- LINK gained attention after the project published an update regarding ETH cross-chain transfers.

- Token price could fall below $14 in the short term.

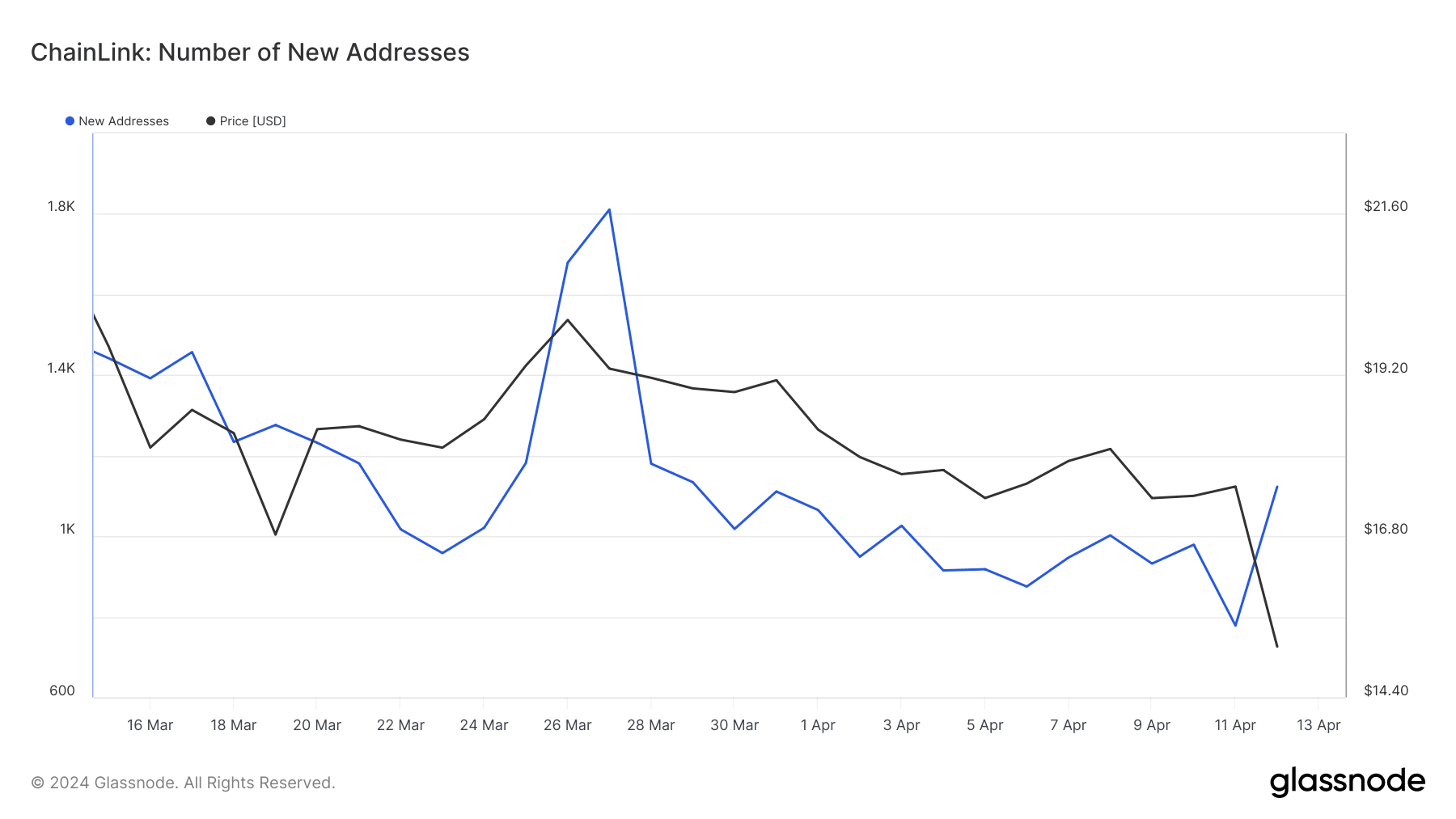

Number of new chain links [LINK] AMBCrypto noticed an increase in addresses since April 11th. According to Glassnode, there were 778 new addresses on the network as of April 10th.

However, as of this writing, that number has increased to 1123. An increase in new entrants to the network is a sign that adoption is improving, which could increase demand for the associated tokens.

Source: Glassnode

More bridges mean more expansions

Since hitting a yearly high in March, Chainlink has until recently found it difficult to attract newbies to its ecosystem. But there was a reason for the increase.

According to AMBCrypto findings, it was no coincidence that the indicator started rising after the project recently integrated with Ethereum [ETH].

On the same day that LINK's new addresses started ramping up, Chainlink made an announcement noting that CCIP has been extended to ETH and some layer 2 networks under the blockchain.

CCIP is an acronym for Cross-Chain Interoperability Protocol. This protocol powers the bridging of assets on multiple blockchains. In a recent announcement, Chainlink explained:

“This upgrade means CCIP will support native ETH cross-chain transfers between different blockchain networks, including Ethereum, Arbitrum, and Optimism. This is possible by locking and unlocking WETH token pools. It will be.”

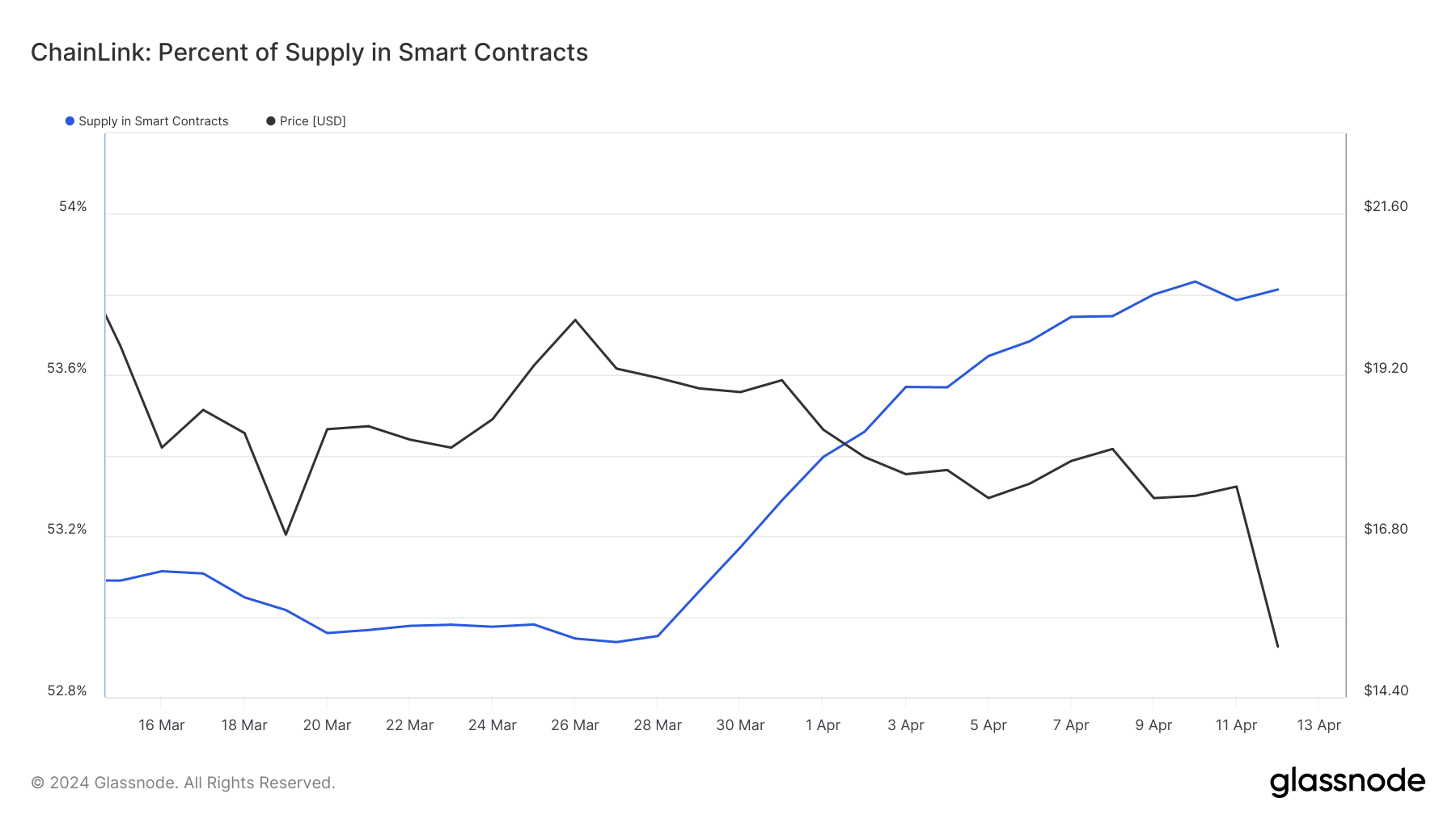

However, the result of development was not only increased traction. Further investigation of AMBCrypto revealed that there had been a change in the supply of smart contracts.

For the uninitiated, the introduction of Ethereum has made it easier to develop smart contracts in other projects.

According to on-chain data, Chainlink's smart contract supply was around 52% as of early April. However, at the time of this writing the supply had increased to 53.81%.

Source: Glassnode

Some things take time

This increase could allow LINK holders to bridge more assets to other chains, including Ethereum. However, in the short term, LINK's price may have to deal with market turmoil.

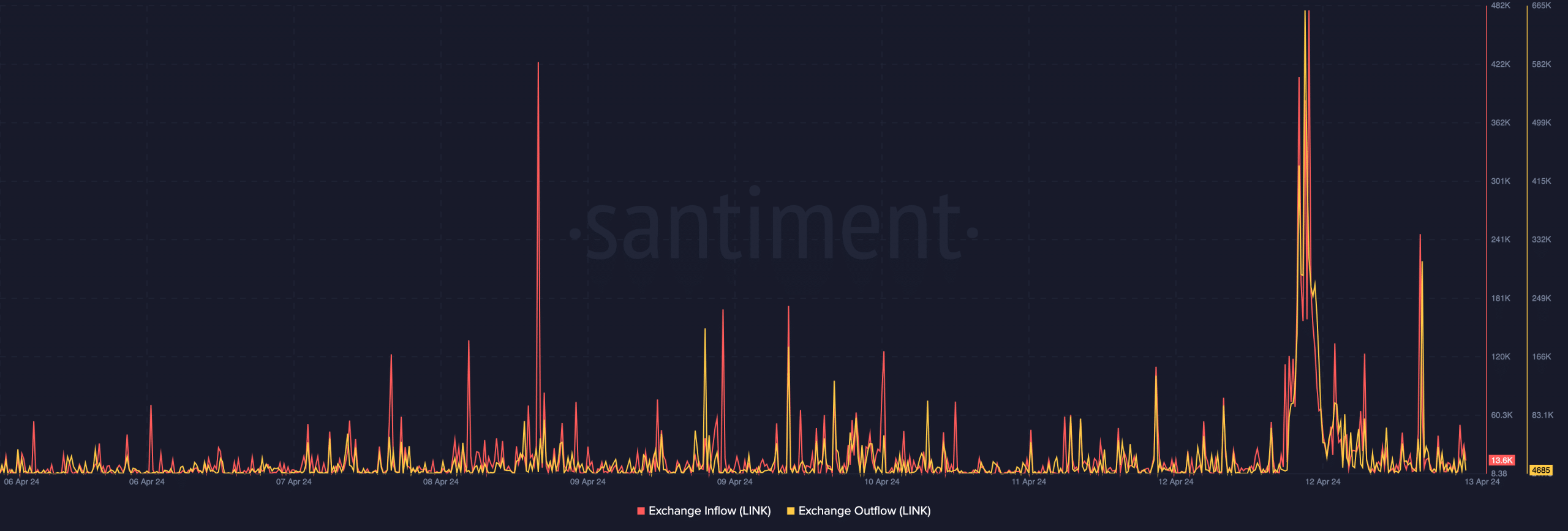

This was due to the situation of foreign exchange inflows and outflows. Increasing foreign exchange inflows means traders are looking to sell assets. But the decline suggests otherwise.

In the case of currency outflows, an increase means a decision to hold back for potentially better profits. At the time of writing, LINK exchange outflows were 4,086 tokens and inflows were over 13,000 tokens.

Whether it's realistic or not, LINK's market capitalization in ETH terms is as follows:

This difference in these indicators was evidence that a decline was occurring in the market. If inflows continue to exceed outflows, LINK's price could drop below $14.

However, if the bears decide to suspend selling and the bulls pile up, the price could rebound.

Source: Santiment