Unlock Editor's Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

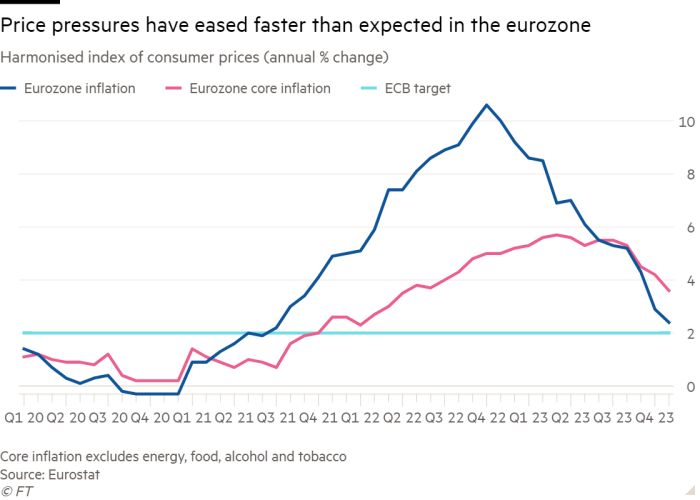

Eurozone inflation fell much more than expected in November to 2.4%, its slowest annual pace since July 2021, providing some relief to consumers and prompting interest rate cuts soon There were high hopes that this would happen.

The sharp decline from 2.9% in the previous month was driven by investors hoping for rate cuts soon and central bankers seeking to keep borrowing costs high until the biggest rise in inflation in a generation is firmly contained. This further heightens the tension between them.

The main factors behind the slowdown in the harmonized index of consumer prices were lower energy prices and lower growth in food and services prices, according to data released by the EU's statistics arm Eurostat on Thursday.

Economists polled by Reuters had expected a more modest slowdown to 2.7%. With inflation falling, investors are pushing the European Central Bank to start cutting deposit rates as early as April next year.

“Lower inflation and a weaker economy could justify an ECB rate cut as early as the first quarter of next year,” said Matthew Landon, a strategist at JPMorgan Private Bank. . “It's increasingly likely that Lagarde and others will lead the developed world into the next cycle of rate cuts.”

The euro extended its recent decline, falling 0.6% against the US dollar to $1.091.

But ECB President Christine Lagarde warned this week that “this is not the time to start declaring victory” in efforts to bring inflation down to the central bank's 2% target. The ECB president added that wage pressures “remain strong” and are “a major driver of domestic inflation.”

When the ECB meets on December 14, economists expect it to cut its growth and inflation outlook. But Andrew Kenningham, an economist at consultancy Capital Economics, said rate-setters were still on the brink of cutting rates, especially since rising energy prices are likely to push euro zone inflation above 3% in 2019. “It's definitely too early to say,” he said. December.

Inflation in the euro area has slowed from a peak of 10.6% a year ago, and consumers' purchasing power is expected to rise further as wages rise faster than prices.

But the cost of living remains nearly 20% higher than it was before inflation started rising three years ago.

Fabio Panetta, in his first speech since leaving the ECB and taking over as head of Italy's central bank, warned that the “continued slump in economic activity” could accelerate the decline in inflation and that monetary policy He said this meant the economy needed to be tightened only for a “short period”.

“We need to avoid unnecessary damage to economic activity and risks to financial stability, which ultimately threaten price stability,” Panetta said. He also pushed back against calls from other ECB rate-setters to accelerate balance sheet shrinkage by prematurely halting reinvestment in the pandemic-era bond portfolio of 1.7 trillion euros.

Lagarde said on Monday that while price pressures are expected to ease further, she cited expectations for flat energy prices and added that “headline inflation could rise slightly again in the coming months, mainly due to base effects.” Ta.

The OECD predicted on Wednesday that the ECB would not start cutting interest rates until 2025, citing persistent price pressures.

Inflation rates within the euro zone remained wide ranging in the year to November, from 6.9% in Slovakia to -0.7% in Belgium. Of the 20 countries that share the euro, five, including Italy and the Netherlands, have inflation rates below the ECB's 2% target.

Energy prices in the region fell by a record nearly 11.5% in October. Growth in food, alcohol and tobacco prices slowed to 6.9%, slowing from 7.4% last month and a peak of 15.5% earlier this year.

Core inflation, which excludes energy and food, slowed to 3.6% from 4.2% in October. This indicator is closely monitored by the ECB as a measure of potential price pressures.

Separate figures released on Thursday showed unemployment remained at a record low of 6.5% across the region in October. However, unemployment rates rose in both Germany and Italy.