According to market intelligence platform Santiment, Bitcoin (BTC) is sending bullish signals based on certain historical factors.

In a new thread, Cryptocurrency Analysis Company To tell The top crypto asset by market capitalization appears to be losing momentum after surging nearly 150% since October.

However, Santiment points out that historically, the more people worry about BTC over the long term, the more likely the market will continue to rise.

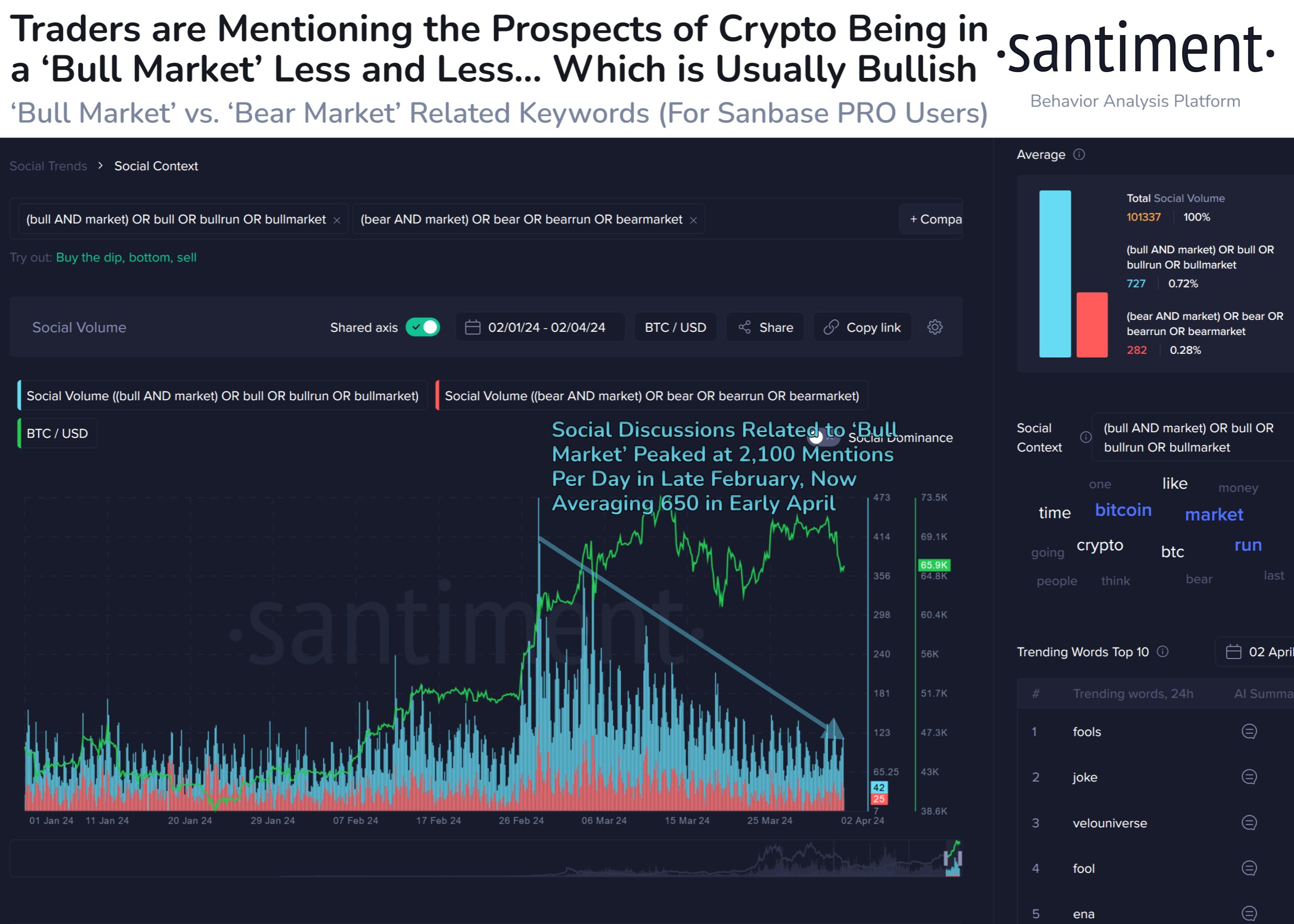

“Are cryptocurrencies still in a bull market after Bitcoin’s +144% price return since October 15th?” Well, according to the crowd, that belief has largely evaporated. . Historically, when long-term optimism wanes, it increases the likelihood that a market rally will continue. ”

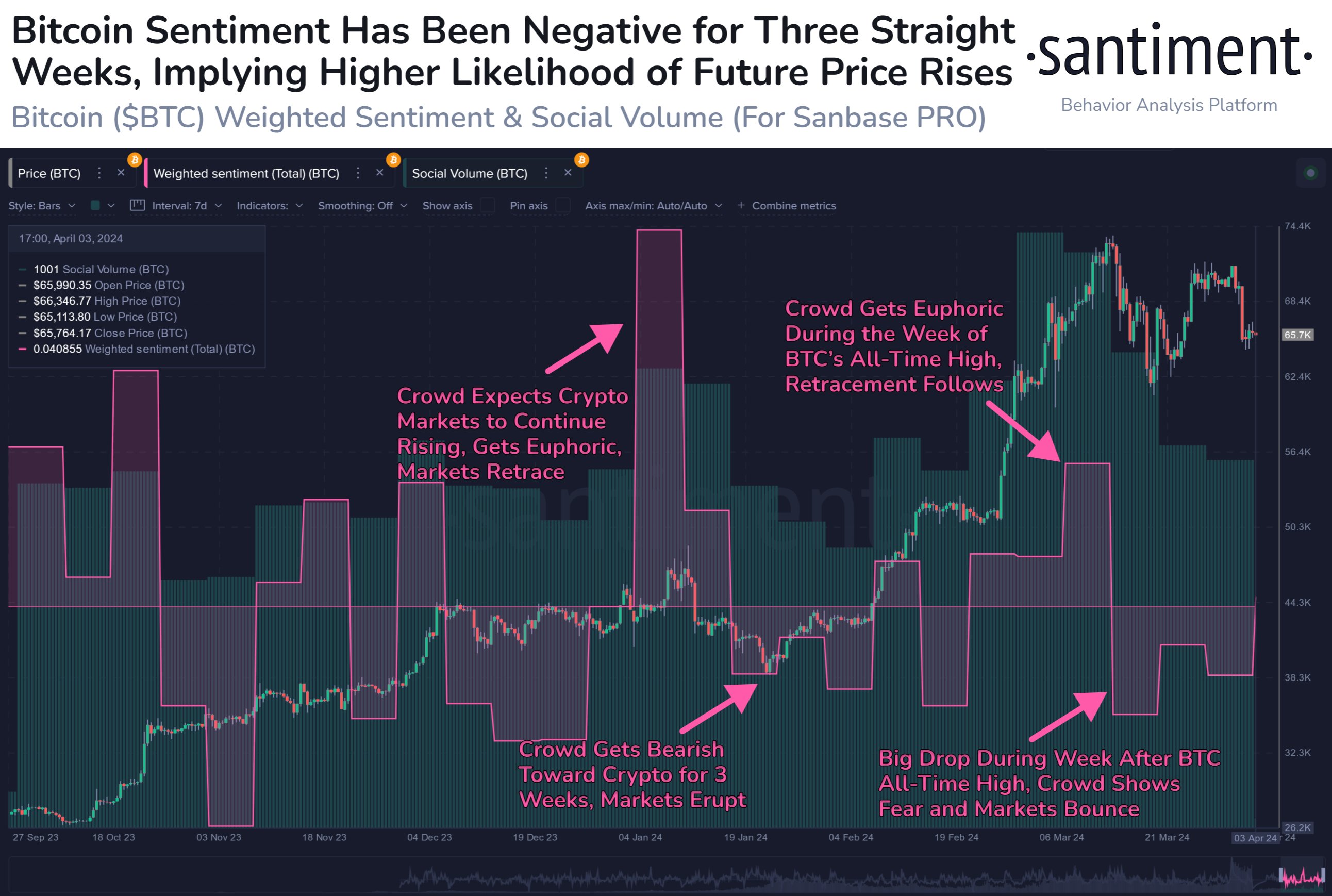

Citing the change in the crowd's view of Bitcoin, Santiment says Bitcoin bulls should be like that. support Market sentiment will remain bearish.

“Crowd sentiment towards Bitcoin and the crypto market in general has been oscillating since the big correction three weeks ago. Even with the BTC halving just two weeks away, there is a lot of FUD in trader sentiment. , uncertainty, doubt) and bearish expectations.

Bulls should be favoring the overall consensus to remain negative, as the price briefly recovered to $69,000 on Thursday. Historically, markets move in the opposite direction to what the crowd expects, so the best time to buy is when most people don't believe the rally will start or continue. ”

Santiment went on to say that the market believes that the government is to blame for Bitcoin's recent decline. sale 10,000 BTC seized from the defunct online black market Silk Road. According to the cryptocurrency analysis firm, BTC price spikes tend to occur when people become concerned about the seized Silk Road Bitcoin stacks.

“Bitcoin has recovered to above $69,000 after falling below $65,000 just two days ago.According to most of the crypto community, the drop was due to U.S. government officials It is believed that this is due to the fact that he approved the sale of nearly 10,000 BTC due to seizure.

Four more falls of similar size are expected to occur throughout 2024, causing great anxiety among traders. As you can see, there were two major spikes in crowd interest related to Silk Road in 2024, and both foreshadowed an almost instantaneous spike in the cryptocurrency market shortly thereafter.

Markets usually move in the opposite direction to what the crowd expects, so if the fear persists, expect further price increases. ”

At the time of writing, Bitcoin was trading at $67,905, down slightly from the previous day.

Never miss a beat – Subscribe to get email alerts delivered straight to your inbox

Check price action

follow me twitterFacebook and Telegram

Surf the Daily Hoddle Mix

Disclaimer: The opinions expressed on The Daily Hodl do not constitute investment advice. Investors should perform due diligence before making high-risk investments in Bitcoin, cryptocurrencies, or digital assets. Please note that transfers and transactions are made at your own risk and any losses you may incur are your responsibility. The Daily Hodl does not recommend buying or selling any cryptocurrencies or digital assets. The Daily Hodl is also not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: Mid Journey