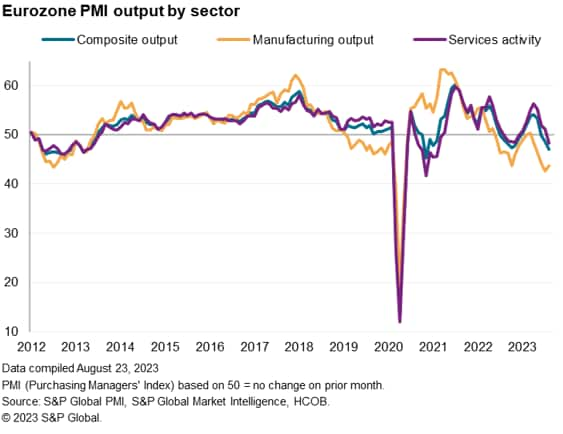

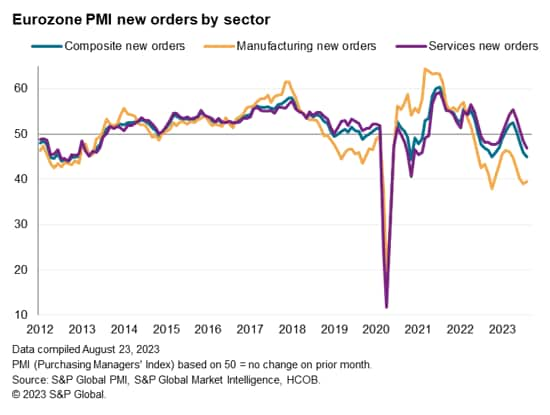

According to the latest PMI survey data, business activity in the euro area contracted at an accelerating pace in August as the euro area's economic downturn spread further from manufacturing to service industries. Both sectors reported declines in output and new orders, but the goods producing sector had a much steeper rate of decline.

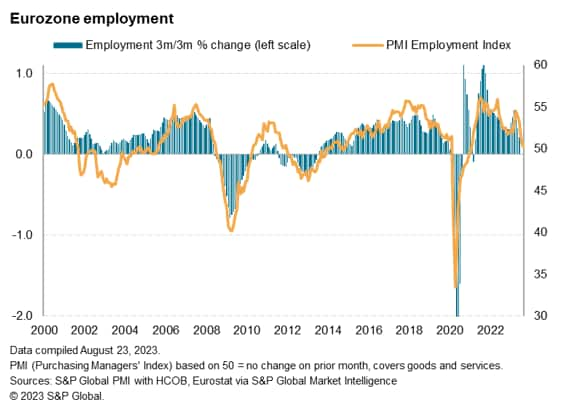

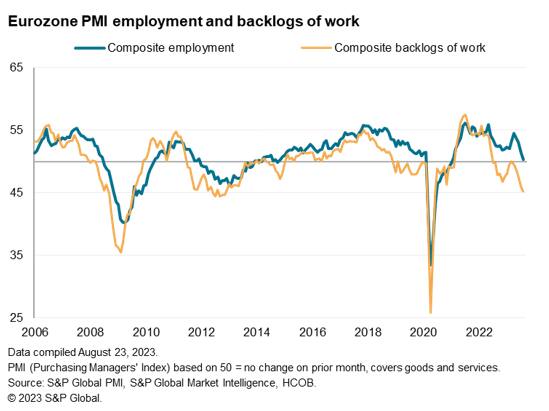

Employment has come close to stalling, with the latter falling to its lowest level so far this year as companies are reluctant to expand capacity amid weak demand and a bleak outlook for next year.

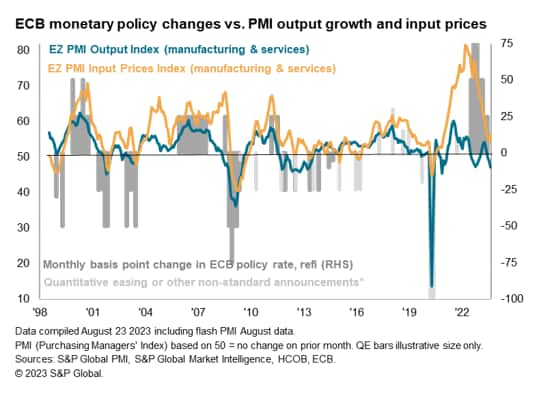

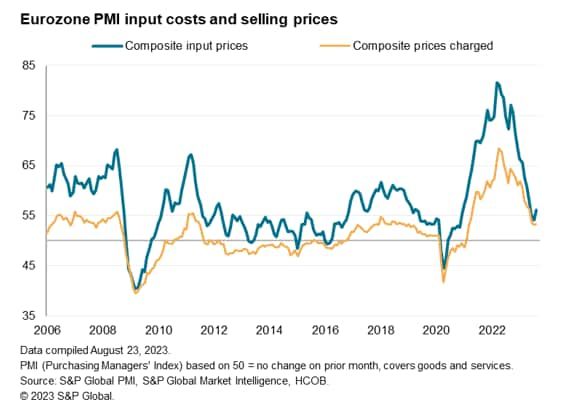

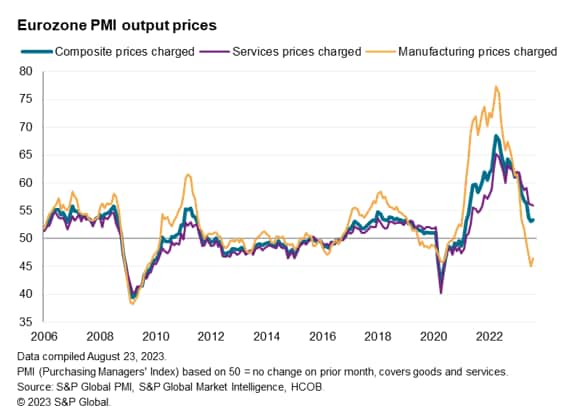

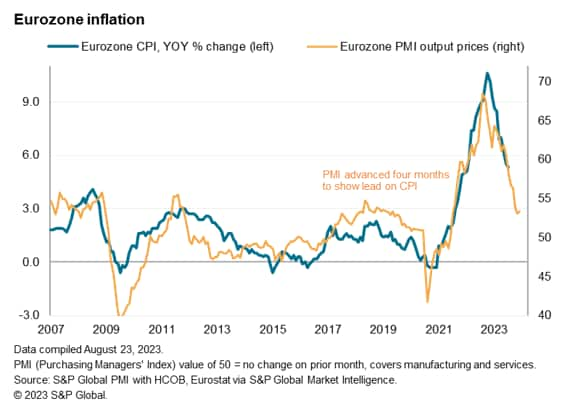

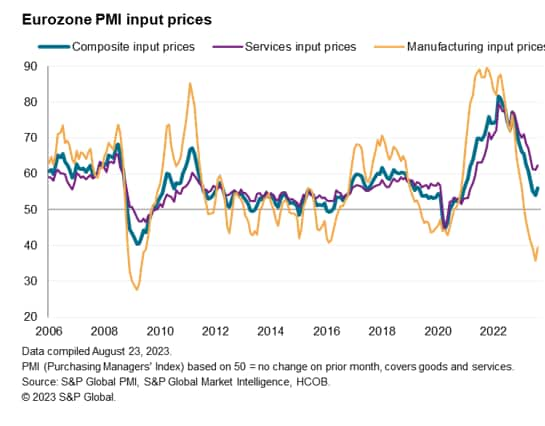

Inflationary pressures remained much lower than they have been for much of the past two and a half years due to lower manufacturing prices, but input cost and selling price inflation declined in August due in part to upward wage pressures. Rose. . However, overall inflation rates in input costs and selling prices indicate that consumer price inflation will continue at an annual rate of 3% in the coming months.

Production decline accelerates

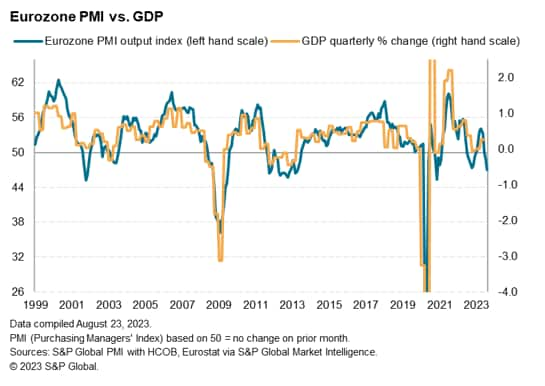

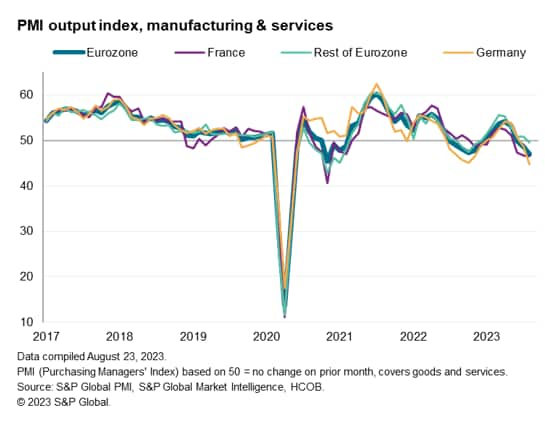

The euro area economy deteriorated further in August, raising the possibility of a third-quarter GDP decline. The seasonally adjusted HCOB Flash Eurozone Composite PMI Production Index, compiled by S&P Global based on about 85% of regular survey responses, was 47.0, down from 48.6 in July and the lowest level since November 2020. It became. Excluding the pandemic months, the latest reading was the lowest since April 2013.

August's statistics show GDP contracting by 0.3% quarterly, and when combined with July's readings, GDP is expected to contract by 0.2% in the third quarter.

Output fell for the third straight month after manufacturing output fell for the fifth straight month. The rate of decline in factory output eased slightly in August, but was still the second-largest recorded in the past 11 years of the survey, excluding only the first COVID-19 lockdown.

Meanwhile, the euro area's services sector also fell in August, with activity contracting for the first time since December, albeit much more modestly than in the goods production sector.

Demand conditions continued to deteriorate in both sectors. Overall new business inflows declined for the third consecutive month, with the rate of decline accelerating to the fastest rate since November 2020. Excluding the pandemic, the decline in new business was the largest since October 2012. New orders for products continued to decline at one of the following levels: In addition to the sharpest rise in interest rates since the global financial crisis, demand for services worsened for the second consecutive month. The latter contracted in August at a pace not seen since May 2013, excluding the COVID-19 lockdown period.

The data therefore suggests that the rebound in demand seen in the spring for consumer services such as travel and tourism has slowed markedly. This demand was booming in early 2023 as coronavirus containment measures were relaxed compared to the previous three years. Anecdotal evidence suggests that this resurgence in activity is partially hampered by rising costs of living and recent interest rate increases, coupled with concerns about the future fiscal health and the knock-on effects of a weakening manufacturing economy. has been done.

employment growth slows

Meanwhile, employment is nearing a stall, with a preliminary PMI survey for August recording the lowest job creation rate since employee numbers started rising after the pandemic lockdown in February 2021. Employment fell nationally, while a slight decline in manufacturing employment was recorded for the third straight month. The larger services sector continued to slow from its recent peak in April, with only modest increases, indicating the sector's smallest net employment increase since February 2021.

The near stagnation in employment reflects an increasingly sharp decline in companies' backlogs and indicates the development of excess production capacity relative to demand. Excluding the initial coronavirus lockdown period, this was the largest decline in the backlog since November 2012. The manufacturing industry's backlog fell sharply again, falling for the 15th straight month, while the service sector's backlog fell for the second consecutive month. The rate of decline was the largest since February 2021.

The deterioration in the order situation played a significant role in further reducing business confidence in the outlook for the coming year. Businesses also cited concerns about a broader economic slowdown in domestic and export markets, as well as concerns about the impact of rising prices.

As a result, business expectations for next year's production levels have fallen for the sixth month in a row, to their lowest level since December last year, falling further below the survey's long-term average and dampening optimism by historical standards. It showed that there is.

price

Meanwhile, inflation pressures increased in August in terms of both average selling prices and input costs, although both measures pointed to much weaker inflation than seen in the two years prior to the summer.

The average price charged for goods and services rose for the first time in seven months and was the second lowest rate since March 2021, but still higher than the survey's long-term average. Product sales prices fell for the fourth consecutive month. Although the deflation rate has eased, it continues. Meanwhile, prices in the service sector showed the lowest rate of increase since October 2021.

Overall sales price inflation, measured across both sectors, rose slightly in July, but remained consistent with consumer price inflation at just under 3%, down from 5.3% in July. . However, note that the Consumer Price Index has a lead of about 4 months.

Input cost inflation for both sectors rose slightly for the first time in 11 months, but remained slightly below the survey's long-term average. The sharp fall in manufacturing costs, although the rate of deflation has fallen compared to July, has been accompanied by a slight rise in service sector input cost inflation, the latter generally associated with upward wage pressures.

national trends

Looking at growth across the euro area, the sharpest decline was recorded in Germany, where production of goods and services fell for the second month in a row, the fastest pace since May 2020 (excluding the pandemic in 2009). since June). Along with a deep and sharp decline in manufacturing production, activity in Germany's service sector fell for the first time since December last year.

France reported a third consecutive month of production decline, and the rate of decline remained unchanged in July, marking the largest decline since May 2013, excluding just four months of pandemic lockdown. The rate of contraction in the manufacturing industry, although still sharp, has slowed, while in the service industry, contraction has accelerated.

The rest of the region suffered a modest decline in output compared to France and Germany, but continues to see a decline in manufacturing output while service sector activity has largely stagnated. This decline is notable in that it is the first recorded since December.

Access the Eurozone PMI flash press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Phone: +44 207 260 2329

chris.williamson@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers Index™ (PMI)®) Data is compiled by S&P Global for more than 40 economies around the world. Monthly data comes from a survey of senior executives at private companies and is available by subscription only. The PMI dataset includes headline numbers that indicate the overall health of the economy and sub-indices that provide insight into other key economic factors such as GDP, inflation, exports, capacity utilization, employment, and inventories. Masu. PMI data is used by financial and corporate professionals to better understand where the economy and markets are heading and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, an independently managed division of S&P Global.