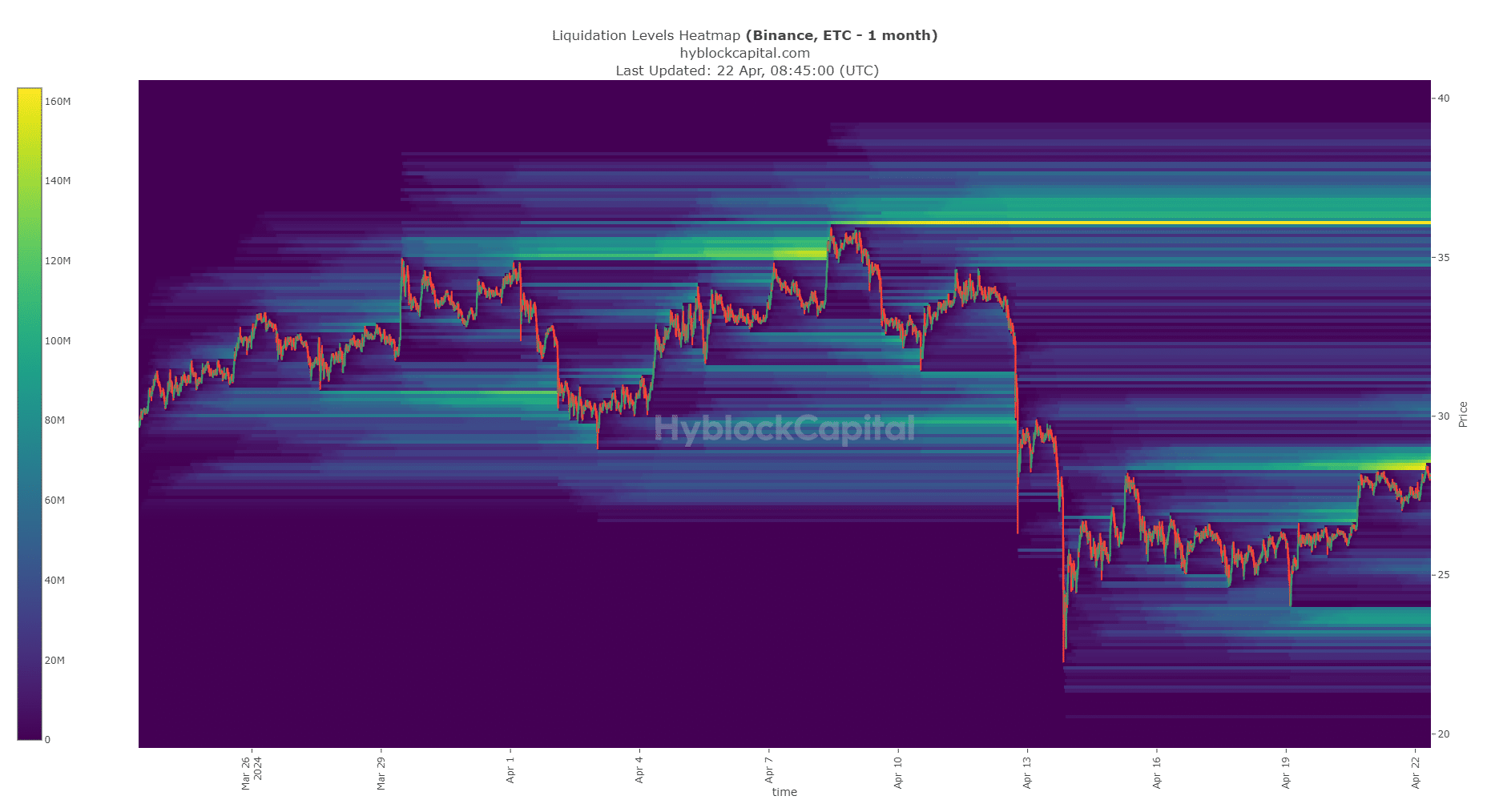

- The liquidation heatmap suggested that an ETC reversal could be imminent.

- Bullish sentiment increased as the pair defended the 78.6% retracement level.

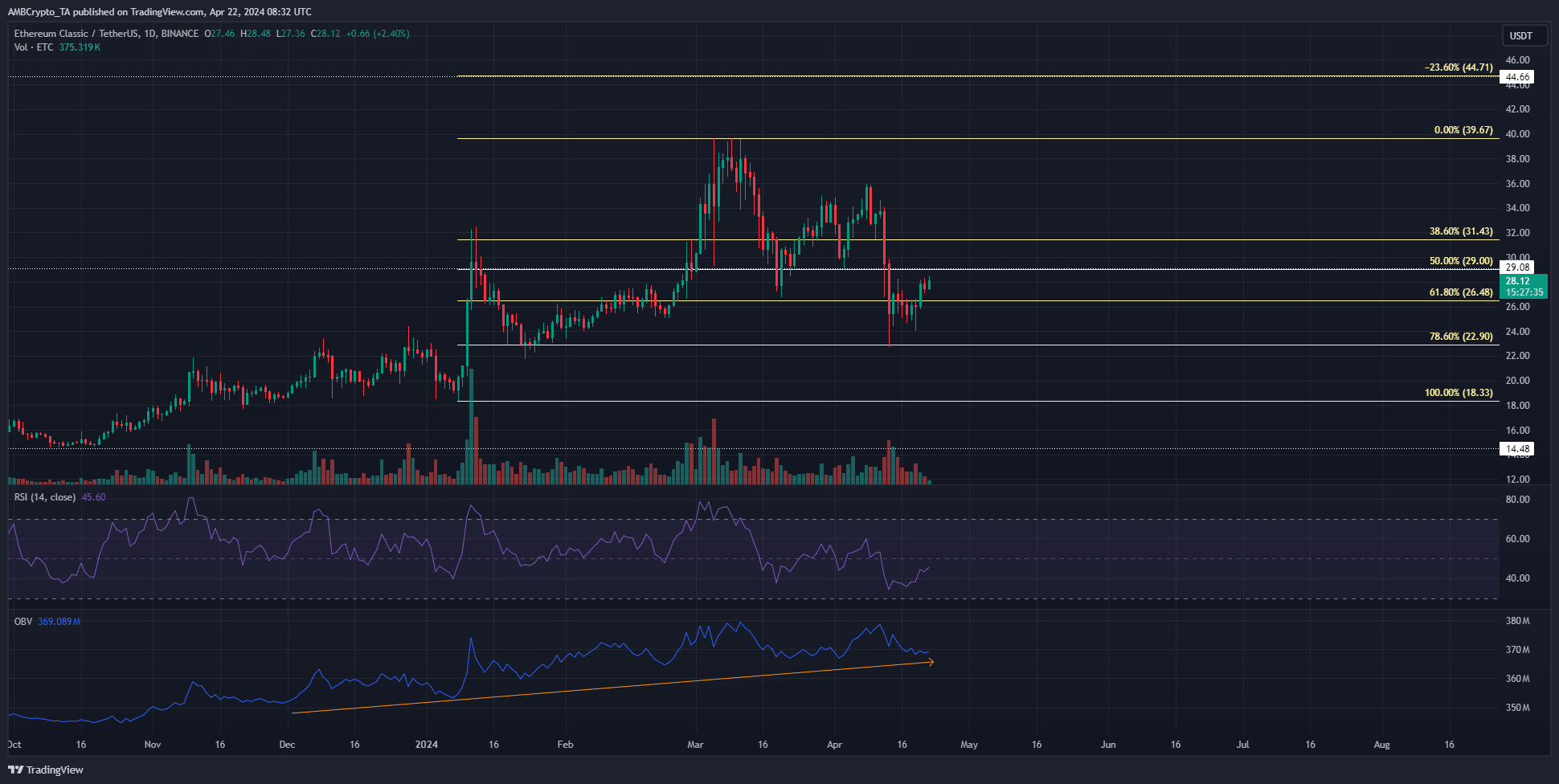

ethereum classic [ETC] It showed signs of long-term bullishness. Its volume indicator has been trending upward since December 2023, indicating strong buying pressure.

On the other hand, recent losses have hurt investor confidence.

In the case of Bitcoin [BTC] At $66,000 at press time, short-term sentiment appeared to be in favor of the bulls. However, BTC also has a large resistance level overhead and we cannot rule out another correction.

Therefore, ETC holders should also prepare for a bearish scenario this summer.

Long-term ETC bulls remain confident

Source: ETC/USDT on TradingView

The Fibonacci retracement level (light yellow) showed that the 78.6% retracement level at $22.9 was defended twice in 2024.

Moreover, the market structure on the longer time frame remains bullish, with $18.33 being the key swing low.

Over the past five months, OBV has been on an upward trend, showing stable purchase volumes. So, despite the recent pullback, the bulls are likely to come out on top.

Conversely, OBV has struggled to reach new highs since March.

Therefore, purchases last month only increased slightly. Buyers still have to fight to regain the short-term uptrend. The next important levels that the bulls claim as support are $29 and $34.4.

The RSI remains below neutral 50 on the daily chart, indicating continued bearish momentum.

With heavy resistance overhead, could we see some movement southward soon?

Source: High Block

AMBCrypto analyzed the liquidation heatmap for the past month. It showed two sharp pockets of liquidation levels at $28.47 and $36. At the time of writing, the $28 region was being tested.

Read Ethereum Classic [ETC] Price prediction for 2024-2025

A clearout of the $28-$29 zone remains possible before a bearish reversal towards $23.6.

To the north, the next largest pocket of liquidity, $36, was a long way off. Traders should brace for rejection from the $29 resistance area unless demand arrives and sentiment turns bullish in the near term.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.

![ethereum classic [ETC] Defend important support twice: Is $36 next?](https://decentralizedrebel.com/wp-content/uploads/2024/04/Ethereum-Classic-Featured-Image-1000x600.webp.webp)