- ETH faces untold odds as ETF expiration approaches

- Analysts predict BTC or SOL as potential beneficiaries of ETH issue

Ethereum [ETH] If recent analysts' forecasts come true, we could face a difficult situation and even major bloodshed.

According to cryptocurrencies Analyst James Van Straten says ETH could fall even further Bitcoin [BTC] If the SEC rejects the Spot ETH ETF application at the end of May.

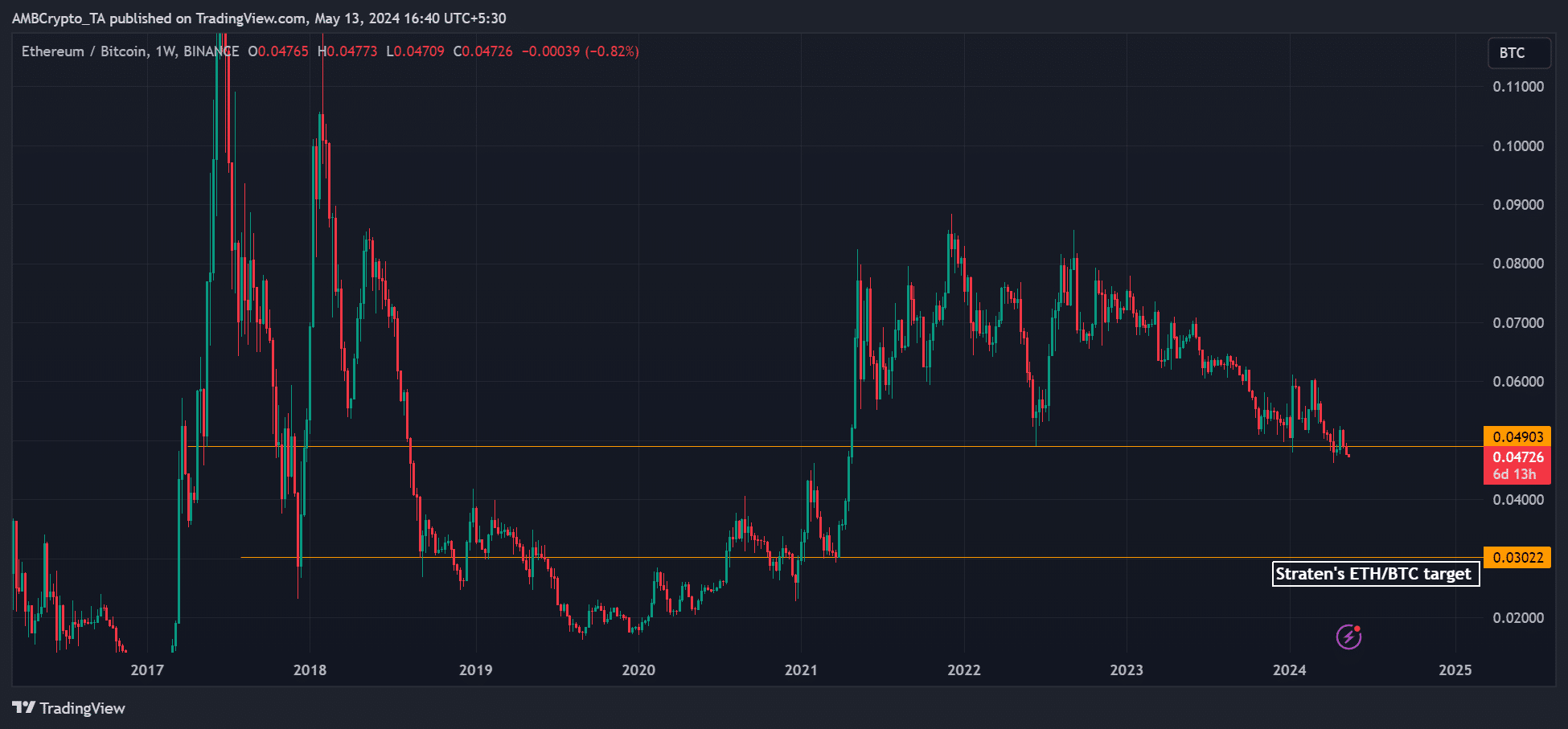

“Ethereum looks like it’s going to the grave. With the rejection of spot ETFs, the long-term forecast is for the ETHBTC ratio to fall from 0.047 to 0.03.”

Source: ETH/BTC on TradingView

SEC decisions on most ETH ETF applications are expected to be made between late May and August. VanEck and Hashdex's decisions are expected to be made on May 23 and 30, respectively.

These are the immediate dates the market is tracking starting next week. Straten predicts that the ETF rejection could cause the ETHBTC ratio to fall further.

This ratio tracks the value of ETH relative to BTC. If the ratio is 0.047, it means the value of ETH is 0.047 BTC.

In an ETF rejection scenario, negative market sentiment and selling pressure could reduce the value of ETH in BTC terms.

Ethereum’s inflationary “state” could worsen price outlook

Ethereum is currently “producing” more ETH than it is “burning” and is in a state of inflation. This is in direct contrast to BTC's fixed supply of 21 million pieces.

Straten added that due to the inflationary nature of ETH and the drop in transaction fees after the Dencun upgrade, Bitcoin is likely to take the lead in terms of fees.

“Bitcoin fees continue to exceed ETH, and there are very few transactions taking place on BTC. ETH is now moving towards inflation (lol). The Dencun upgrade will reduce transaction fees and reduce ETH burn. The rate increases the supply.”

AMBCrypto used Ultrasound to assess ETH inflation status data. It is shown that in the last 7 days he has spent 4.2,000 ETH, while in the same period he has 17.6,000 ETH minted.

This means that Ethereum has issued four times as many tokens as were burned last week, which could significantly increase supply and cause ETH price to fall.

Bitcoin maximalist Fred Krueger shared the same opinion.kruger said ETH then “depreciated” Solana [SOL] Increased competitiveness by lowering fees.

“But then they (Ethereum) get fooled by Solana with low fees. So we enter phase 2, where new upgrades lower fees and ETH becomes inflated again.”

Bloomberg ETF analyst Eric Balchunas remained pessimistic. view ETH ETF application will be approved in May.

If the rejection becomes a reality, it could cause a catastrophe for ETH on the price charts and affect the ETH stock price. long term holderthose who have not yet recorded profits.

It remains to be seen how BTC or SOL will benefit from the ETH issue if the SEC rejects ETFs starting next week.