Stocks of Nvidia and other AI chip makers are bleeding shortly after the launch of Alibaba's new AI model, and AI Tokens' market capitalization is seeing a similar hit.

According to Yahoo!, Nvidia's shares are down 5.7% today, with Nvidia losing nearly 18% since the start of the year, marking the worst monthly performance for Nvidia since June 22nd. finance.

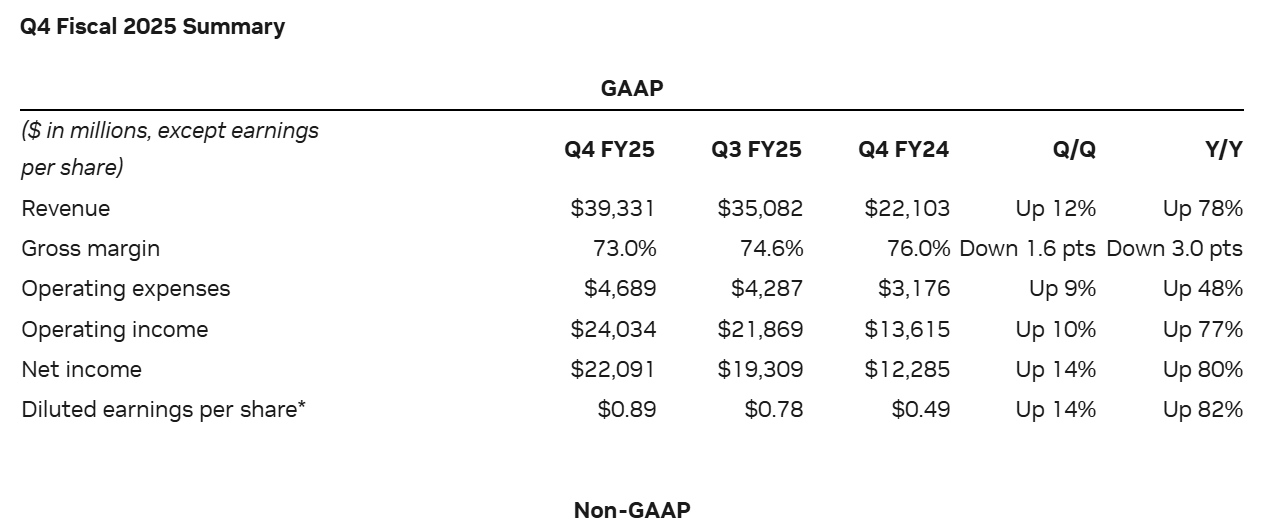

Nvidia recently announced its fourth quarter revenue for 2024, which ended January 26th, reporting 78% growth in the quarter at $39.33 billion, a year-on-year, breaking analyst estimates of $382.5 billion.

However, while Nvidia's revenue exceeded analysts' forecasts, they were worried that the potential impact of Deepseek's related investors would reduce future demand for Nvidia's chips. However, Nvidia said Deepseek has increased demand for inference solutions and has baffled investors about the possibility that it is causing recent falls.

Another concern was Nvidia's profit margin, a bit lower than expected. According to Nvidia, this is mainly because they invest heavily in the production of new Blackwell GPUs. Nvidia expects profit margins to recover by the second half of the year.

One important factor that could have caused Nvidia to overturn the inventory is the risk of tariffs being placed on Taiwan, where Nvidia manufactures AI chips. These duties can cost Nvidia's products to produce and sell, which can affect profitability. There is also uncertainty about whether the US will impose additional restrictions or extend current restrictions. If this occurs, it could limit the ability to sell its chips to Chinese customers, especially given how important China is in the global semiconductor market, which will affect its growth potential.

Jim Kramer made a cynical comment about XX.

Following in the footsteps of NVIDIA and other AI inventory, AI & Big Data Tokens' market capitalization fell nearly 5% in the last 24 hours and 9% in the last month. This suggests that investors appear to be pulling back from AI Cryptos as AI stocks become hits, fearing that slowing down AI hardware development will be able to stop the growth of distributed AI projects that rely on it (like NVIDIA GPUs).

Story Protocol (IP) and Rendering (rendering) have been hit particularly hard, falling 9% and 4% respectively over the last 24 hours. Both story protocols and rendering may rely on Nvidia or other similar high-performance GPUs to handle visual data, simulations, and other AI-driven features. Nearby protocols (nearby) and virtual protocols (Virtual) that support GPU-heavy applications built on top of the platform were hit even more violently, dropping by 6% and 12%, respectively.

What happens to Nvidia can feel like a tsunami. Global uncertainty appears to be spurring recent divestments as Behemoth outstrips revenues than last quarter, with several AI tangential cryptocurrencies stripping them of the pinch.