- Bitcoin fell 2.31% after halving, but ETF inflows surged, boosting investor confidence

- Potential expansion of crypto ETFs beyond Bitcoin and Ethereum could drive mainstream adoption

Looks like Bitcoin [BTC] Being halved came with its own share of surprises. After all the hype surrounding the Bitcoin halving, BTC hit a rocky patch and fell 2.31% in just 24 hours. This despite the Bitcoin ETF market noting such significant changes. After 5 days of outflows, there was suddenly a positive net inflow just before the halving day.

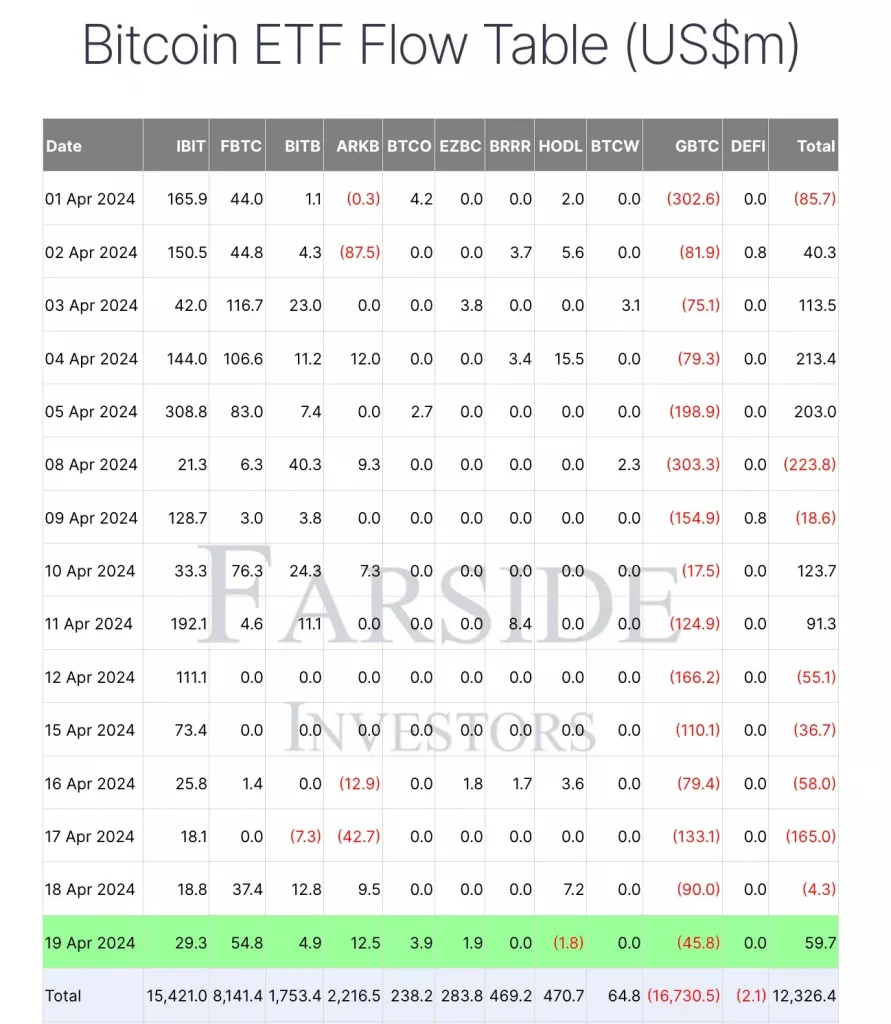

In fact, five out of 10 ETFs had total positive inflows of $59.7 million, according to data from Pharcyde Investors.

Source: Farside Investors

This highlighted the growing confidence among investors in the ETF space in Bitcoin's pre-halving and post-halving performance.

Expansion of ETFs leading to mainstream adoption of cryptocurrencies

Discussing the potential expansion of the crypto ETF space beyond Bitcoin and Ethereum [ETH]Chainlink co-founder Sergei Nazarov claimed in a recent interview:

“I think the next thing we'll see is more ETFs around coins other than Bitcoin and Ethereum. So I think the momentum in ETFs will continue this year and continue to grow and grow.”

His comments highlighted the potential for ETFs to foster widespread adoption of digital assets and accelerate mainstream integration of Web3 technologies.

It is worth noting here that Anthony Scaramucci, founder of SkyBridge Capital, also mentioned this topic in a separate interview.

“Bitcoin is on the adoption curve.”

he added,

“Until we get over 1 billion users, we won't see the kind of inflation hedge or store of value that other experts are talking about. So right now it's a lot more volatile than people would like. It will be.”

Focus on Spot Ethereum ETF

Positive steps are being taken towards mainstream adoption, with Hong Kong recently approving Bitcoin and Ethereum ETFs. But while the U.S.-based ETF has amassed nearly $60 billion in assets since its inception, predictions for the success of Hong Kong's new ETF are mixed.

A Bloomberg ETF senior analyst expressed a similar opinion. Eric Balchunas Recently commented,

“Other countries adding BTC ETFs is definitely additive, but it’s a nickel and dime compared to the mighty US market.”

All of this brings us to the question – will the SEC deny the Spot Ethereum ETF application?

In response to the above question, Jupiter Zheng, Head of Research at Hashkey Capital, replied:

“If the ETF were to be rejected, it wouldn't be that bearish because the market hasn't priced it in yet. And we still have Bitcoin ETFs as an entry point for traditional funds.”

But what determines entry into the crypto market? According to Nazarov, adoption is possible.

According to the executive, to address concerns about mainstream adoption, the cryptocurrency industry needs to focus on enhancing ease of use, scalability, connectivity, and privacy. Improvements in these areas will not only attract broader adoption, he concluded, but will also push boundaries and move the industry forward.