- The captured value of ETH remained at a high level in the second quarter.

- Several indicators suggested that the bull market could move higher in the coming days.

The first quarter of 2024 saw significant volatility in the market. Ethereum [ETH] and Bitcoin [BTC] Large gatherings were recorded.

Apart from the price trend, the situation for Ethereum also looked quite optimistic in terms of revenue.

Ethereum's first quarter report is here!

Coin98 Analytics, a data analytics platform, recently Tweet We focus on the first quarter report of the king of altcoins. The report addresses multiple aspects of the current state of blockchain.

Firstly, Ethereum witnessed promising growth in terms of revenue in the first quarter.

Blockchain fees and revenue increased nearly 1.8x quarter-on-quarter (QoQ), and revenue tripled quarter-on-quarter.

The total number of token holders reached 114.69 million, a growth of more than 5% quarter-on-quarter. Thanks to the bull market in the first quarter, the circulating market capitalization of ETH increased by 48% to over 350 billion.

aAnother interesting statistic regarding ETH's P/F ratio. Simply put, a decline in the indicator generally means that the asset is undervalued.

ETH's P/F ratio has fallen by over 34%, which can be interpreted as a bullish signal.

What can we expect from Q2?

Since ETH’s P/F ratio has dropped significantly, AMBCrypto planned to check the ETH indicators to see if we can expect a price increase in the coming days.

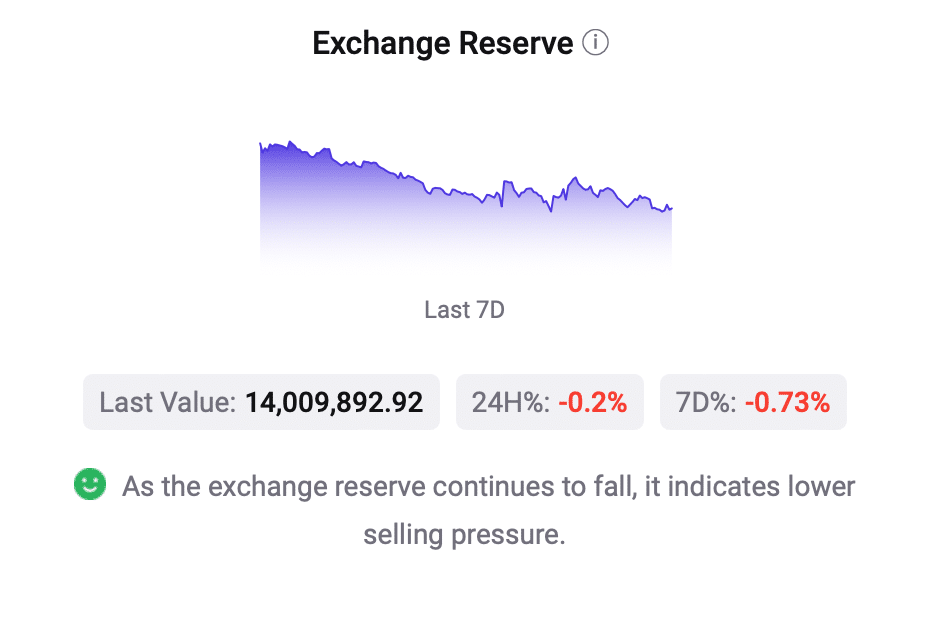

Analyzing CryptoQuant data It revealed that ETH exchange reserves are decreasing, which means there is less selling pressure on the token.

Additionally, the trading volume and total number of trades in the past 24 hours also increased.

Source: CryptoQuant

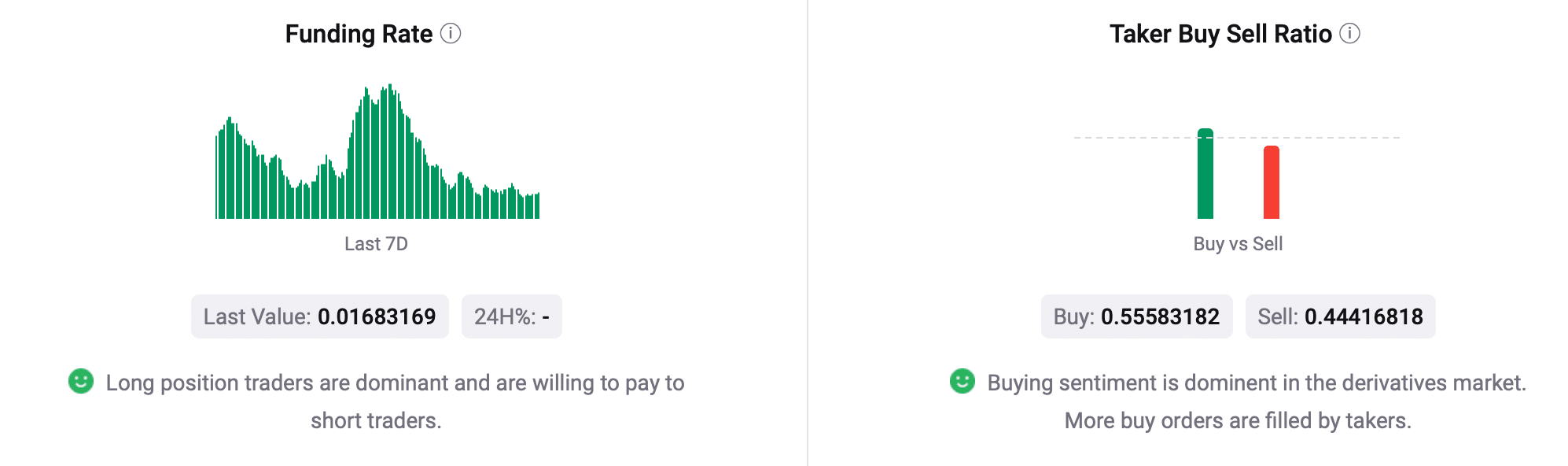

The situation in the derivatives market also looked optimistic. ETH funding rate is green, indicating that long position traders are dominant and are willing to pay short position traders.

In addition to that, ETH's taker-buy-sell ratio was also green. In other words, buying sentiment was dominant in the derivatives market.

according to coin market capat the time of writing, ETH was trading slightly higher at $3,319.92, giving it a market cap of over $398 billion.

Source: CryptoQuant

read ethereum [ETH] price prediction 2024-25

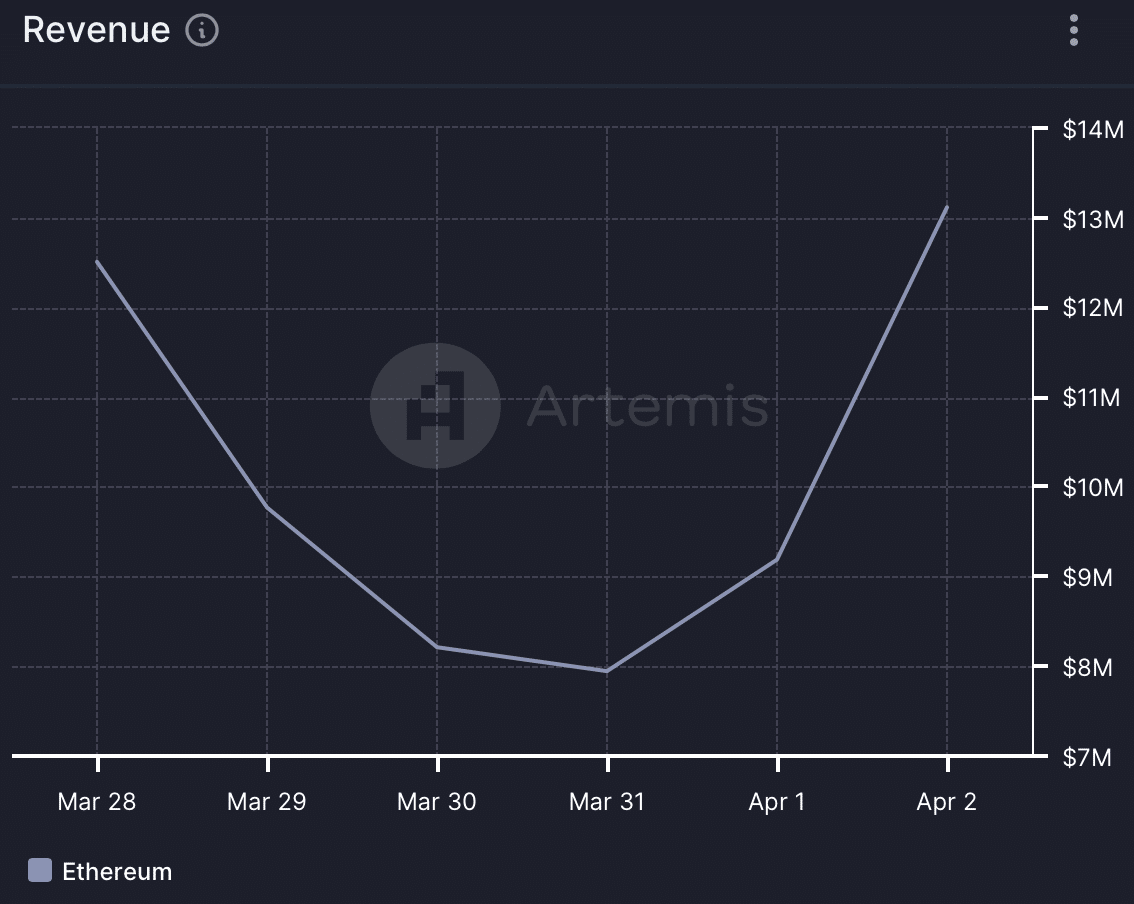

Similar to the price trend, the acquisition value of ETH also continued towards the higher side in the second quarter. AMBCrypto’s analysis of Artemis data reveals that ETH fees have increased sharply in the last week.

Revenues followed a similar upward trend, giving Q2 2024 an optimistic start.

Source: Artemis