- AUDIO up +60% to $0.27

- However, the rally hit a hurdle near the $0.3 level. Can it be cleared?

Audius cryptocurrency, a Web version of music streaming platforms like SoundCloud and Spotify, saw its native token AUDIO rise by more than 65% on Thursday and Friday.

Interestingly, trading volume also increased by 6,900% in 24 hours, according to CoinMarketCap. The token is owned by Audius. list The company was featured by Business Insider as one of the top 14 music technology companies to watch.

“We're honored to be named one of @BusinessInsider's '14 Music Tech Companies to Watch'”

The rally turned the HTF (higher time frame) market structure bullish, but the price quickly hit a major hurdle: Thus, the question is, can AUDIO bulls clear the hurdle?

Audius Crypto Bulls' $0.3 Headache

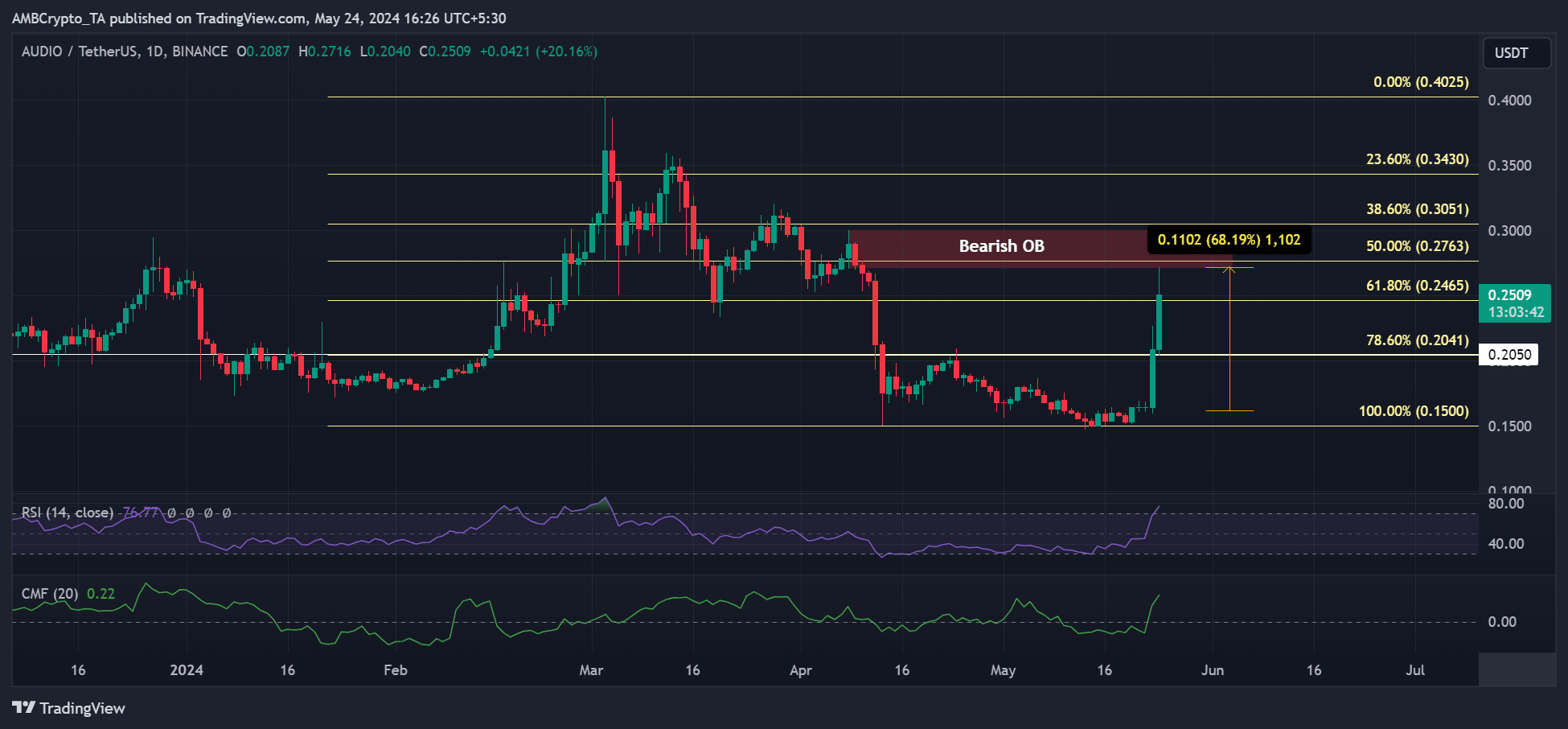

Source: AUDIO/USDT, TradingView

On the daily chart, the hurdle marked in red was the bearish order block ($0.27 to $0.30) within the 50% and 38% Fibonacci levels.

Although the market structure has turned bullish after breaking out of $0.270, the bulls can establish further leverage only if they overcome the $0.30 hurdle.

If the cooldown from the massive rally continues for an extended period of time, AUDIO could fall to $0.25 or even $0.20 before attempting to clear the roadblock.

Bullish readings from the RSI and CMF support the bounce scenario, highlighting the strong buying pressure and massive inflows over the past two days.

Audius cryptocurrency liquidity is declining

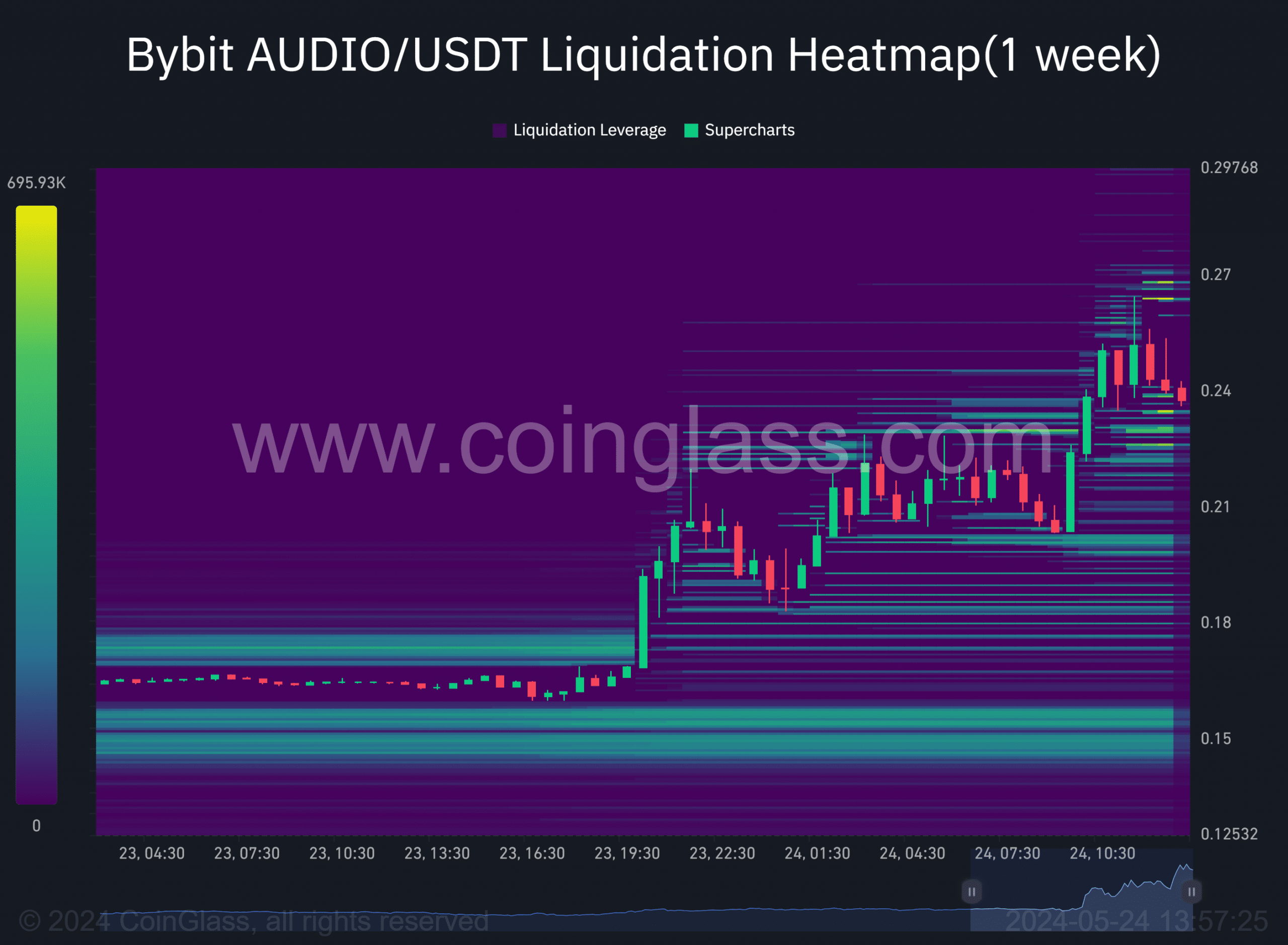

Source: Coinglass

According to liquidation data from Coinglass, the main clusters of liquidity were concentrated at the lower end of the price movement, specifically $0.20 and $0.15.

That meant that the price could pull back and gather liquidity in these key areas before attempting a rebound move.

Therefore, $0.20 and $0.25 are key price levels in the short term. If the bulls fail to sustain the 0.25% (61.8% Fib level), AUDIO can drop to $0.20. Bitcoin [BTC] On the charts, the decline continues to below $66,000.

read Audius [AUDIO] Price forecast 2024-2025

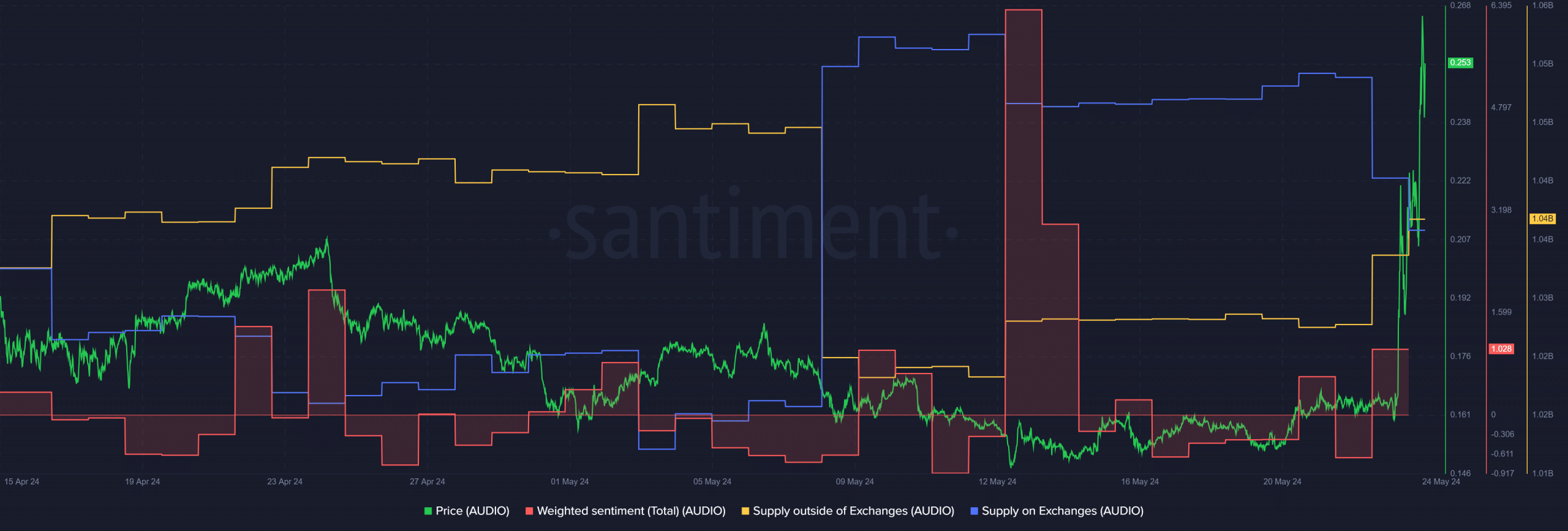

However, it is worth noting that key on-chain indicators have issued bullish signals: For example, exchange supply (blue) has decreased and off-exchange supply has surged, suggesting an easing of selling pressure and a surge in demand for AUDIO, respectively.

Source: Santiment

Moreover, the positive weighted sentiment reading highlights the bullish sentiment among market participants towards the audio market at the time of writing.

That being said, the pursuit of market liquidity below $0.20 or $0.25 remains an important move to watch, especially if the $0.3 hurdle is re-examined.