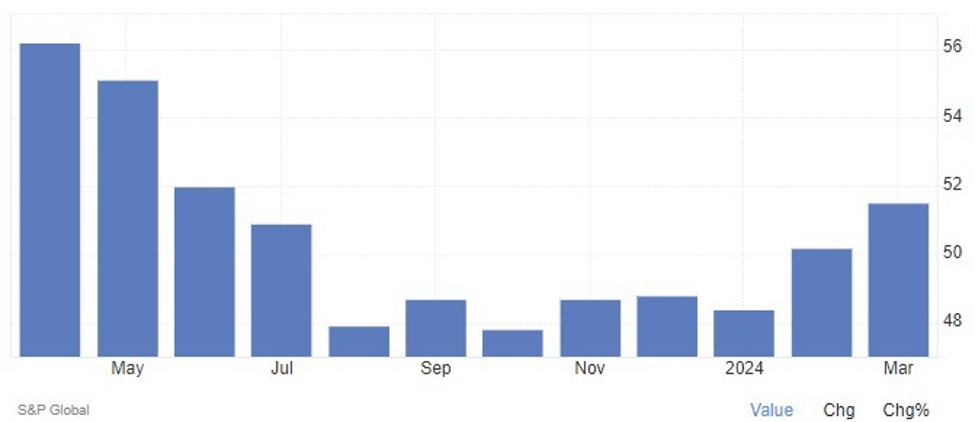

- Eurozone final services PMI 51.5 vs expected 51.1

Eurozone Services Final PMI (April 4, 2024)

- Eurozone final composite PMI expected 50.3 vs. 49.9

Euro area composite PMI final value (April 4, 2024)

Comments on S&P's data:

“Finally, another bit of good news. The euro area services sector is gradually gaining footing, with activity stabilizing in February and signs of moderate growth in March. Eight months of drought It is particularly encouraging that new business has resumed growth after a period of time. This favorable trend, driven by above-inflation wage growth, has strengthened household purchasing power and is expected to continue. As a result, individuals are more likely to spend money on eating out, traveling, and other services. But the real boom is yet to arrive.”

“Service providers have not stopped hiring additional staff despite the temporary economic downturn. Over the past two months, employment growth has been remarkably strong, reinforcing optimism within the industry. In fact, business expectations have soared again, rising to their highest level in more than two years and above their long-term average.”

“Service providers are still in a position to pass on at least some of the rise in input costs to their customers in the form of higher prices. However, the pace of inflation slowed slightly in March, both in costs and sales prices. This development is likely to be welcomed by the European Central Bank.Nonetheless, it is too early to discern any clear trends from this data, which is why we do not expect a rate cut in June rather than April. maintain.”