Ethereum (ETH) price analysis suggests potential volatility before attempting to break above the $4,000 mark again.

Despite being located between strong support and resistance levels, ETH could be poised for a notable correction of around 12.5% in the near future.

Ethereum indicators predict correction

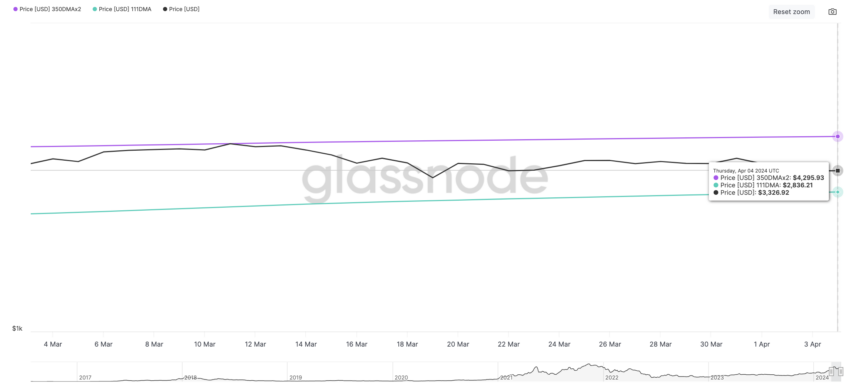

Ethereum’s trajectory highlighted by the Pi Cycle top indicator indicates a possible short-term correction. This prediction is based on the observed gap between his 111-day moving average and his double of the 350-day moving average.

The indicator currently has an upper and lower limit set at approximately $4,295 and $2,836, respectively. While this range may suggest market stability, Ethereum's current situation suggests a recession may be imminent.

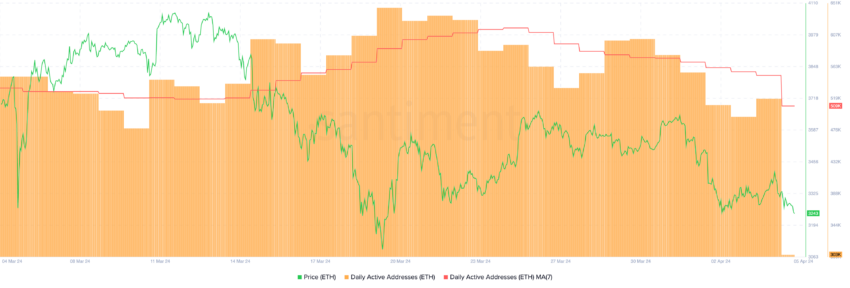

ETH daily active addresses have shown a steady decline since March 30th, supporting the bearish narrative. This metric is important because it reflects network activity and user engagement, and a downward trend suggests a decline in usage and interest.

Therefore, the price of Ethereum could be negatively affected due to the perceived decrease in demand and investor confidence.

ETH price prediction: corrections ahead

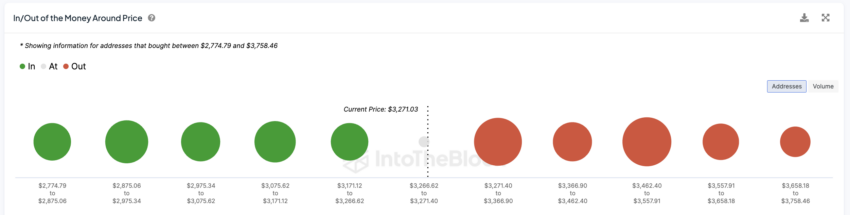

The In/Out of the Money Around Price (IOMAP) chart shows that Ethereum is currently surrounded by tight support and resistance levels around the current price. This tool provides insight into potential price pressure by highlighting where significant buys and sells have occurred in the past.

However, given the decline in daily active addresses and Pi Cycle predictions, ETH could test the $2,800 support level soon, indicating a possible 12.5% correction. If this support cannot be sustained, the price could fall to around $2,200, highlighting the risk of a significant decline.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the contrary, favorable market dynamics and the introduction of the Ethereum ETF could cause ETH to challenge the $4,300 level, which is the upper limit of the Pi cycle indicator.

Disclaimer

All the information contained on our website is published in good faith and for general information purpose only. Any action you take upon the information you find on our website, is strictly at your own risk.