- BTC Could Rise to $67,269 in First Stage of Predicted Rally

- Liquidation levels indicate bearish bias and may soon become invalid

Bitcoin's situation may have changed [BTC] After the end of the fourth quarter. However, in terms of price, there is more that remains the same than what changes. AMBCrypto came to this conclusion after tracking coin transfers to derivatives exchanges. According to CryptoQuant data, the number of BTC sent to derivatives exchanges has increased significantly.

Specifically, we observed that this was the work of a whale. Historically, when this happens at a fast rate, it means whales are preparing to open long positions in Bitcoin.

Source: CryptoQuant

Big guns are getting aggressive

A pseudonymous on-chain analyst, Datascope, also commented on the activity. According to his datascope who shares his thoughts on CryptoQuant:

“The increase in the rate of Bitcoin transfers from exchanges to derivatives exchanges is considered an important indicator. Recent data shows that this type of transfer is an important factor in the rise in Bitcoin prices. Masu.”

At the time of writing, the price of Bitcoin was $63,572. It is worth noting here that before the halving, AMBCrypto had claimed that the number one cryptocurrency may have already been priced in.

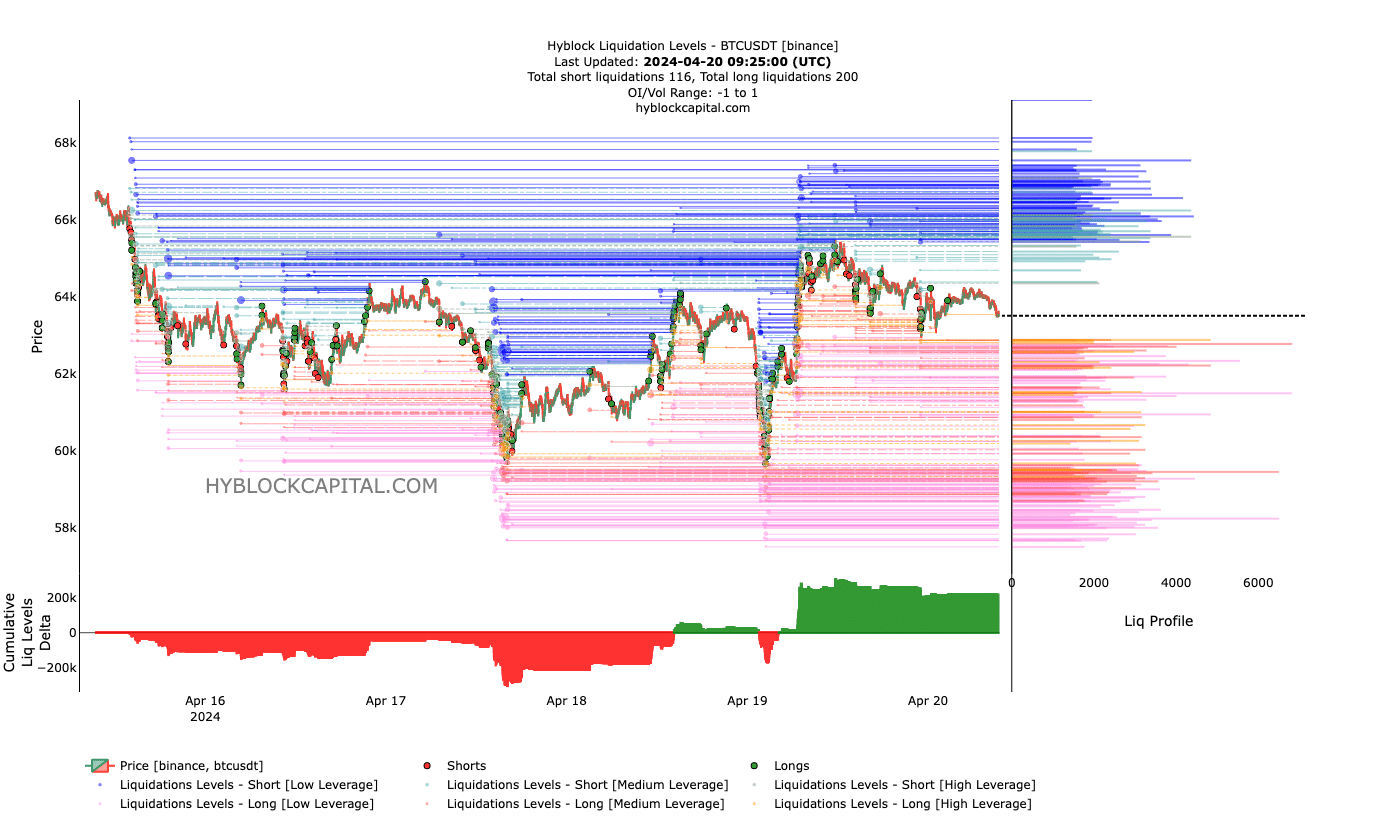

However, based on the latest analysis, the stalemate could turn to the upside. Liquidation levels are one metric driving this prediction.

Liquidation levels reveal the estimated price level at which a liquidation event may occur. For context, a liquidation occurs when an exchange forcibly closes a trader's position. This is due to insufficient margin balance or highly leveraged bets in the opposite direction.

At the time of writing, a chunk of liquidity has appeared between $65,434 and $67,269, suggesting that Bitcoin price may aim for these levels in the short term.

Another thing we noticed is that there has been some aggressive buying since below $64,000. If buying pressure increases, low leverage longs could quickly pay off.

The bear won't survive what's about to happen.

Finally, we considered cumulative liquidation level delta (CLLD). As of this writing, CLLD was positive. A negative value of CLLD indicates a shorter period of liquidation.

Conversely, a positive reading means there was a longer period of liquidation. However, this indicator also has some influence on prices.

Source: High Block

The above signs indicate that CLLD is manifesting a bearish bias. However, if a whale enters an order with current liquidity, the signal may reverse.

In this situation, the price may fall and a stop loss may occur. Still, once some of the liquidity is drained, prices could start to rebound.

read bitcoin [BTC] Price prediction for 2024-2025

If this holds true in the future, Bitcoin could rise and could reach $75,000 in the medium term. However, in the short term, BTC could fall below $63,000 before the pump starts much later.