- More than 12% of staked ETH was re-staken

- ETH is now gradually emerging as a reliable yield-producing asset

Ethereum [ETH] Staking has become more desirable since the concept of restaking was introduced.

A new paradigm for Ethereum staking

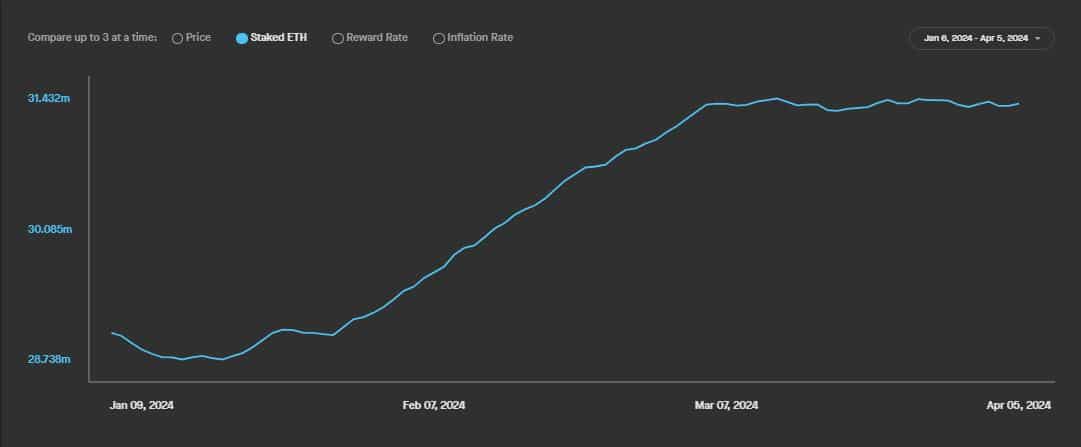

According to an analysis of Staking Rewards data by AMBCrypto, ETH locked on the network has increased by 9% in the past three months. In fact, the growth rate has been parabolic since the beginning of February.

Source: Staking Rewards

Interestingly, EigenLayer, a successful restaking story, has a similar growth curve in total value locked (TVL), according to DeFiLlama.

Source: Defilama

Additionally, Tom Wang, research analyst at Web3 company 21.co, recently revealed that more than 12% of the staked Ether has already been re-staked.

These findings strengthened previous claims that restaking provides momentum to ETH staking.

Why are users leaning towards re-staking?

EigenLayer took a huge leap forward in 2024, overtaking its competitors and becoming the second largest DeFi protocol in a very short period of time. The secret to our success lies in our unique service: retakes.

Restaking involves reusing staked ETH to extend security to other applications outside of Ethereum. There are no prizes for guessing this. This allows stakers to earn additional rewards for their deposited holdings. As traditional ETH staking yields continue to decline due to increased participation, re-staking is a viable option for users to increase their income.

What benefits does ETH have?

Overall, both staking and restaking emphasize the broader important idea of ETH as a yield-producing asset. With stable and guaranteed returns, users can start looking at it from a long-term perspective, rather than seeking short-term profits from market price fluctuations.

Is your portfolio green? Check out our ETH Profit Calculator

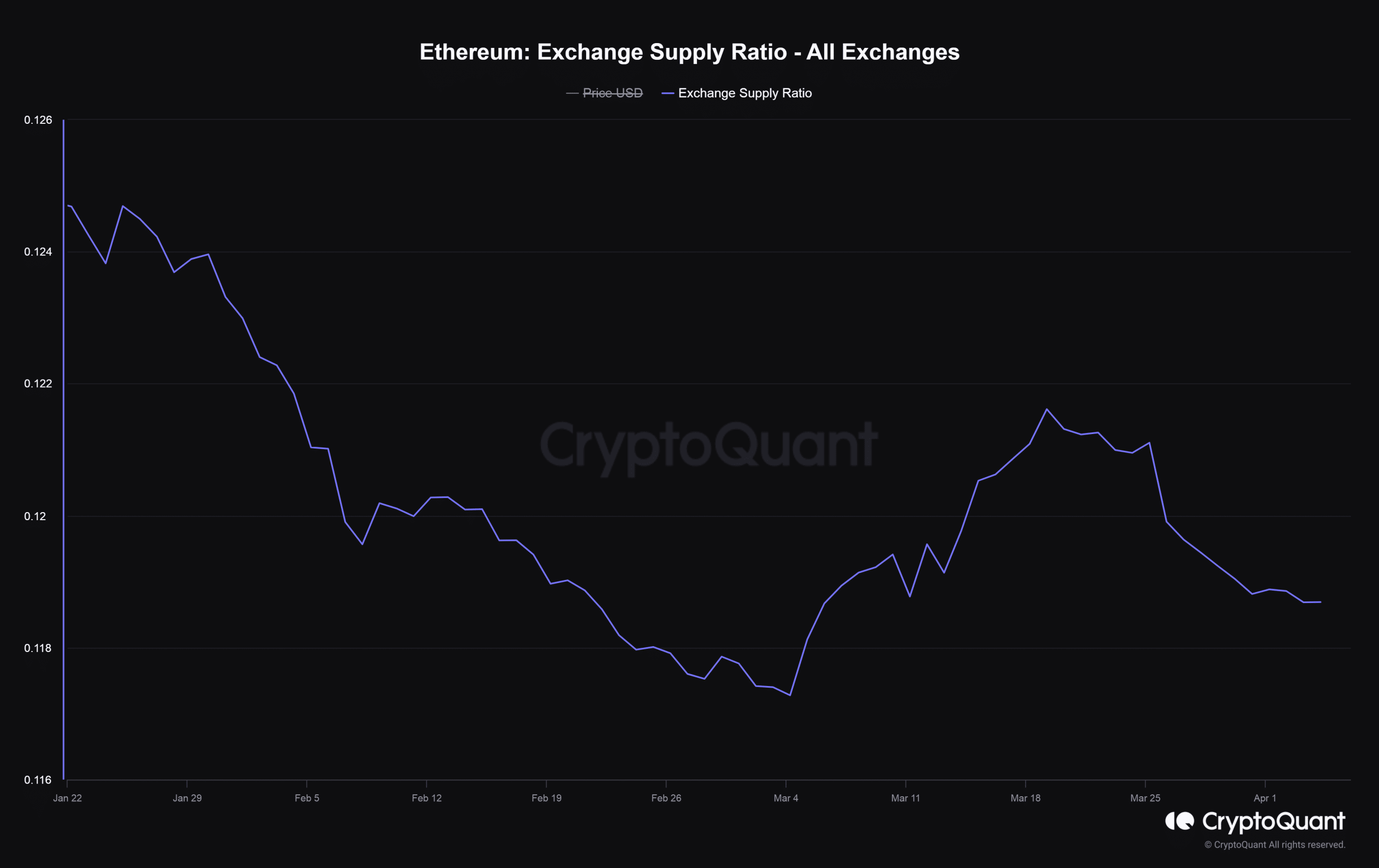

Interestingly, the results are already being felt. For example, Ethereum’s exchange supply ratio has plummeted to multi-year lows, according to AMBCrypto’s analysis of CryptoQuant data.

This could gradually lead to scarcity in the market, which, when matched with increased demand, could put positive pressure on the price of ETH.

Source: CryptoQuant