- Inflation increased by 3.5%.

- Ethereum has risen more than 2% in the past 24 hours.

Ethereum [ETH] There was a positive response after the release of the latest CPI report. This report attracted a lot of attention and discussion among traders, with many traders expressing an increased interest in crypto assets based on the findings of this study.

CPI shows inflation rise of 3.5%

CPI rose 0.4% in March, better than expected, compared to an expected 0.3% rise and February's 0.4% rise. Compared to the same month last year, the CPI increase rate was 3.5%, slightly higher than the expected 3.4% and February's 3.2%.

Year-over-year core CPI rose slightly to 3.8%, slightly above the 3.7% expected, but unchanged from February's figure. This data suggests that a rate cut is unlikely anytime soon.

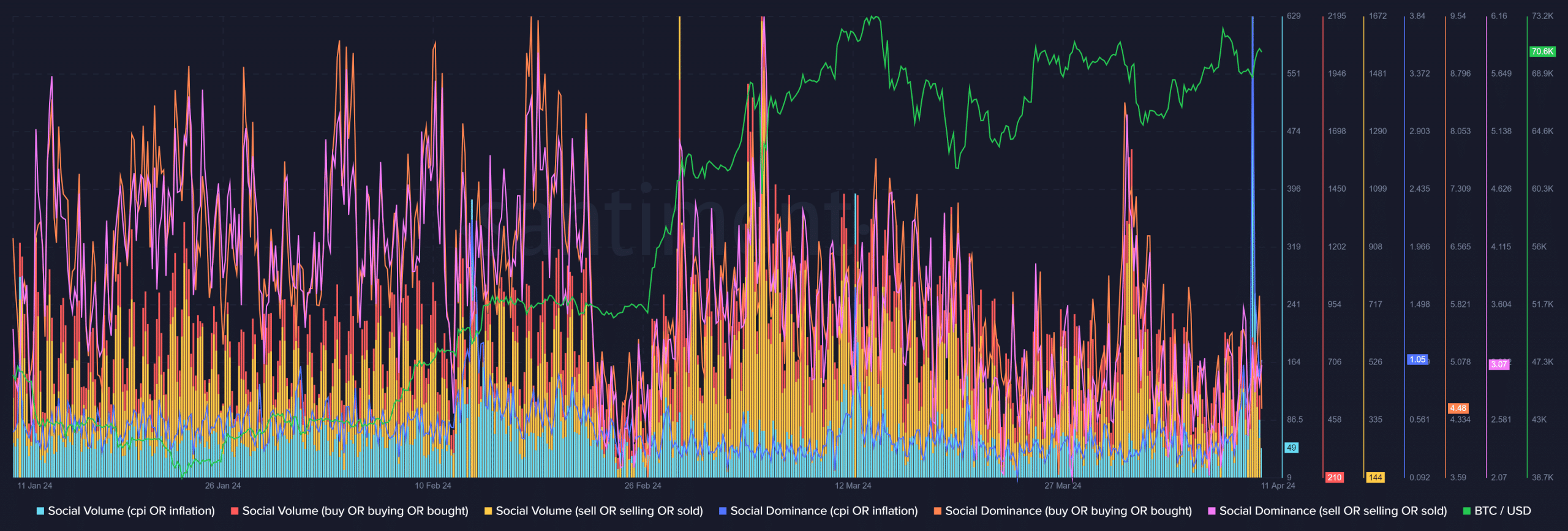

According to Santimento data, this month's CPI report garnered significant attention and proved to have the highest number of mentions in social discussions. Social volume jumped to over 257 and social dominance reached approximately 1.58%.

As of this writing, social volume had decreased to 49 and social dominance was 1.05%. The impact of this report has led to increased interest in crypto assets like Ethereum.

Buy call puts Ethereum in an advantageous position

The CPI report was not the only topic driving increased interaction. Discussions about buy and sell calls also saw increased engagement. According to Santiment data, on April 10, the social volume of buy calls reached 814 calls, with a social dominance of 4.97%.

Conversely, the social volume of the sell call was 533 and the social dominance was 3.25%.

Source: Santiment

At the time of writing, the buy social volume was down to 210 and the sell social volume was 144. Additionally, the buy social dominance was 4.48% and the sell dominance was 3.07%.

These numbers indicate a strong buying trend among traders, which is reflected in Ethereum outflows.

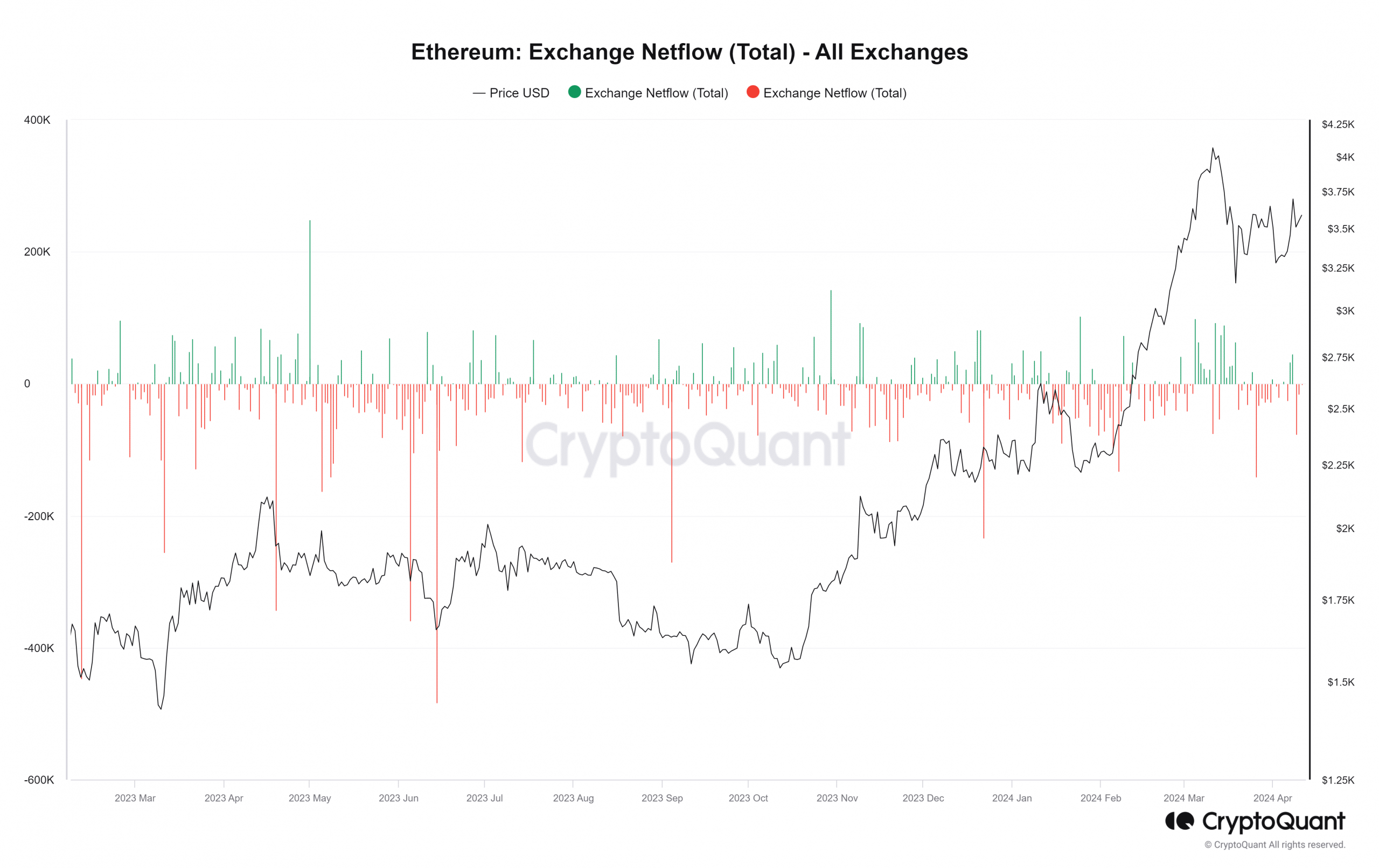

Ethereum expects more currency outflows

An analysis of Ethereum exchange net flows reveals that the increase in buy calls following the CPI report is reflected in exchange flows. According to the data, leaks are dominating the flow on ETH exchanges, with more than 15,800 ETH leaked from various exchanges on April 10th.

As of this writing, outflows continue to dominate, with over 800 ETH already withdrawn from exchanges. This suggests that ETH buying and selling activity has increased after the CPI report.

Source: CryptoQuant

Read Ethereum (ETH) price prediction for 2023-24

Ethereum continues to rise after CPI

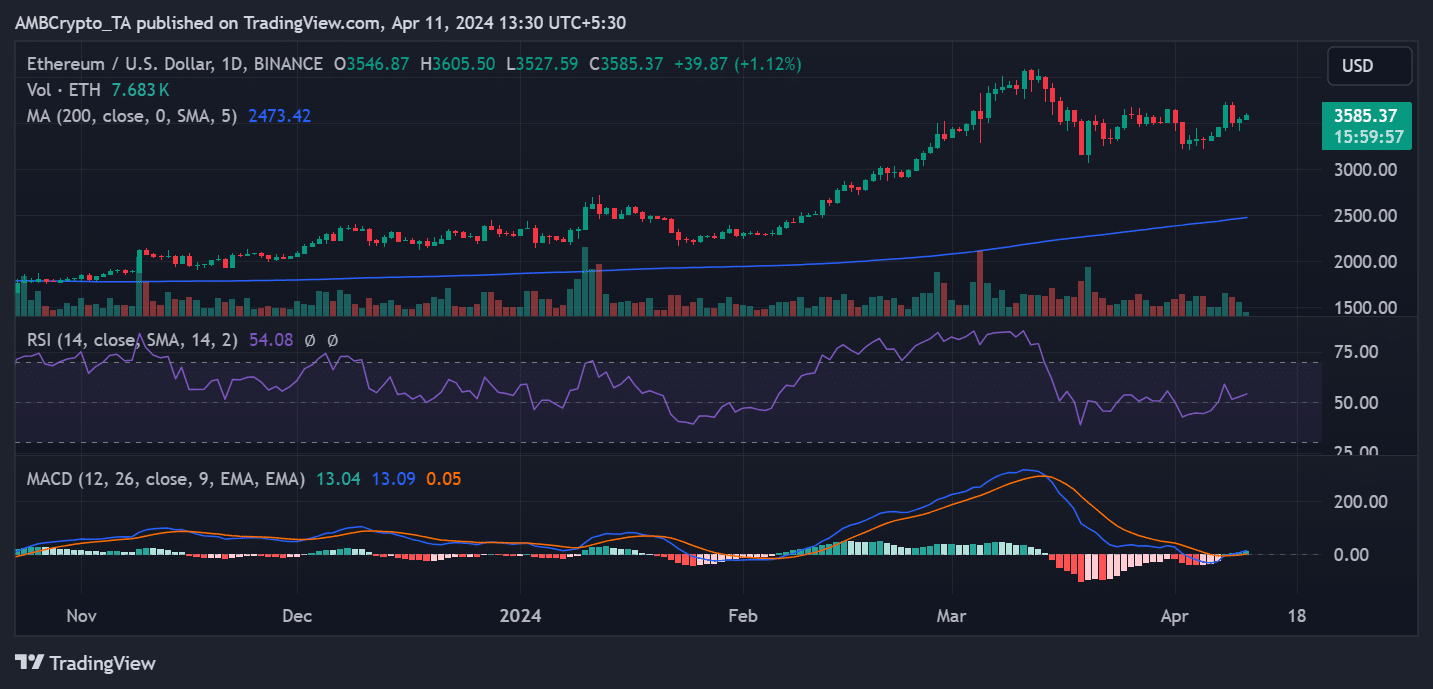

The daily timeframe chart shows Ethereum closing higher on April 10th, suggesting that the CPI report had no negative impact.

An analysis of the charts shows that ETH closed up more than 1%, trading at around $3,400. As of the latest data, the rally continues, with ETH trading around $3,580, reflecting an additional gain of over 1%.

Source: TradingView