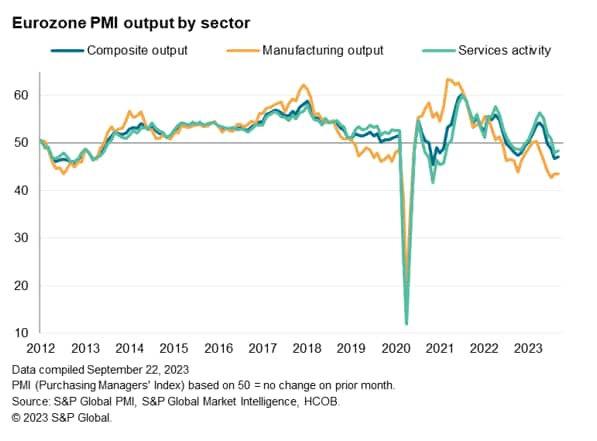

Business activity in the euro area continued to contract at the end of the third quarter of the year, as an increase in order loss rates further reduced activity. The overall decline in production was once again led by manufacturing, but service sector activity fell for the second month in a row.

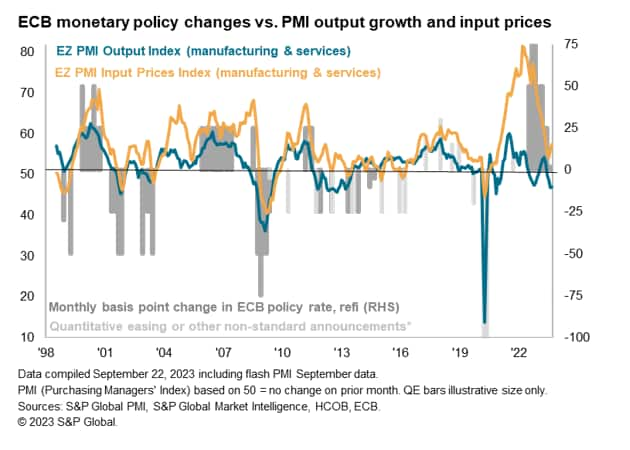

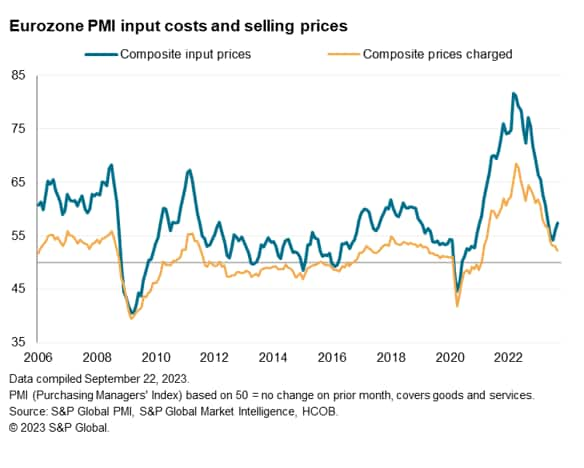

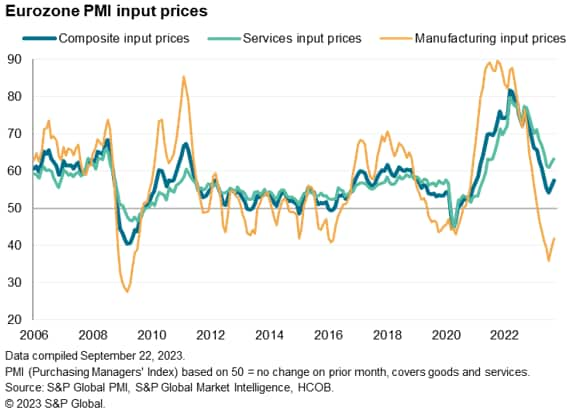

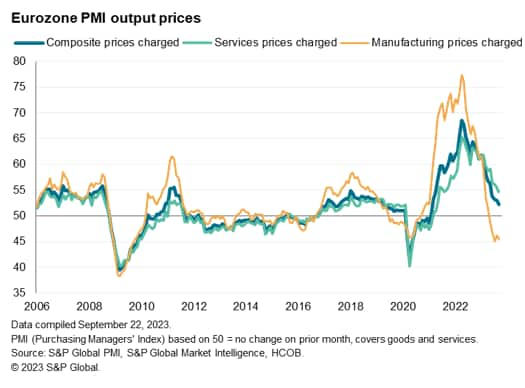

Input costs continued to rise sharply, and inflation accelerated compared to August, due in part to soaring oil prices. However, output prices rose at the slowest pace in two and a half years as pricing power weakened.

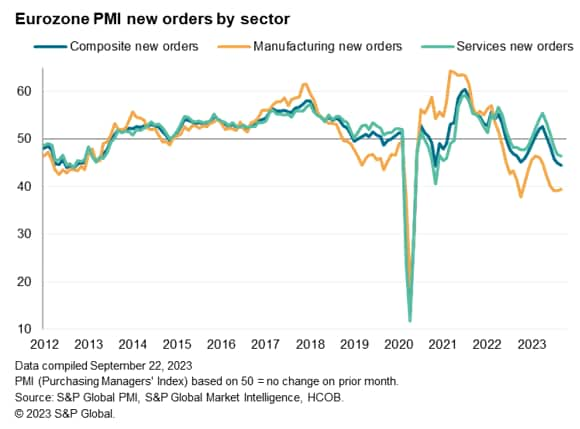

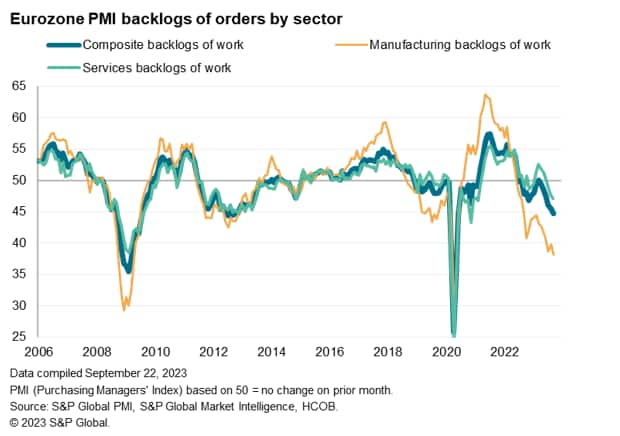

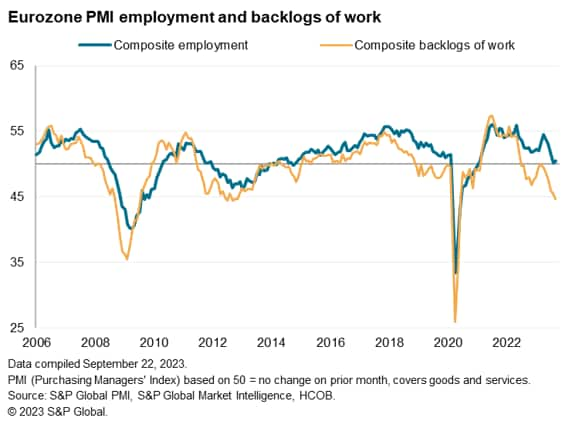

Forward-looking indicators suggest the economic contraction is likely to continue into the fourth quarter. Expectations for the future economy have fallen significantly and are now weak by historical standards, suggesting the rate of decline will accelerate in the coming months. Similarly, the influx of new orders has fallen faster than production in both manufacturing and services, suggesting that companies will look to reduce capacity in the coming months. Similarly, the backlog of orders is decreasing at an accelerating pace, suggesting production cuts across products and services will occur in the coming months. In the goods production sector, destocking remains widespread, suggesting that the intense destocking cycle that has exacerbated the recent weakness in customer demand will not ease any time soon.

However, these factors should not only constrain output growth into 2024, but also affect pricing power and lower inflationary pressures in both manufacturing and services.

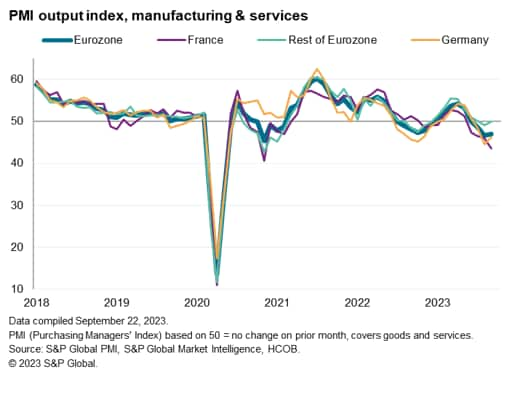

Production decline accelerates

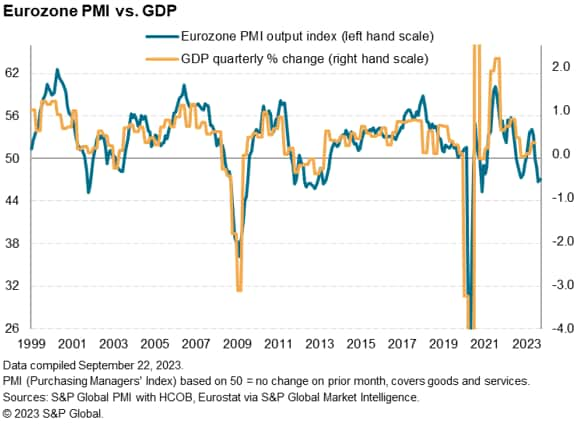

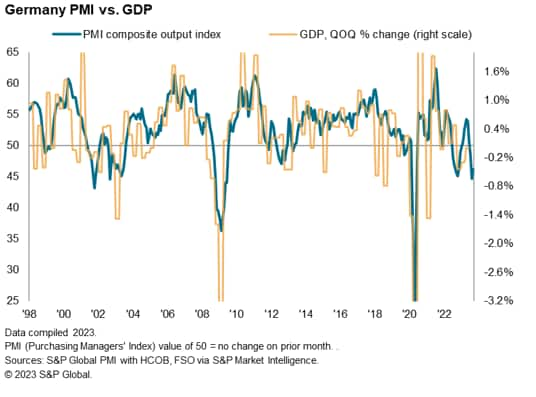

The HCOB Eurozone Composite PMI Production Index compiled by S&P Global recorded a preliminary reading of 47.1 in September, up slightly from 46.7 in August, but still indicating a steady decline in monthly business activity. There is. Production has declined for four consecutive months.

August statistics show GDP will decline by 0.4% quarterly, but combining August and July measurements means GDP is likely to contract by 0.3% for the entire third quarter. It means that.

For the second month in a row, both manufacturing and services sectors saw a decline in output. However, although the rate of contraction in the services industry eased slightly from August, it was still much slower than the rate of contraction in the manufacturing industry. The decline in manufacturing production is unchanged from the rapid pace seen in August. Apart from a brief increase in the first quarter of this year, manufacturing output in the euro area has been in continuous decline since mid-2022, with the latest decline being the largest since the global financial crisis.

Central to the recent contraction in business activity was a further deterioration in demand, highlighted by a fourth consecutive month of decline in new orders. Moreover, September's drop was the most significant since November 2020 and the largest drop since September 2012, excluding the pandemic months.

New orders in the manufacturing industry contracted sharply again, but the overall rate of decline accelerated mainly in the services industry, where the drop in new contracts was the largest since the pandemic. In fact, excluding months affected by COVID-19 restrictions, the decline in new service orders was the largest since May 2013.

Therefore, the data continues to show that the recovery in demand seen in the spring for consumer services such as travel and tourism has slowed markedly. This demand was booming in early 2023 as coronavirus containment measures were relaxed compared to the previous three years. Also note that new orders continue to decline at a faster pace than production currently being cut. This suggests that companies will be under pressure to reduce operating capacity in the coming months unless demand suddenly revives.

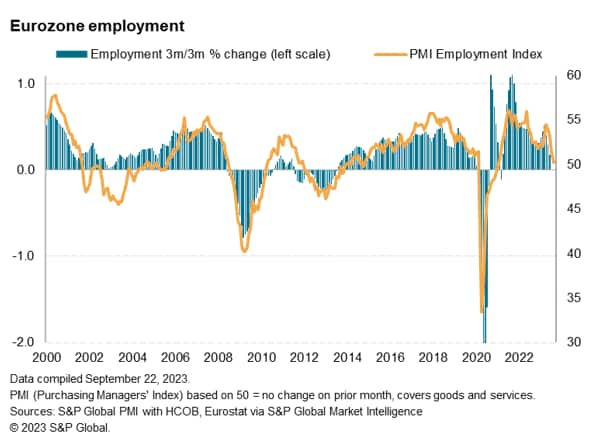

The job market remains largely stagnant

Sharp's decline in new orders meant the company often worked on backlogs of business to maintain activity levels. As a result, the order backlog decreased significantly again in September, with the recent decline being the most significant since June 2020. Excluding the months of the pandemic, the decline is the largest since 2012 and reflects the largest decline in services backlog since 2012 and the largest decline in manufacturing backlog since 2012. Since the global financial crisis.

Eurozone companies also signaled at the end of the third quarter that confidence in the outlook for next year was waning. Future sentiment has declined significantly, reaching its lowest level since November last year. Optimism diminished across both monitored sectors, with manufacturing confidence remaining in marginally positive territory.

With spare capacity and confidence in the outlook declining, companies have once again become cautious in their approach to hiring. Although employment rose modestly in September, the job creation rate was the second-lowest in the 32-month period of growth.

The number of manufacturing employees has declined for the fourth straight month, while employment in the services industry has increased slightly.

In addition to reducing staffing levels, euro area manufacturers have also significantly reduced their purchasing activities, reducing their holdings of both purchased and finished goods. The decline in finished goods inventories was the sharpest in two years.

Reduced demand for raw materials has allowed suppliers to speed up deliveries, reducing vendor lead times for eight straight months. The acceleration in deliveries was significant, although not the most significant since February.

Decreasing pricing power

Regarding inflation, a different trend was observed in September due to a sharp rise in input costs in contrast to a slowdown in output price inflation.

Input costs increased at the fastest pace in the past four months, although at a pace well below the average over the past three years. Inflation was driven by the service sector, where rising wages and rising fuel costs caused prices to soar. Meanwhile, in manufacturing, input costs declined for the seventh consecutive month.

Despite the accelerating pace of input cost inflation, firms' sales price increases were slower than in August due to a weaker demand environment. In fact, recent rate increases were modest and the slowest since February 2021. Manufacturing output prices fell at a marked and accelerated pace, while service charge inflation slowed to a 25-month low.

Overall sales price inflation, measured across both sectors, has now fallen from 5.2% in August to a level consistent with consumer price inflation of less than 3% in early 2024.

national trends

Looking at overall eurozone growth, the eurozone's two largest economies, Germany and France, were the main contributors to the overall slump in economic activity in September.

Germany Production fell for the third straight month, at a steady pace, albeit at a slightly slower pace than in August. Germany's manufacturing production fell at the fastest pace since the early wave of the COVID-19 pandemic, while services activity fell slightly.

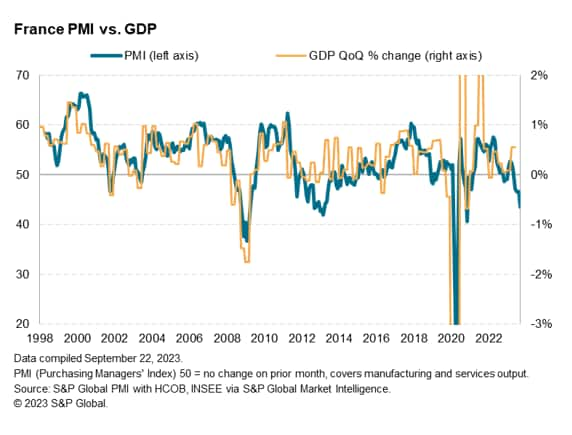

contraction of France It was worse than in Germany, where activity fell to the greatest extent since November 2020. Excluding months affected by the pandemic, September's production decline was the steepest in more than a decade. The rate of decline accelerated in both manufacturing and services.

of Remainingeuro area Corporate activity generally remained stable in September. Manufacturing production fell for the sixth consecutive month, but the decline was the largest since April. Meanwhile, service activity increased slightly, but the degree was greater than in August.

View the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Phone: +44 207 260 2329

chris.williamson@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers Index™ (PMI)®) Data is compiled by S&P Global for more than 40 economies around the world. Monthly data comes from a survey of senior executives at private companies and is available by subscription only. The PMI dataset includes headline numbers that indicate the overall health of the economy and sub-indices that provide insight into other key economic factors such as GDP, inflation, exports, capacity utilization, employment, and inventories. Masu. PMI data is used by financial and corporate professionals to better understand where the economy and markets are heading and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, an independently managed division of S&P Global.