A wave of activity by large crypto investors known as crypto whales has flooded major exchanges with millions of dollars worth of Ethereum (ETH), Uniswap (UNI), and Space ID (ID).

This surge in transactions has caught the attention of the crypto market, raising questions about the motives behind these moves and their potential impact on prices.

Whale activity surges: Crypto exchanges flood

Since April 16, 2024, crypto analysts have been tracking several significant transfers. According to on-chain data, DWF Labs moved his 9.2 million ID tokens worth $6.69 million to cryptocurrency exchange – OKX. After this transaction, the ID token will no longer be held in DWF Labs' wallet tracked by Spot On Chain.

Read more: Best crypto exchanges with lowest trading fees

Amber Group, a major cryptocurrency company, also appears to be involved in sales activities. Arkham Intelligence data suggests that Amber Group transferred 1 million Arbitrum (ARB) tokens worth $1.13 million to Coinbase. This comes after $9.43 million worth of ARBs were transferred to exchange addresses last month, leaving $3.57 million remaining.

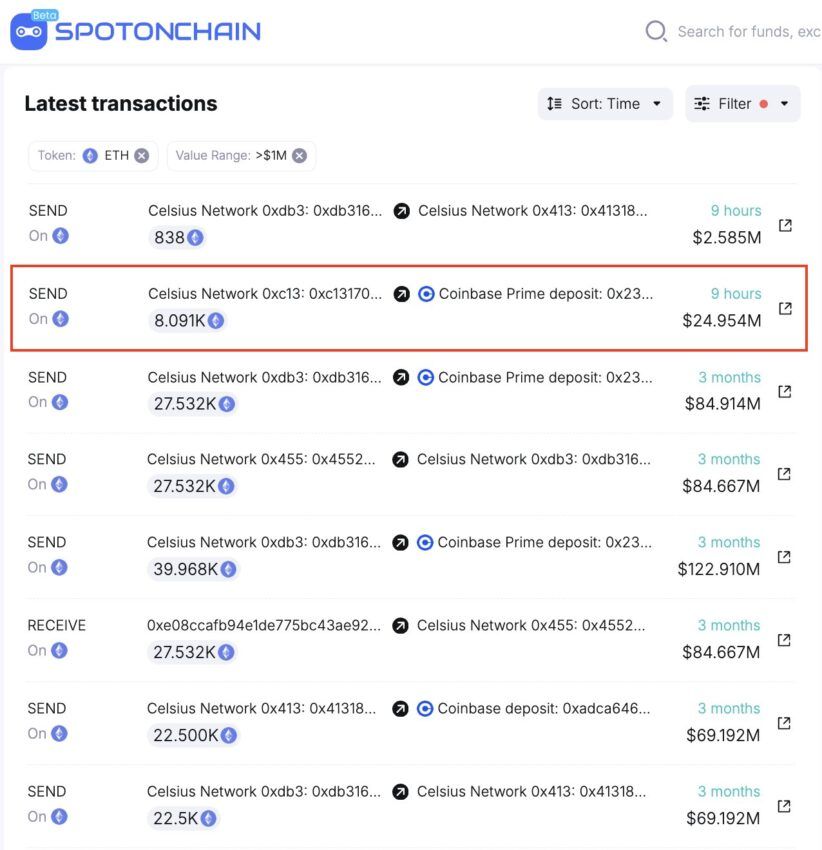

In another notable transaction, Celsius Network moved 8,091 ETH (approximately $24.5 million) to Coinbase. Blockchain analysis firm Spot On Chain reported the transaction on April 17th.

“This is the largest ETH deposit for the Celsius network in the past three months. Previously, from November 13, 2023 to January 31, 2024, Celsius received 847,626 ETH (approximately $1.9 billion) for some OTC transactions. ) to various CEXs,” Spot On Chain explained.

Further notable activity includes the withdrawal of 6,513 staked ETH from Lido by multi-signature address 0xA97…08Ddc. Wallet owners deposited $5,100 of these ETH, worth $15.72 million, into OKX. This address still holds a significant amount of cryptocurrencies (10,389 ETH and 50 WBTC, totaling $64.65 million).

Additionally, Uniswap (UNI) whales have accumulated tokens since October 2023 by withdrawing from the MEXC exchange and purchasing on-chain at an average price of $6.20. Finally, this whale sold his UNI holdings today at his $6.83, making a profit of $250,000 (approximately +10%).

In another transaction, Lookonchain spotted Tron founder Justin Sun withdrew 196 million USDT from Huobi and deposited it into Binance. However, the reason for this transfer remains unclear.

Such large-scale virtual currency transactions attract a lot of attention from investors. Historically, investors have viewed declines in major crypto whales as a bearish signal, which could suggest holders are taking profits.

Read more: 11 best altcoin exchanges for crypto trading in April 2024

Despite the possibility of sale, some transactions are aimed simply at transferring assets to another wallet before further distribution. It's also important to note that large sales can flood assets into circulation, causing prices to fall.

While the motives behind these particular whale movements remain speculative, they do highlight the liquidity of the crypto market. Monitoring large trades is very important as they can provide clues about potential market trends.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.