By: Alexander Reed | Last updated: 2/22/24

Buying Bitcoin with a bank account is probably the best way to go in order to get the cheapest exchange rate possible. Different exchanges will be best suited for you depending on where you live in the world. This post will cover the leading reputable exchanges that supply bank wire services.

How to Buy Bitcoin with a Bank Account Summary

- Visit Kraken and open an account

- Go to your dashboard and select – “Add payment method”

- Add your bank account

- Go to “Buy/sell”

- Buy Bitcoin

eToro disclaimer: This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK

Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU

protections & not supervised by the EU regulatory framework. Investments are subject to market risk,

including the loss of principal.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CFDs are not available to US customers.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

If Kraken doesn’t work for you, or you’d like to review additional options, keep on reading. Here’s what I’ll cover:

- Kraken

- eToro

- Coinmama

- CEX.IO

- Coinbase

- Bitpanda

- Luno

- Bitstamp

- Bitfinex

- CoinCorner

- Frequently Asked Questions

- Conclusion

1. Buy Bitcoin with your bank account through Kraken

Pros: Reputable exchange, low deposit and trading fees

Cons: No brokerage service, historically a lot of reported downtime

Headquartered in San Francisco, Kraken is a veteran exchange known to be one of the largest Bitcoin exchanges in terms of euro volume and liquidity.

It operates across the United States (with the exception of New York and Washington state due to regulation) and Canada, as well as in the European Union, Asia, Africa, and South America.

SWIFT deposits are available for US dollars with a 150 USD minimum through Etana Custody or a 4 USD minimum through Bank Frick. SEPA deposits are available for EU members, with a 1 EUR minimum.

Deposit fees are mostly free, with the exception of just a handful of options.

Read our full Kraken review here.

2. Buy Bitcoin with your bank account through eToro

Pros: Intuitive interface for beginners, low fees

Cons: Not available worldwide, mainly suited for price speculation

eToro is a pioneering trading company that puts an emphasis on cryptocurrency. It supplies users with an easy-to-use trading platform for investing in cryptocurrencies. eToro is more suited for price speculation (not available for US users) than actually buying the coins, as withdrawing them to your wallet is much more complicated than with other platforms.

eToro accepts SWIFT transfers worldwide and ACH transfers within the US. eToro also offers a mobile wallet for trading, sending, and receiving funds.

Read our full eToro review here.

Visit eToro Read review

eToro disclaimer: This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK

Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU

protections & not supervised by the EU regulatory framework. Investments are subject to market risk,

including the loss of principal.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

CFDs are not available to US customers.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

3. Buy Bitcoin with your bank account through Coinmama

Pros: Good support, good reputation, smooth platform

Cons: Not supported in New York, Hawaii, or Louisiana

Coinmama is a brokerage company that accepts bank transfers, including SEPA, for purchases, with a minimum amount of 5 USD per transaction, a maximum of 10,000 USD, and a 1,000,000 USD monthly limit.

The company has been around since 2013 and is considered to have a good reputation, fast service, and an easy-to-use and smooth platform

If you use a bank transfer with Coinmama’s service, you can save up to 5% of the processing fee compared to its debit and credit card transactions. Furthermore, using bank transfers lets you enjoy higher spending limits than credit card purchases.

Read our full Coinmama review here.

Visit Coinmama Read review

4. Buy Bitcoin with your bank account through CEX.IO

Pros: Multiple payment options, good reputation, wide selection of cryptocurrencies

Cons: Relatively high fees on brokerage service (can be avoided by using the trading platform)

CEX.IO was founded in 2013 and is one of the oldest crypto companies around. Today, the company provides two main services – a brokerage service and a trading platform service. The brokerage service is usually more expensive but easier to use. On the other hand, the trading services are cheaper but can be confusing.

The company supplies the option for SEPA transfers within the EU, SWIFT, Faster Payments, domestic wire, and bank transfers for countries outside the EU. All bank account transfer fees are minimal at $2.99.

Read our full CEX.IO review here.

Visit CEX.IO Read review

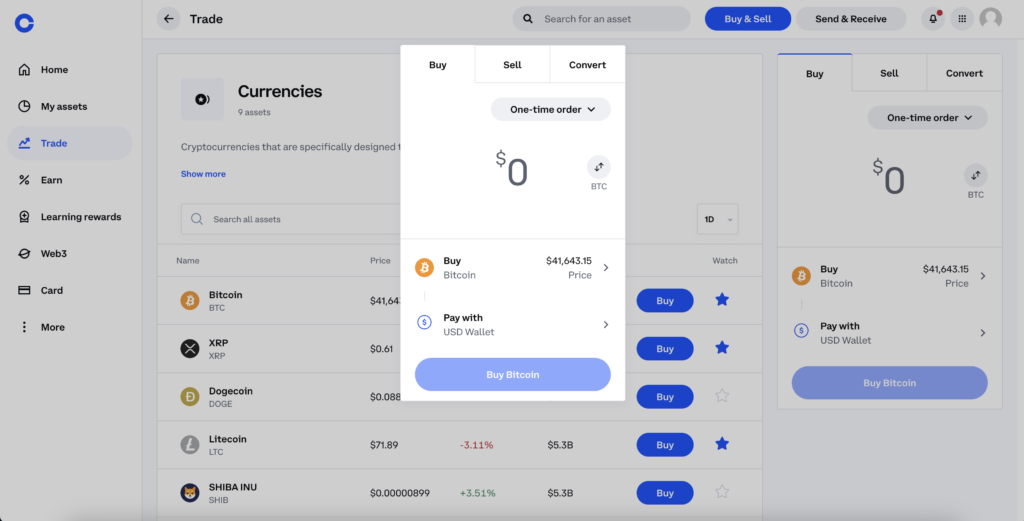

5. Buy Bitcoin with your bank account through Coinbase

Pros: Fast transfers within the US and EU, low fees

Cons: Slow support, not completely available worldwide

Coinbase is one of the pioneering companies in the Bitcoin ecosystem and has been around since late 2012. Coinbase supplies brokerage services to many countries worldwide (meaning they sell you Bitcoin and other cryptos directly and not through a trading platform).

For US customers, Coinbase allows you to connect your bank account via ACH bank transfer. For European customers, Coinbase will also allow you to buy Bitcoin with a SEPA transfer, Faster Payments, or Easy Bank Transfer.

For all countries Coinbase supports (100+ in total), there is a US $10 fee for wire deposits and a €0.15 EUR fee for SEPA deposits, while SWIFT GBP deposits are free.

Read our full Coinbase review here.

Visit Coinbase Read review

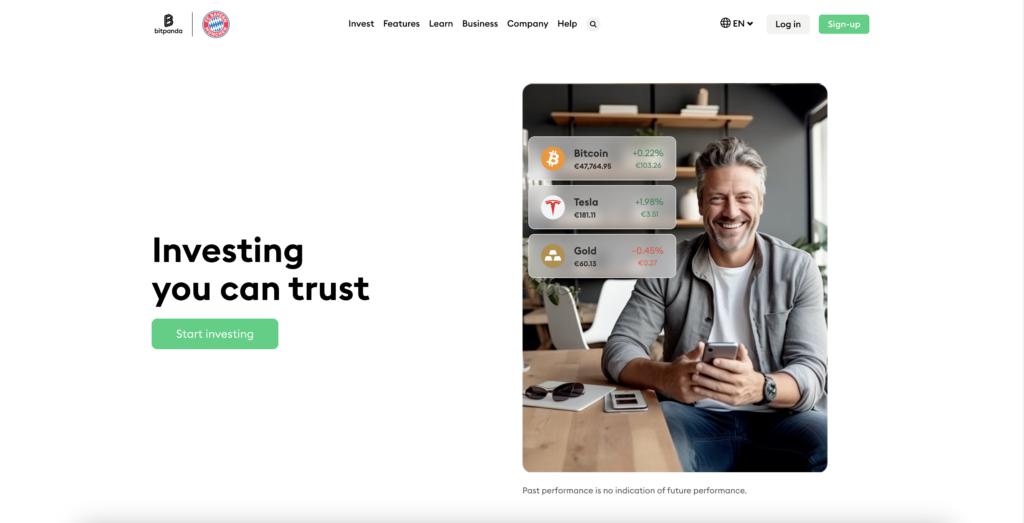

6. Buy Bitcoin with your bank account through Bitpanda

Pros: Multiple payment options, intuitive interface, wide variety of investable assets

Cons: Not available worldwide, fees “hidden” inside the exchange rate

Bitpanda was founded in 2014 and supplies brokerage services for Bitcoin plus other cryptocurrencies to countries within the Eurozone and a handful of other countries. The company accepts SEPA transfers from European countries.

You can deposit nine major fiat currencies via bank transfer: the Euro, US dollar, Swiss franc, British pound, Swedish krona, Hungarian forint, Czech koruna, Polish zloty, and Danish krone.

At the time of writing, there are zero fees on all deposit methods, including credit cards.

The minimum amount to buy and sell assets is 1 EUR or 1.50 USD.

Read our full Bitpanda review here.

Visit Bitpanda Read review

7. Buy Bitcoin with your bank account through Luno

Pros: Best option for under-served, emerging markets

Cons: Limited country support

Luno (formerly known as BitX) is a great option for emerging markets. The company supports many European countries, as well as Indonesia, Malaysia, Nigeria, South Africa, and Uganda.

For Australia, bank transfers are free for amounts above $50. SEPA transfers are free for accounts verified in Europe. Bank transfers are free for accounts verified in the UK. Deposit fees for Uganda and South Africa are free.

Read our full Luno review here.

Visit Luno Read review

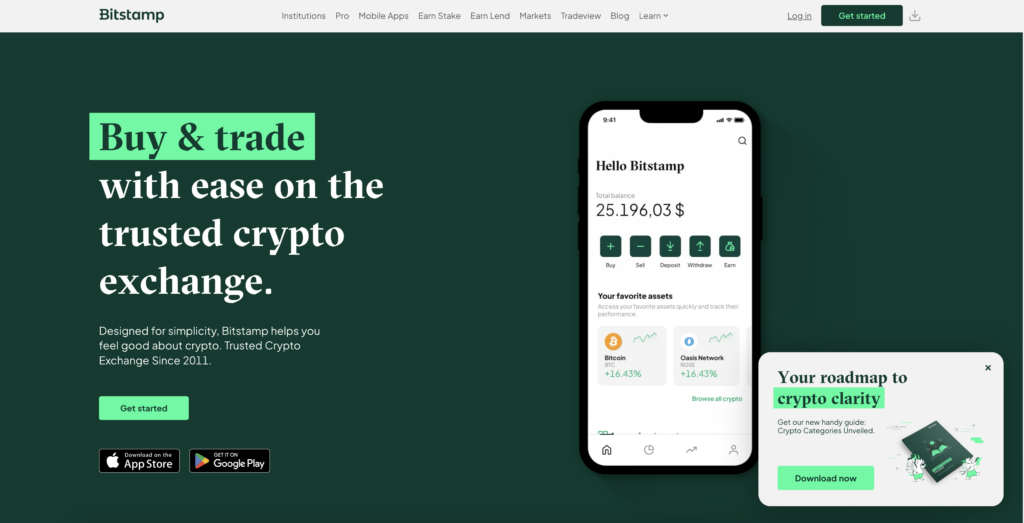

8. Buy Bitcoin with your bank account through Bitstamp

Pros: Reputable exchange, low deposit and trading fees

Cons: No brokerage service; platform can be confusing for beginners

Probably the oldest exchange on this list is Bitstamp, which was founded in 2011. The exchange has offices worldwide, including Singapore, Luxembourg, Slovenia, the UK, and the USA.

SEPA, ACH, and Faster Payments deposits are free.

Trading fees on the platform vary depending on your monthly volume; for most users, the fee will be between 0.25% and 0.50%. Bitstamp does not offer brokerage services, so you must know your way around trading platforms to use the site.

Read our full Bitstamp review here.

Visit Bitstamp Read review

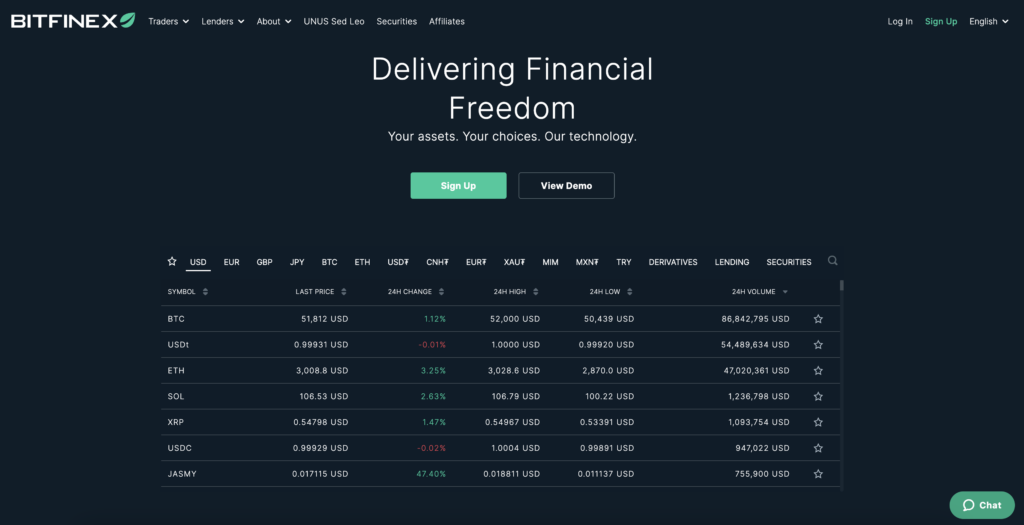

9. Buy Bitcoin with your bank account through Bitfinex

Pros: High liquidity, reasonable fees

Cons: Complex interface, history of hacks

Bitfinex, registered in the British Virgin Islands, is one of the world’s oldest Bitcoin exchanges, having been founded in 2012. The company supports bank account transfers worldwide and takes a 0.1% deposit fee for incoming wire transfers with a minimum fee of 60 USD or EUR.

Bank wires with OpenPayd have a 5 EUR/GBP fee per transaction.

The company supplies only a trading platform and no brokerage services. Trading fees depend on volume and start at 0.2%.

Read our full Bitfinex review here.

Visit Bitfinex Read review

10. Buy Bitcoin with your bank account through CoinCorner

Pros: Smooth platform, good reputation, established company

Cons: Supports limited countries

CoinCorner is a Bitcoin exchange established in mid-2014. The company is based in the Isle of Man and currently supports 30 countries.

GBP bank transfer and EUR bank transfer deposit fees are free. British Pounds can be deposited via Faster Payments for free, with a minimum deposit of 5 GBP and no maximum. EUR deposits are made with SEPA and are also free, with a 5 EUR minimum and no maximum.

Visit CoinCorner Review coming soon

11. Frequently Asked Questions

People who want to buy large amounts of Bitcoin or don’t have any access to credit or debit cards will probably look to buy Bitcoin with their bank account.

Since exchanges have substantially less risk when people purchase Bitcoin with their bank account, the fees for such a process are significantly lower. Unlike credit cards, bank transfers are considered irreversible and reduce the risk of chargeback.

So, if you buy $1,000 from Coinbase via a bank transfer, you’d pay $14.9 in fees, while if you bought the same amount with a credit card, you’d pay $39.9 in fees. As you can see, you can save 50% and more when using a wire transfer.

Also, buying limits are much higher when using a bank transfer to fund your account than when using a credit or debit card.

On the downside, bank transfers are usually less convenient to execute and take longer to process since the transfer needs to clear several banks on its way to the exchange.

You can’t transfer Bitcoin to your bank account. Bitcoin can only be held inside a Bitcoin wallet. If you would like to “cash out” your bitcoins, you’ll need to exchange them back to fiat currency (dollars, euros, etc.) and then withdraw that currency to your bank account.

No, you don’t have to have a bank account in order to buy Bitcoin. There are a variety of methods to buy Bitcoin without a bank account.

12. Conclusion – Bank transfers are cheaper but slower

If you’re thinking about buying large amounts of Bitcoin or don’t have any access to credit cards, you should probably use one of the methods above. Keep in mind that some banks may require additional info about the nature of the transaction and may also collect additional fees for the transfer itself.

In my opinion, if the purchase amount isn’t large, you’re better off using your credit card or debit card. It will cost a little more, but the coins will arrive quicker, and there will be much less hassle in the buying process.

If you have any questions about the process or the exchanges, please ask them in the comment section below.

We hate spam as much as you do. You can unsubscribe with one click.