- Ethereum showed bearish potential on its April and May price charts.

- The chances of an Ethereum ETF being approved were slim at best.

“Sell in May and walk away” was once a popular saying in the cryptocurrency industry.It's not May yet, but Ethereum [ETH] Holders are already starting to leave.

crypto analyst daan cipher highlighted to X several scenarios that could play out regarding Ethereum ETF speculation.

Eric BalchunasA senior ETF analyst at Bloomberg revealed that the ETH ETF has a 25% chance of approval. With the deadline approaching in May, a negative result could cause prices to fall further.

AMBCrypto analyzed price trends and related indicators to understand the state of the market and whether (or when) investors should get bullish on the altcoin king.

The bearish pennant was unfolding

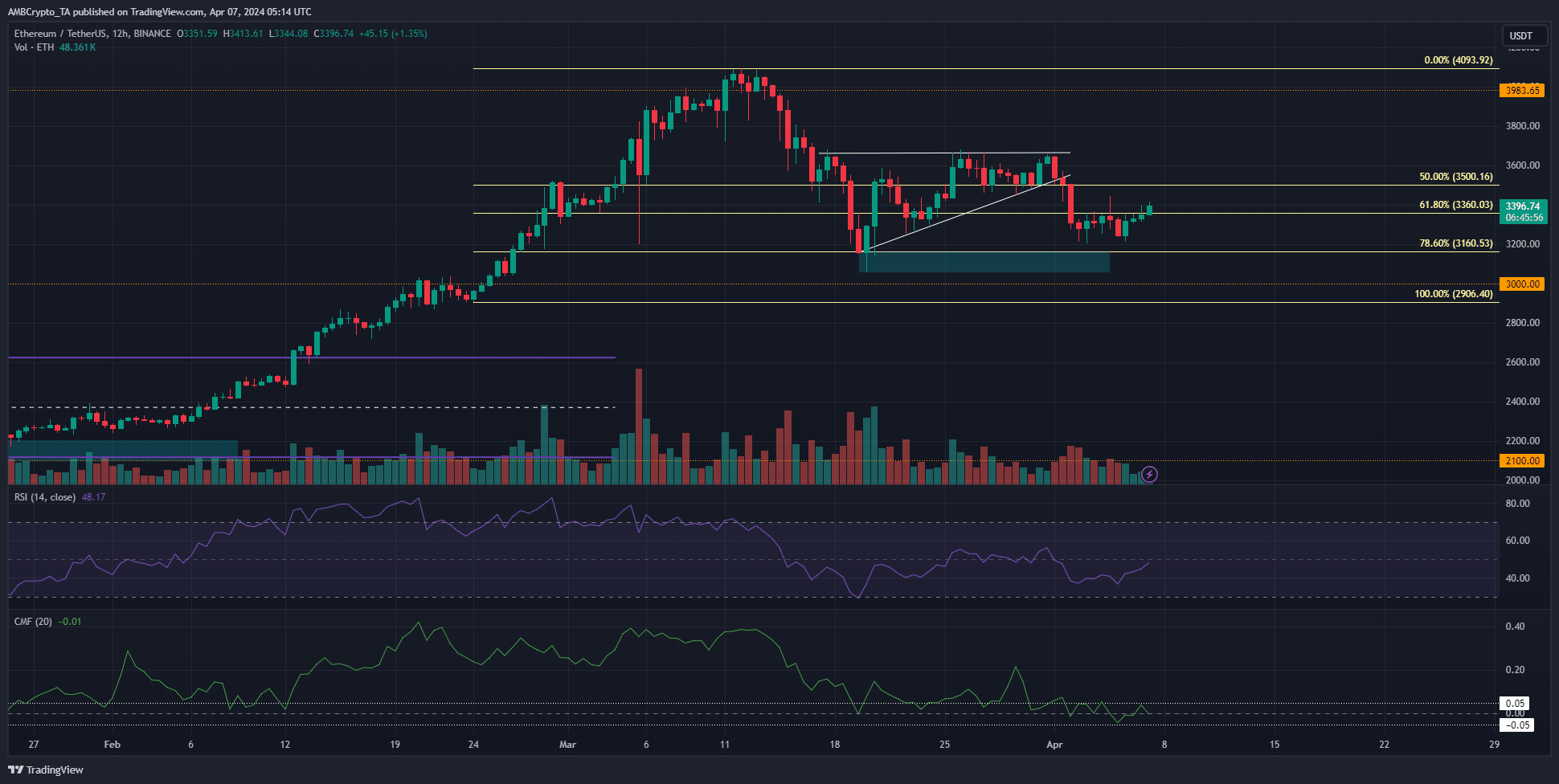

Source: ETH/USDT on TradingView

The 12-hour market structure remained bullish. ETH hit a low of $3,056 on March 20th. A recent AMBCrypto report indicated that a bearish chart pattern is developing and the price could fall to $2800.

This bearish outlook remains unchanged. A move below $3,056 means swing traders should shift their bias to sell. Technical indicators are also becoming increasingly bearish.

The RSI read 44 and has been below the neutral 50 most of the time since March 15th. CMF was also on the decline, indicating that capital outflows were increasing.

However, neither momentum nor capital flows were significantly bearish on the 12-hour chart.

Bulls are still holding out hope that the bearish chart pattern will be completed, meaning that the price will not fall to the $2.6 million to $28,000 area.

On-chain indicators showed upcoming volatility

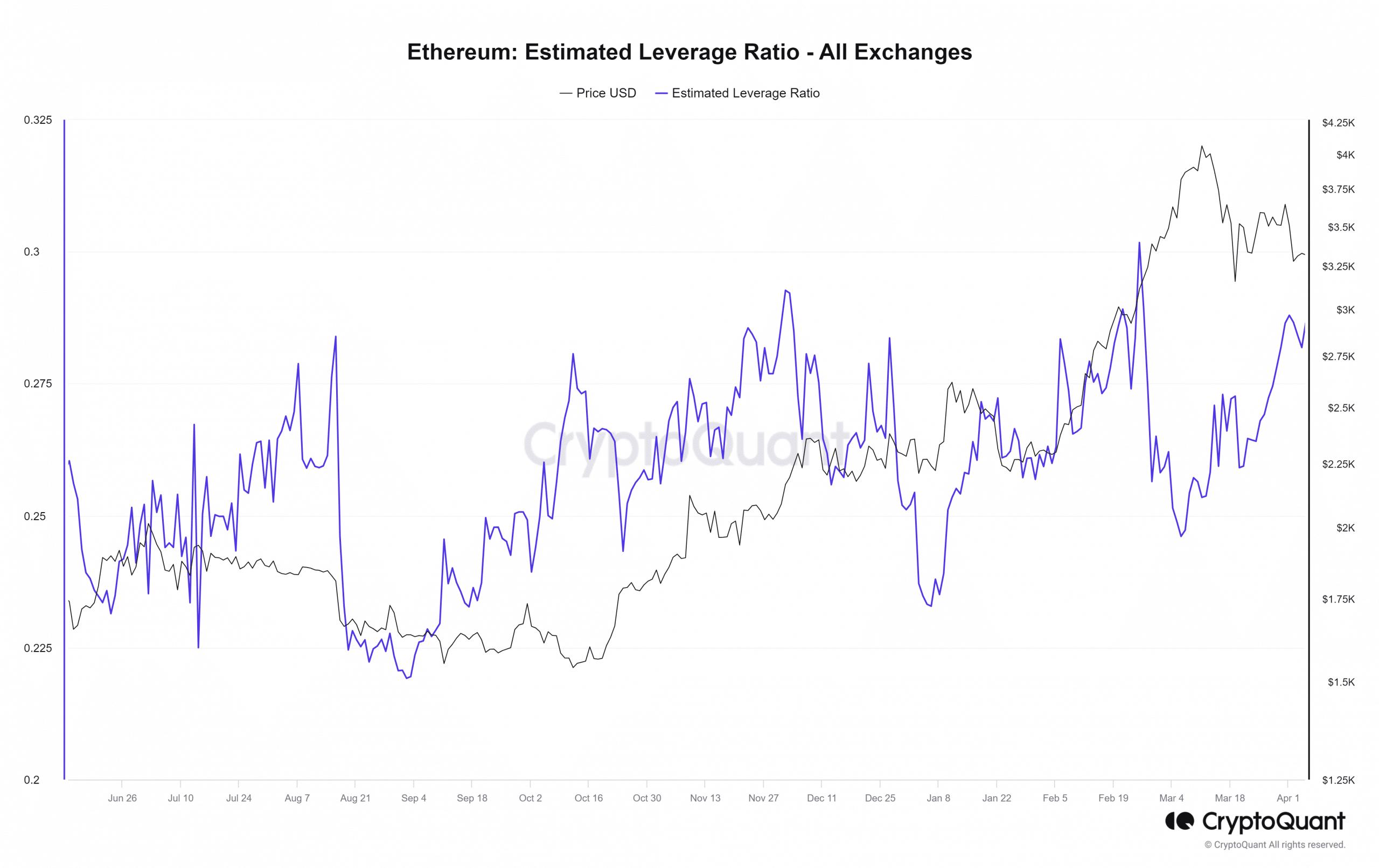

Source: CryptoQuant

In March, Ethereum faced a rejection for $4.1 million. A week before this pullback, the Estimated Leverage Ratio (ELR) began to decline. After the decline, the ELR turned to an upward trend.

This ratio is defined as (Ethereum's) open interest/exchange reserves.

Therefore, an increase in ELR means that either OI is increasing or reserves are trending downward. Based on his Coinglass data over the past two weeks, no increase in open interest was evident.

Due to recent ETH losses, the ratio has decreased slightly. This showed that speculators are beginning to unwind leveraged positions in the face of market adversity.

Are long-term holders also expecting volatility?

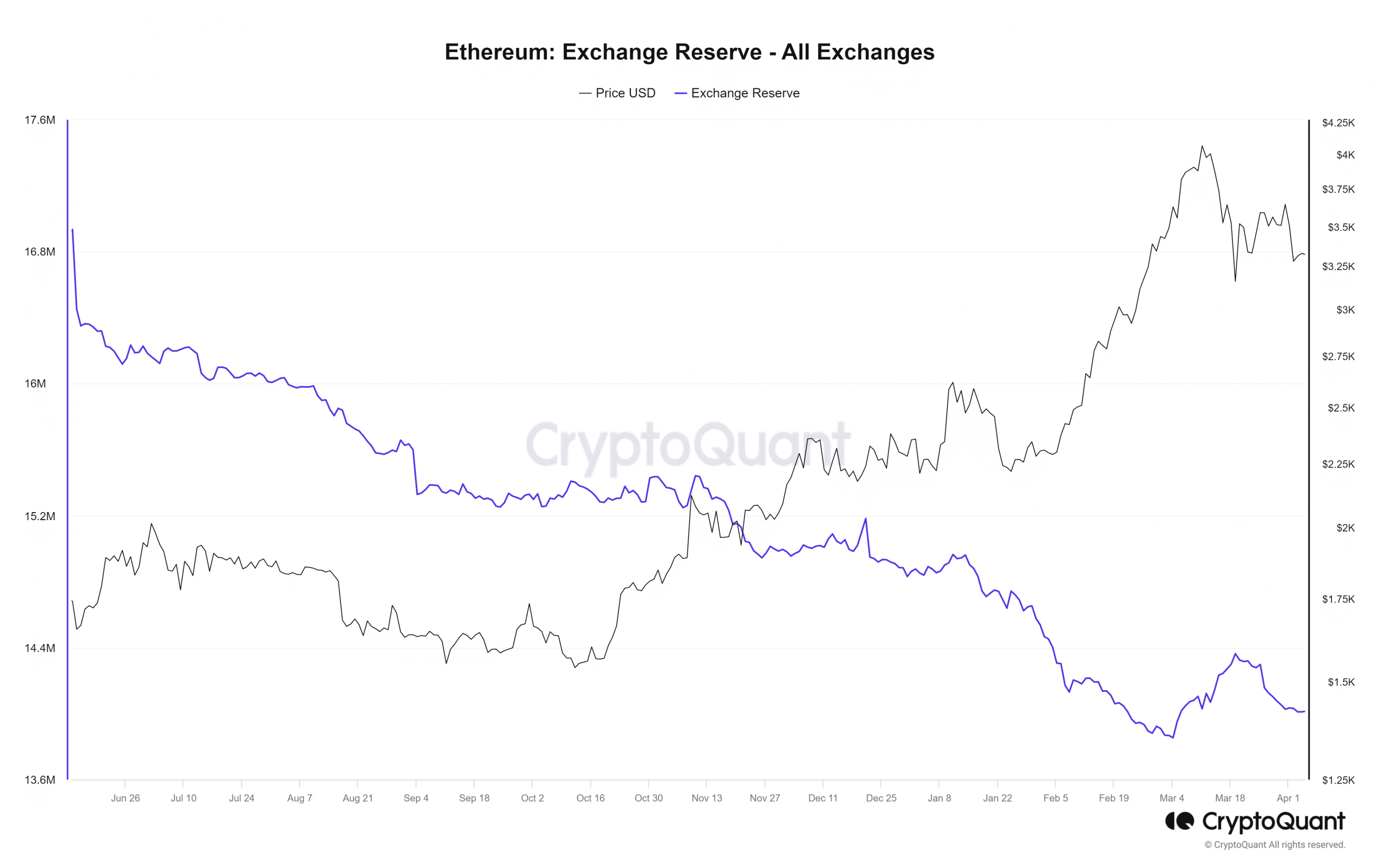

Source: CryptoQuant

An analysis of Ethereum foreign exchange reserves shows that after a two-week spike in early March, it has been on a downward trend since mid-March. This indicates that holders are likely taking profits and the selling wave is starting to wane.

The decline in foreign exchange reserves indicates increased accumulation, which is a positive for ETH investors.

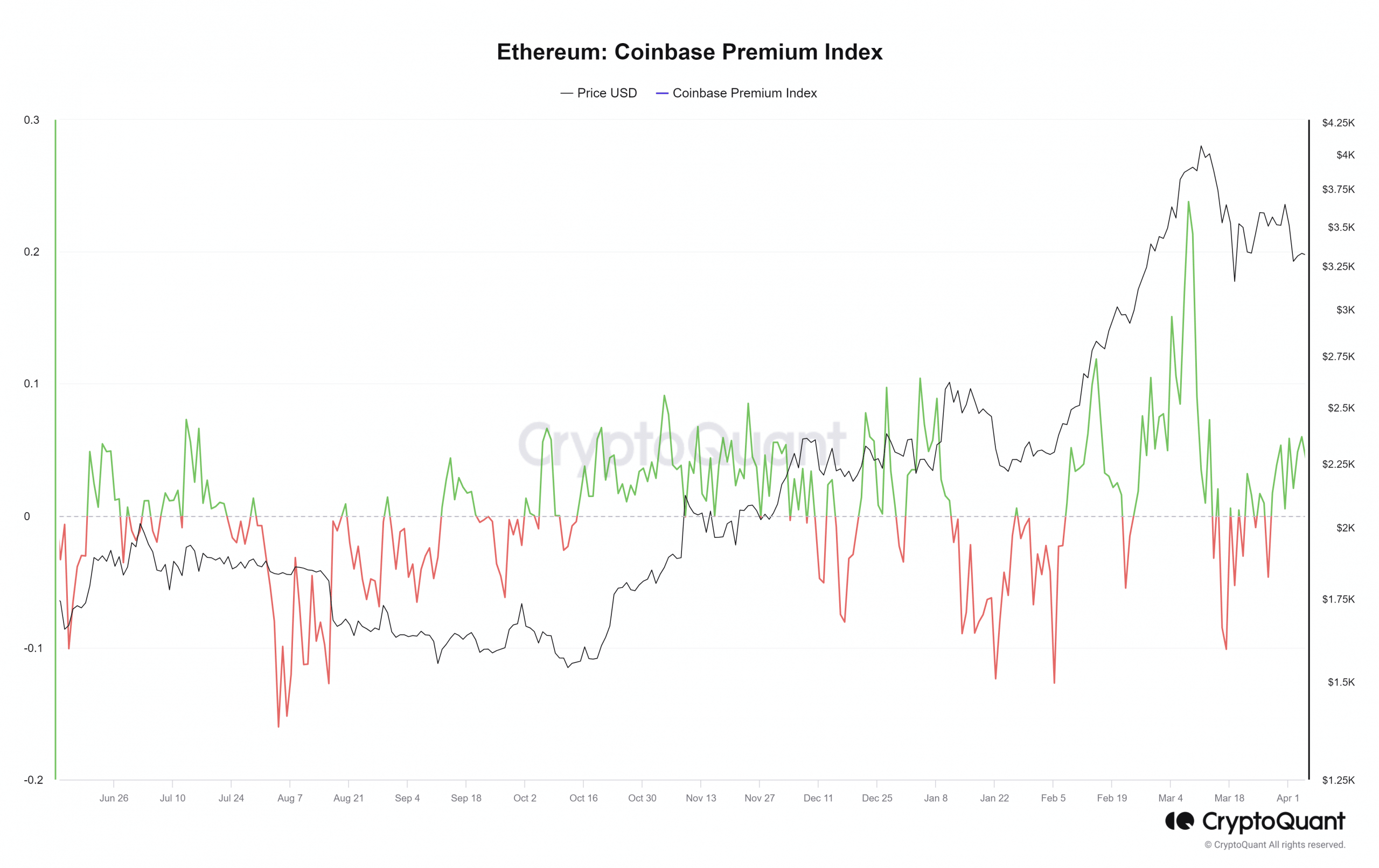

Source: CryptoQuant

The Coinbase Premium Index reflects the percentage difference between the Ethereum price on Binance and the Coinbase price of the USDT (Tether) pair. For the past two weeks, the premium index has been on an upward trend.

Although it fell short of the highs seen in early March, it still signaled the bullish attitude of U.S. investors.

Technical analysis indicated that April performance is likely to be bearish. Looking at leverage ratios, it becomes clear that speculators are also starting to move to the sidelines due to fear of volatility.

Meanwhile, other on-chain indicators showed investors are bullish despite the losses.

read ethereum [ETH] Price prediction for 2024-2025

Overall, the impact, or denial, of the Ethereum ETF will be a pivotal event in May. As it stands, the U.S. SEC is upholding the denial, and Balchunas said:

“There were no positive signs.”

Bitcoin [BTC] Performance in the weeks following the halving could lead to further declines. Therefore, there is reason for Ethereum investors to be cautious for the next 6-8 weeks.