Bitcoin Cash (BCH) price is going through an interesting phase with market interest high despite contrasting signals.

BCH has found support at $617, and the cryptocurrency faces a pivotal resistance level that could lead to significant price movements. This scenario presents a complex but potentially bullish situation for Bitcoin Cash.

Strong interest in Bitcoin Cash

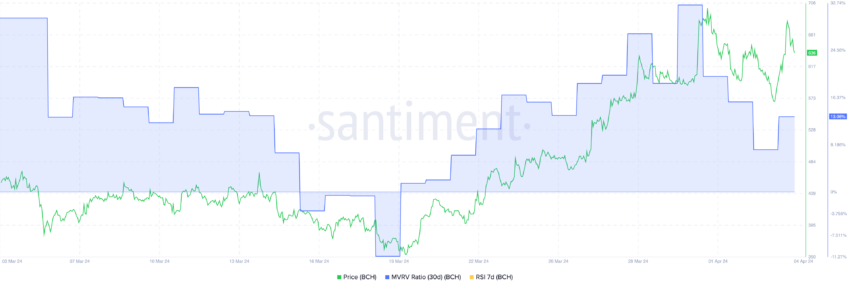

BCH's current Relative Strength Index (RSI) is 79, consistent with the levels seen during the March rally, suggesting significant momentum. The RSI is an oscillator that measures the speed and change of price movements; a value above 70 typically indicates an asset is overbought, and a value below 30 indicates an oversold asset. .

Despite hints of overbought, Bitcoin Cash's high RSI does not necessarily predict a decline. Rather, it highlights strong investor interest and continued buying activity. This could indicate a continued rise in price, supported by a market willing to invest in BCH at or above its current price.

Bitcoin Cash has a 30-day market value-to-realized value (MVRV) ratio of 13%, which some analysts may view as bearish.

It is worth noting that BCH has achieved price appreciation with similar MVRV ratios in the past, albeit down to 13%. This suggests continued investment and the potential for price appreciation, supporting an overall bullish outlook for cryptocurrencies.

The MVRV ratio evaluates whether an asset is undervalued or overvalued by comparing its market capitalization to its realized cap. There is no universally perfect MVRV ratio, but extreme values can indicate a potential market correction.

BCH Price Prediction: $733 within reach

With $617 being solid support and $673 the next major resistance, a breakout of this barrier could put BCH on track to $733 and revisit its highest valuation since May 2021. There is sex.

Read more: Bitcoin Cash (BCH) Price Prediction 2024/2025/2030

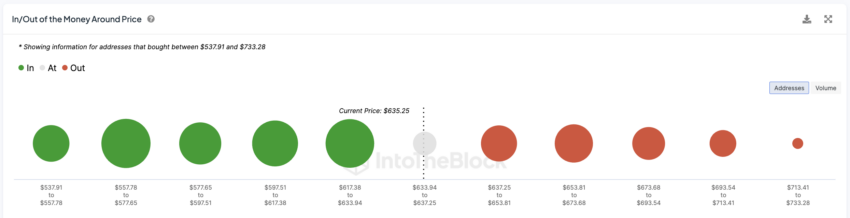

The In/Out of the Money Around Price (IOMAP) chart is a valuable tool in this analysis, showing important price levels based on past buying and selling activity.

These insights highlight key support and resistance levels determined by investor positions, the breakdown of which could lead to a fallback to $577 for Bitcoin Cash.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.