Prices for Arbitrum rose 12.9% on Thursday after Arbinhood announced its listing, while ARB has dropped more than 80% from an all-time high.

Ethereum's Layer-2 solution, Arbitrum (ARB), can now trade on Robinhood by participating in Bitcoin (BTC), Ethereum (ETH), Solana (SoL), and other Altcoins. In an X post on Wednesday, March 5th, the US-based online brokerage said users can trade ARBs through crypto-centric arms called Robinhood Crypto.

Following the announcement, Arbitrum's price rose 12.98% to $0.4258. However, even with the rally, the tokens are 82% below the $2.26 peak reached in January 2024, according to crypto.news pricing data.

In late January, Crypto.News suggested that Arbitrum tokens could be on a strong bullish breakout crisis as the amount of tokens on the chain suddenly jumped 118%, solidifying its best week in months. Another positive catalyst is that arbitrum formed a falling wedge pattern. It consists of two falling and convergence trend lines. These two lines are approaching the confluence level, indicating the potential for rebounds that could push any price to $1.2470.

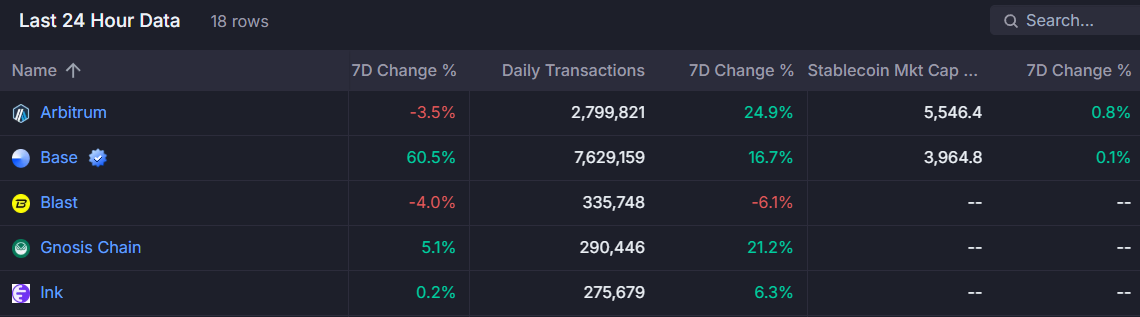

Meanwhile, Artemis' on-chain data suggests that traders have jumped on the latest news, with daily trading reaching 25% to 2.8 million over the past week. The top three most active addresses appear to be linked to tether and circle smart contracts. This suggests an increase in Stablecoin conversions, where willingness to capitalize on price movements could indicate traders' motivation.

What is ARB?

Founded in 2016 by Steven Goldfeder, Harry Kalodner and Joshua Goldfeder, Arbitrum is a Layer-2 blockchain designed to allow Ethereum to process more transactions at a greater cost. It handles the high charges and congestion of Ethereum by offloading some processing and data storage from your main Ethereum network.

Running Ethereum smart contracts requires a node to process every step, so transaction costs can be added immediately. By handling some of this work off-chain, Arbitrum aims to reduce congestion, reduce fees and improve overall efficiency.