Frankfurt rate-setters on Thursday held steady on interest rates, but said a cut would be justified if the next forecast in June showed greater confidence that inflation would start to fall.

The policy statement also said that the European Central Bank's Governing Council would take decisions on a meeting-by-meeting basis and that interest rates would not follow a preset path.

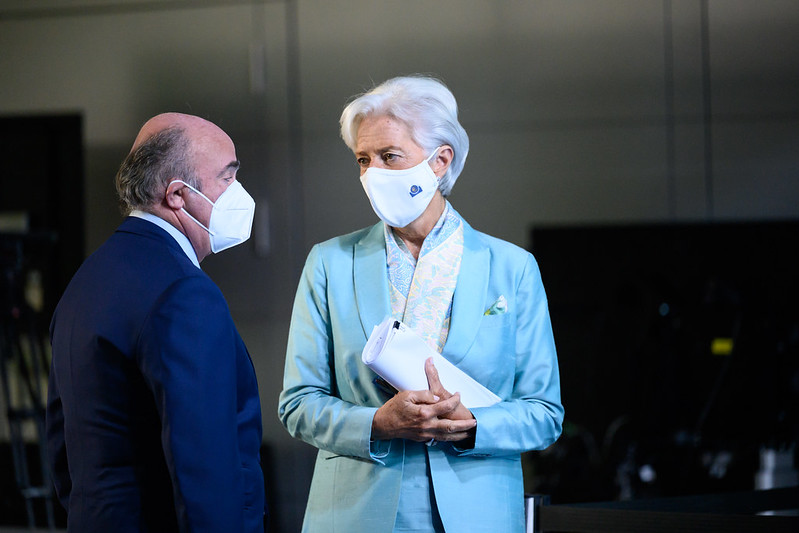

Meanwhile, ECB President Christine Lagarde devoted much of her opening remarks to the impact that geopolitical events, whether in Ukraine or the Middle East, could have on growth and prices.

Lagarde also acknowledged that fluctuations in energy prices are important and that inflation in the euro area is expected to fall, but not in a linear manner.

Additionally, a “small number” of GC members were prepared to cut rates on Thursday, he added.

The GC also said in a statement that the latest information available “generally” supports its previous medium-term inflation outlook.

It added that most indicators of underlying inflation are “easing” and that wage growth is “gradually moderating”.

Similarly, companies were absorbing some of the rise in labor costs through profits.

However, domestic inflation is “steady” and service price inflation “remains high.”

The ECB left interest rates on major refinancing operations, marginal lending facilities and deposit facilities unchanged at 4.50%, 4.75% and 4.00%, respectively, as expected.

About Holger Schmieding, Berenberg The ECB's interest rate cut in June was almost a “foregone conclusion.”

The economist said that while it was unusual for the ECB to take the lead on whether it should or could deviate from the Fed's leadership, the euro zone's “current economic situation fully warrants it.” “It's becoming a reality,” he said.

“The eurozone is a large economy, and exchange rates play a modest role in it. Unless the US dollar appreciates significantly from its current level, the Fed's long-term upside outlook is limited by ECB policy,” he said in the study. It shouldn't have a big impact.” Notes sent to client.

“Fiscal policy is only mildly expansionary in the euro area. There is no need to offset it by maintaining the current level of monetary restrictions.”

Also on Thursday, Schmieding pushed back the expectation that the Fed would first cut interest rates from June 2024 to December 2024.