- Eurostat is scheduled to release key European inflation data on Wednesday.

- The main annual inflation rate is expected to hold steady at 2.6% in March.

- The European Central Bank (ECB) is expected to cut interest rates in June.

The harmonized index of consumer prices (HICP), the euro area's inflation indicator, will be released on Wednesday 3 April. Inflation data from the Old Continent will be closely scrutinized by the European Central Bank (ECB) amid growing speculation about inflation in the eurozone. An event as early as June could trigger a easing cycle.

A glimpse of recent European data shows that consumer prices in the euro area rose at an annual rate of 2.9% in the year to December 2023, but retreated to 2.8% and 2.6% in the following two months. It was similar to other G10 countries.

In her final comments on March 20, ECB President Christine Lagarde asked whether current price pressures simply result from a combination of slow adjustment of wages and service prices and cyclical fluctuations in productivity, or whether they are caused by persistent fluctuations in productivity. It is difficult to judge whether the current inflation trend is showing a strong trend.

Lagarde added that unlike previous stages of the policy cycle, there are signs that the expected disinflationary trajectory will persist. Lagarde believes that if the data reveals a significant correlation between underlying inflation trends and the ECB's forecasts, the ECB could move to a stage of tapering its policy tools.

What can we expect from the next European Inflation Report?

As a result, economists expect core HICP inflation to rise by an annualized rate of 3.1% to 3.0% in March, with the composite index expected to rise 2.6% year-on-year, in line with the rise observed in the previous month. . .

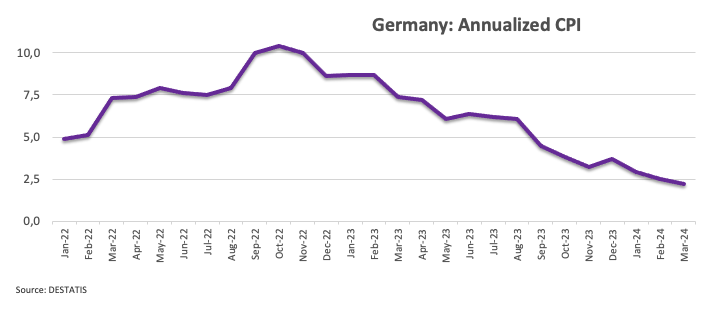

Supporting the idea of sustained disinflationary pressures, Germany's advanced consumer price index (CPI) rose an annualized 2.2% in March, slowing from February's 2.5% rise.

The median inflation forecast for the next 12 months fell from 3.3% to 3.1%, according to the ECB Consumer Expectations Survey (CES). However, inflation expectations for the next three years remained unchanged at 2.5%.

When will the Harmonized Consumer Price Index report be released? What impact could it have on EUR/USD?

The provisional HICP for the euro area is expected to be announced at 09:00 GMT on Wednesday.

The euro (EUR) hits a milestone in the round against the US dollar (USD) as investors continue to assess the likelihood of the U.S. Federal Reserve (Fed) starting an easing cycle ahead of a long-awaited inflation lift from Europe. It is struggling to fall below 1.0800. (FRB) June.

FXStreet Senior Analyst Pablo Piovano said: “Looking ahead, we expect EUR/USD to encounter first resistance at the key 200-day SMA at 1.0833. A move above could restore constructive bias and enable further gains in the short term.

“Conversely, reaching the April all-time low of 1.0724 (April 2nd) could trigger an even deeper decline towards the 2024 low of 1.0694 (February 14th),” Pablo said. he added.

economic indicators

Eurozone Core Harmonized Consumer Price Index (YoY)

The Harmonized Core Index of Consumer Prices (HICP) measures changes in the prices of a representative basket of goods and services in the European Monetary Union. The HICP, published monthly by Eurostat, is harmonized as all member states use the same methodology and their contributions are weighted. YoY measurements compare prices in a base month to one year ago. Core HICP excludes volatile components such as food, energy, alcohol, and tobacco. Core HICP is an important indicator for measuring inflation and changes in purchasing trends. Generally, high numbers are considered bullish for the euro (EUR), while low numbers are considered bearish.

read more.

Next release: 04/03/2024 09:00:00 GMT

frequency: monthly

sauce: eurostat

ECB FAQ

The European Central Bank (ECB), located in Frankfurt, Germany, is the reserve bank of the euro area. The ECB sets regional interest rates and controls monetary policy. The ECB's main mission is to maintain price stability, which means keeping inflation at around 2%. The main means of achieving this is by raising or lowering interest rates. Relatively high interest rates usually result in a strong euro and vice versa. The ECB Governing Council decides monetary policy at its eight annual meetings. Decisions will be made by the heads of the euro zone national banks and the six permanent members of the ECB, including Christine Lagarde, president of the ECB.

In extreme circumstances, the European Central Bank can enact a policy measure called quantitative easing. QE is a process in which the ECB prints euros and uses them to buy assets (usually government and corporate bonds) from banks and other financial institutions. QE usually leads to a weaker euro. Quantitative easing is a last resort when the objective of price stability cannot be achieved by simply lowering interest rates. The ECB used this system during the great financial crisis of 2009-2011, in 2015 when inflation remained stubbornly low, and during the coronavirus pandemic.

Quantitative tightening (QT) is the opposite of QE. This is done after quantitative easing, when economic recovery is underway and inflation begins to rise. In QE, the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide liquidity, but in QT, the ECB suspends additional bond purchases and waits until the maturity of bonds it already owns. Stop reinvesting principal. Usually positive (or bullish) for the euro.