Bitcoin (BTC) price is currently stuck in the sub-$70,000 range after hitting an all-time high.

However, looking at on-chain indicators, it looks like BTC may be headed back up.

Bitcoin buy signal flashing

Bitcoin price, trading at $67,760 at the time of writing, is eyeing a red candlestick today, but indicators suggest a long-term bullish outlook for the cryptocurrency. The Reserve Risk Indicator is currently in the green zone and is moving out of it.

This indicator measures the confidence of long-term Bitcoin holders by comparing the current price to a long-term HODLer cost standard. A decline in reserve risk suggests that long-term holders are likely to accumulate and a recovery is on the horizon.

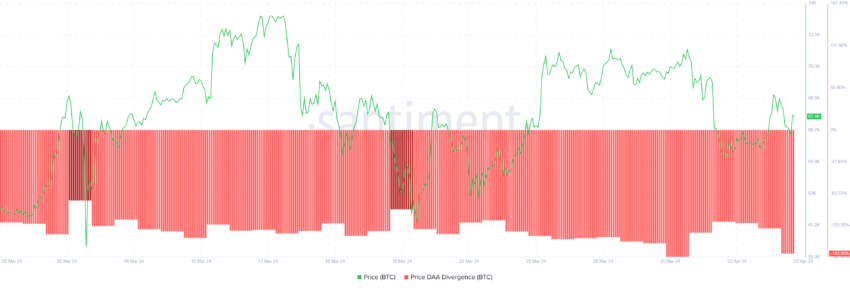

This possibility is also seen in the differences in Price Daily Average Addresses (DAA). This indicator measures the difference between the price of a cryptocurrency and the number of active addresses that interact with it on a daily basis and helps identify potential price trends based on user activity.

At the moment when the price falls and active addresses rise, the indicator flashes a “buy” signal. That's the situation at the moment, and BTC is ripe for accumulation.

If these factors prompt investors to add BTC to their wallets, Bitcoin price could skyrocket in the coming days.

BTC Price Prediction: Bounce

Bitcoin price is likely to rise above $70,000 this weekend. Investors are likely raising money on bullish expectations ahead of the halving, so prices could rise as well.

However, Bitcoin price will find some resistance at $71,370. This wall has not been breached since mid-March and is likely to remain so until strong bullish cues are noticed.

Read more: Bitcoin Price Prediction 2024/2025/2030

On the other hand, if BTC fails to break out of the resistance level marked at $68,250, Bitcoin will fall back to $65,300. However, below that, the bullish theory will be invalidated and we will see a crypto test at $61,730.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.