The number of cryptoassets that can be used as a means of payment has exploded to more than 10,000 types since the introduction of the first and still largest cryptocurrency, Bitcoin, in 2009. It has developed with incredible speed, and due to its anonymity, tax systems are catching up.

New paper explores how governments address the new challenge of taxing crypto assets while their use is still restricted to prevent tax revenue leakage and protect the integrity of the tax system We will discuss whether it is possible.

Classification of cryptocurrencies

We have diverse perspectives on crypto assets and are passionate about them. The prospect of freeing financial transactions from government oversight and involvement by financial institutions is a libertarian dream for some. El Salvador and the Central African Republic have gone as far as adopting Bitcoin as legal tender.

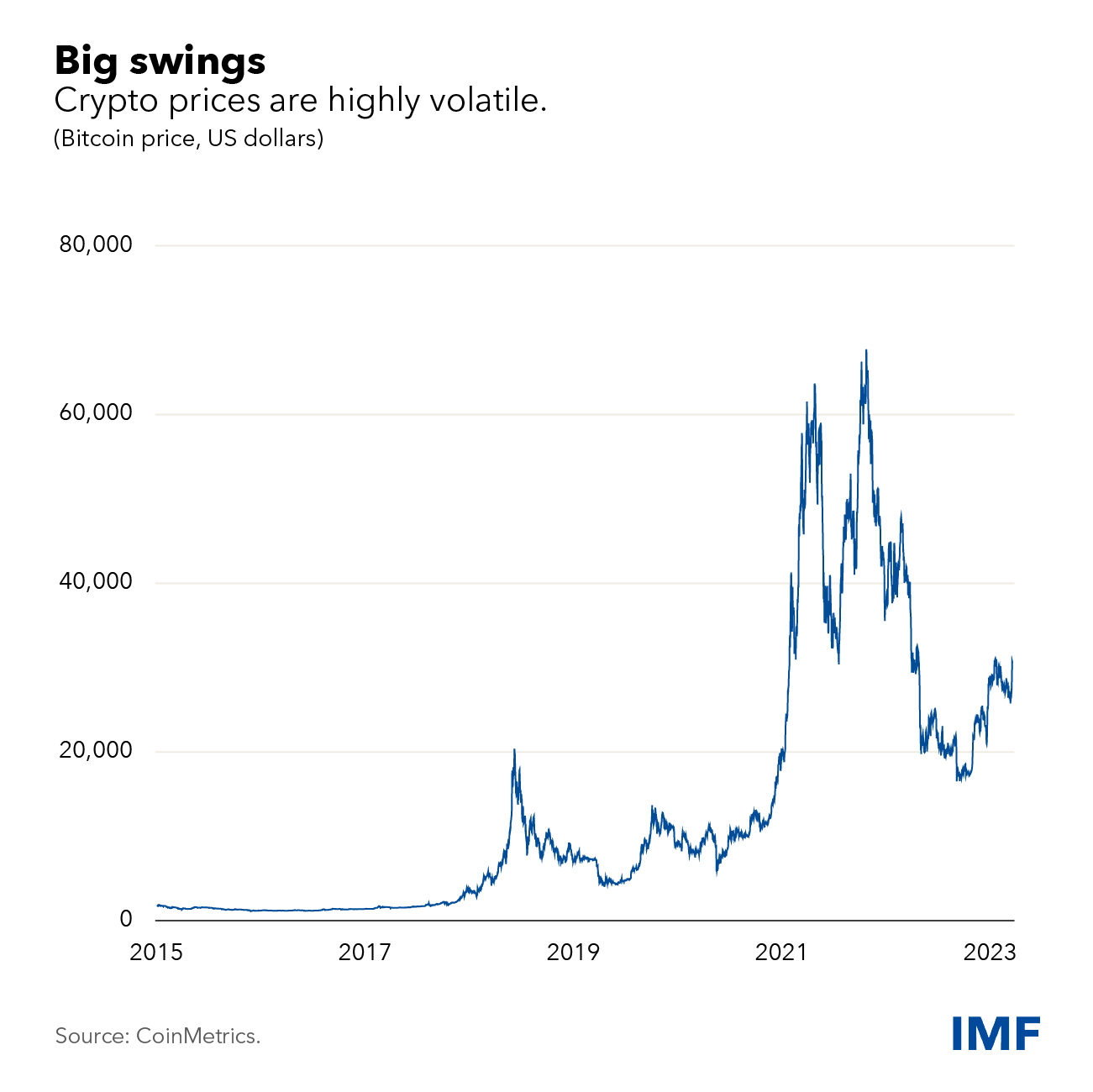

But critics see crypto assets as not only inherently worthless, but also a breeding ground for crime, fraud and gambling. They also point out its dizzying volatility. For example, Bitcoin soared from $200 a decade ago to nearly $70,000 in 2021, before falling to around $29,000 today.

The collapse of FTX last year and recent U.S. Securities and Exchange Commission lawsuits against Binance and Coinbase have fueled fears among users, while allegations of criminal activity have been reflected in high-profile seizures of billions of dollars. These trends have drawn increased scrutiny from policymakers and widespread calls for regulation.

But regardless of whether cryptoassets ultimately boom or bust, there needs to be a consistent way to tax cryptoassets.

A key question is how to classify cryptoassets: whether they should be considered property or currency. If you sell cryptocurrencies for profit, capital gains must be taxed like any other asset. And purchases made with cryptocurrencies must be subject to the same sales tax or value added tax (VAT) that applies to cash transactions.

Therefore, one of the key challenges is to ensure that these principles are applied, including characterizing cryptocurrencies for tax purposes, essentially as currency for VAT and sales tax purposes, and as an asset for income tax purposes. The method needs to be clarified. Due to the evolving nature of crypto trading, this is not easy, but it is entirely possible. The most serious challenge lies in enforcement.

Revenue considerations

Rough estimates suggest that a 20% tax on crypto capital gains could raise around $100 billion worldwide from rising prices in 2021. This represents about 4% of global corporate tax revenues, or 0.4% of total tax revenues.

However, the market capitalization of cryptocurrencies has fallen by 63% since its peak at the end of 2021, and tax revenues would have declined. If these losses are fully offset by other taxes, your income will be reduced accordingly. At the current market size in more normal times, global crypto tax revenues would likely average less than $25 billion per year. This is not a huge amount in the broader scheme of things.

Important equity issues are also at stake. Their anonymity makes it difficult to determine exactly who owns cryptocurrencies, but even though ownership of cryptocurrencies is surprisingly common, even among low-income people, There are signs that it is concentrated among the relatively wealthy. According to available research, around 10,000 people own a quarter of all Bitcoin.

There is also a value added tax. Cryptocurrency transactions are similar to cash transactions in that they can be hidden from tax authorities. Currently, the percentage of purchases made with cryptocurrencies is still small. However, if the tax system is not prepared, widespread use could one day lead to widespread VAT and sales tax evasion, leading to significant reductions in government revenues. This may be the biggest threat posed by cryptocurrencies.

Dealing with implementation

The most fundamental difficulty in taxing crypto assets is that they are “pseudonymous.” This means that transactions use public addresses that are very difficult to link to individuals or businesses. This could facilitate tax evasion. Its implementation is therefore central to the issue for tax authorities.

If people trade through a centralized exchange, this problem cannot be overcome as it can be subject to standard “know your customer” tracking rules and in some cases withholding tax can be applied. Masu. Many countries have introduced such rules in the hope of improving tax compliance.

However, reporting requirements may encourage people to bypass tax authorities by using centralized exchanges overseas instead. To address this concern, the Organization for Economic Co-operation and Development has developed a framework for the exchange of crypto-related information between countries. However, implementation is still a long way off.

An even more troubling possibility is that reporting rules (and the failure of some crypto intermediaries) could lead to more people trading directly through decentralized exchanges or through peer-to-peer trading, where transactions are not overseen by a central governing body. It means that it has sex. These remain extremely difficult for tax administrators.

Given the complexity of the fundamental challenges posed by anonymity, the speed of innovation, the vast digital divide, and the uncertainty of the future, the battle to properly incorporate cryptocurrencies into the broader tax system is still on the rise. Not changed. Some of the necessary elements for this (such as clarity of tax classification) are clear.

But the challenges are fundamental, and the risks, particularly for value-added tax and sales tax, may be greater than people realize. As many, but not all, governments are beginning to realize, policymakers need to develop a clear, consistent, and effective framework for taxing cryptocurrencies.