- Bitcoin continues to dominate as excitement around altcoins grows.

- Interest in retailers remains significant and should not be ignored.

2024 brought some unexpected twists and turns in the cryptocurrency space.From the long-awaited Bitcoin [BTC] Investors have experienced significant changes due to relentless price fluctuations.

The situation is further complicated by regulatory oversight from agencies such as the Securities and Exchange Commission (SEC) and now the Federal Bureau of Investigation (FBI).

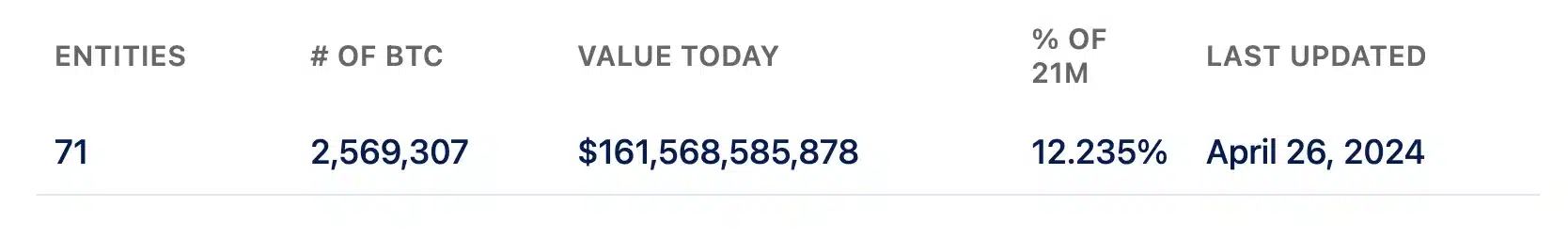

Despite these significant issues, investors remain attracted to the leading cryptocurrency Bitcoin, according to AMBCrypto analysis of Bitbo data.

Source: Vitobo

Zach Pandle, managing director of research at Grayscale Investments, made a similar point in a recent conversation with Anthony Pompliano:

“I'm incredibly bullish on this asset class.”

Bitcoin or altcoin?

However, contrary to the above sentiment, Brett Tejpaul, head of Coinbase Institutional, argued:

“As exciting as Bitcoin and Ethereum are, altcoin products are much more exciting to me.”

he added,

“I think this speaks to who is actually buying these products and the resilience of their thought process.”

This highlighted the growing excitement and attention surrounding altcoin products in the cryptocurrency market.

Despite the ups and downs of the market, interest and investment in altcoins such as Uniswap remains consistent. [UNI]Cardano [ADA]Polka dot pattern [DOT]Solana [SOL].

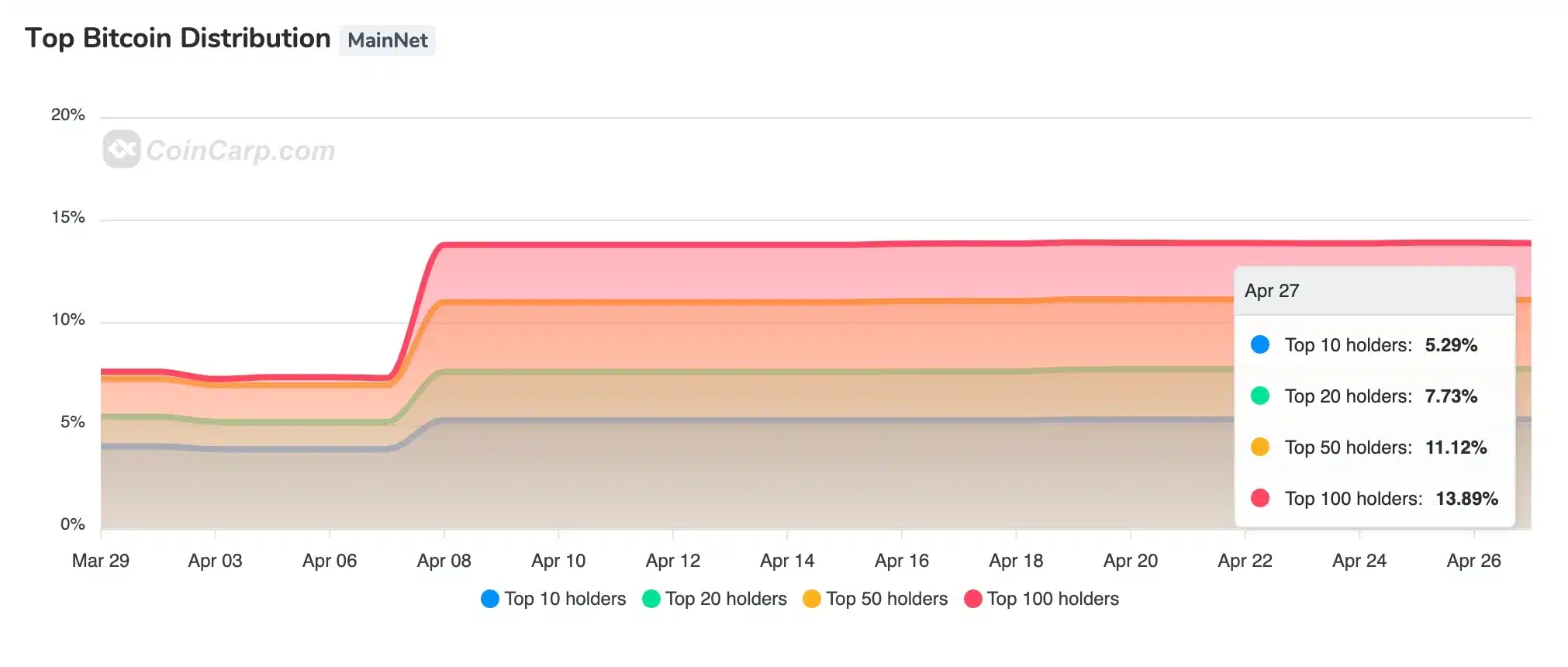

This is further supported by data from CoinCarp, which shows that the top 10 holders combined only hold 5.29% of the total BTC supply.

Source: CoinCarp

Bitcoin leads the market

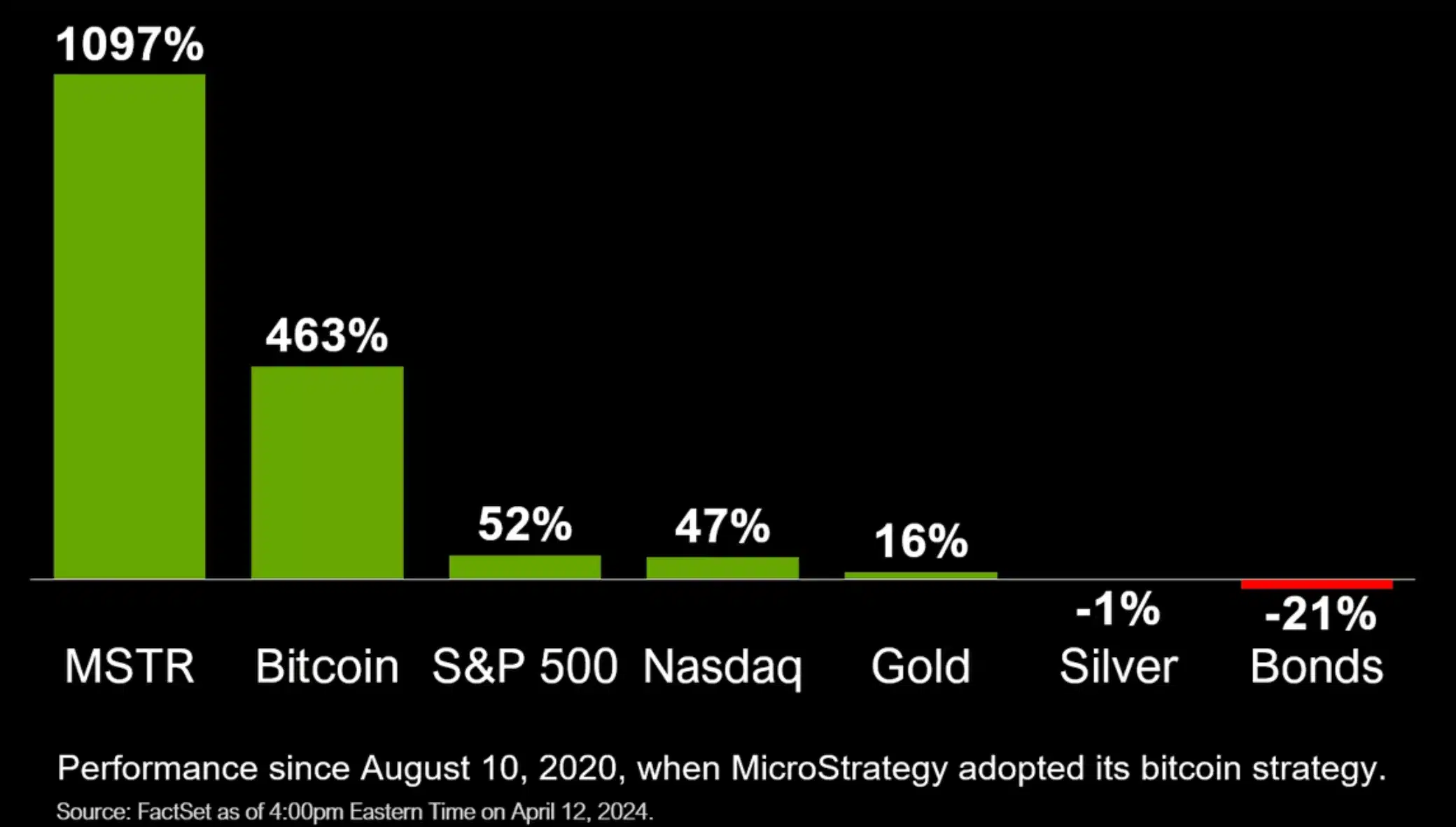

In contrast to Tejpor's views, Michael Saylor remained optimistic about King Coin. He explained how BTC has benefited his company through a graph shared in a post on X (formerly Twitter).

Source: Michael Saylor/Twitter

As of March 19, MicroStrategy owned 214,246 BTC.

Source: Vitobo

In 2021, institutional demand fueled Bitcoin’s rise, setting a new precedent.

The arrival of the BTC Exchange Traded Fund (ETF) in 2024 saw renewed interest from institutional investors, highlighting the important role of ETFs in driving demand and prices.

Role of individual investors

Amid all the talk surrounding institutional investors' entry into cryptocurrencies through ETFs, it is important to recognize the important role that retail investors play.

Echoing this, Russell Starr, head of capital markets at Defi & Valler, added:

“Well, ETFs welcome a mix of institutional and retail investors as starters.”

In conclusion, while ETFs provide additional liquidity for financial institutions, it is important to realize that early adopters already own direct investments in cryptocurrencies.

Therefore, while ETF approval is an important milestone, it may take some time for institutional inflows to fully materialize.