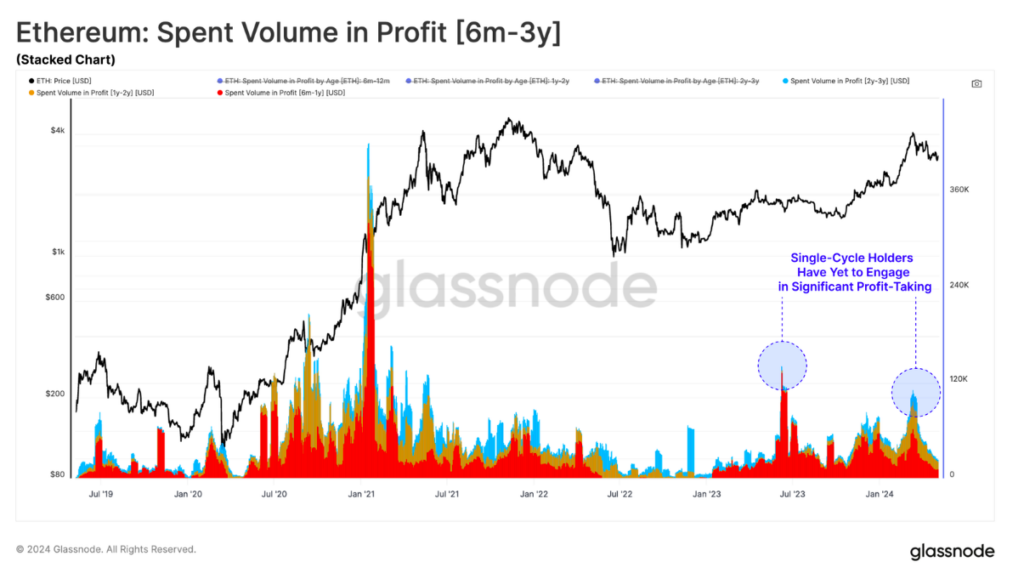

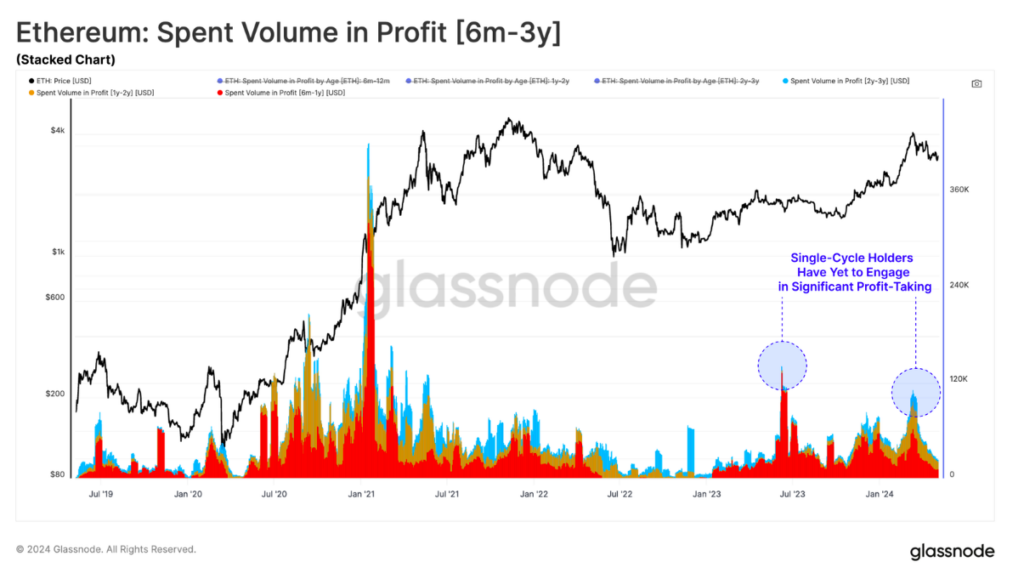

On the other hand, long-term holders (LTH) seem determined not to sell their tokens in a hurry. Despite the potential for significant gains, some companies have not been able to take advantage of recent peaks to cash out large amounts of profits.

This reluctance to sell is reflected in LTH's realized profit volume. Unlike Bitcoin (BTC), where 6-month to 2-year investors increased profit-taking during the last rally, Ethereum’s LTH appears to be patiently waiting for a better exit opportunity.

This behavioral dichotomy between anxious STH and confident LTH gives rise to a kind of “guess divergence.” The coming weeks will tell whether the support at $3,000 will be able to contain the pressure from short sellers.

Is it a bullish signal in the medium term?

Despite this short-term uncertainty, several indicators point to the possibility of a bullish rebound. Technical analysis reveals signs of increased demand, which could start a recovery in prices from a medium-term perspective.

Additionally, futures contract funding rates, although declining, are still in positive territory, reflecting the market not capitulating. Term purchases have not fallen into a euphoria and are maintaining considerable upward pressure, albeit moderately.

Finally, the impending decision by the US SEC regarding the EtherSpot ETF could provide another catalyst. If approved, it would undoubtedly result in higher prices and pave the way for a significant influx of institutional capital.

In conclusion, Ethereum is currently evolving in a bittersweet situation, torn between expectations and underlying concerns. Beyond this consolidation stage, fundamental advances in the ecosystem, especially regarding scalability solutions (Layer 2), could ultimately tip the balance in favor of the bulls. Until then, the certainty of $3,000 support remains uncertain.

Maximize your Cointribune experience with our Read to Earn program! Earn points and access exclusive benefits every time you read an article. Sign up now and get rewards.

Passionate about Bitcoin, explorer of blockchain and cryptography, and a challenger at the forefront of communication. We guarantee you a free life and financial freedom, and we guarantee you a safe life so you can use your Bitcoin safely.

Disclaimer

The views, ideas and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Please do your own research before making any investment decisions.