Bitcoin price continues to hover above $70,000 despite the long holiday. The cryptocurrency market saw some excitement, although activity was mostly subdued due to several economic events, including the US's PCE inflation announcement. The total volume of the cryptocurrency market in the past 24 hours has decreased by more than 15%. However, Coinbase's premium gap shows that institutional investors are buying again.

Coinbase Premium Gap Indicates Bitcoin Purchases

Buying by institutional investors began to decline on March 27th, Coinbase Premium Gap It turned green again in late March 29 following the Fed's preferred inflation indicator PCE. On-chain analyst Martun revealed that Coinbase’s premium gap has been over 50 since the morning of March 30th. He claims that US institutions may have started buying Bitcoin again.

This indicator is so accurate that it is often used by US institutions to determine when to start buying Bitcoin. This suggests that there could be significant inflows into spot Bitcoin ETFs next week ahead of the Bitcoin halving, which is expected to occur in mid-April.

Coinbase Premium Gap is the gap between Coinbase Pro price (USD pair) and Binance price (USDT pair). A high premium value typically indicates strong buying pressure from US investors on cryptocurrency exchange Coinbase. Traders can closely monitor indicators and trading volumes to see market direction.

Analysts remain bullish on BTC price

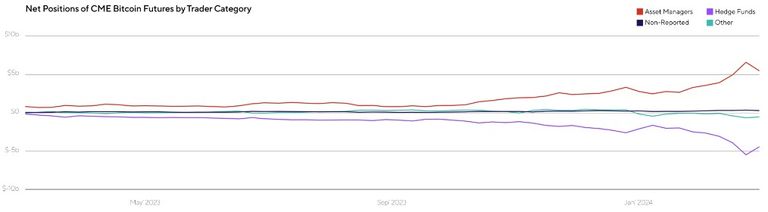

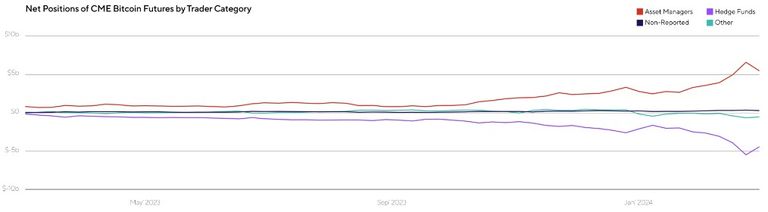

Ryze Labs analysts revealed that the gap between hedge funds (purple) and asset managers (red) continues to widen. “This divergence indicates that while asset managers continue to buy Bitcoin futures, hedge funds are increasingly short-selling.In the current bullish environment, this move could be a sign of a potential short squeeze. , which could fuel Bitcoin’s next rally,” they said.

popular analyst michael van de poppe He said Bitcoin's sideways movement led to a consolidation near $70,000. However, he assures that Bitcoin is still following the typical four-year cycle path. He added, “Honestly, this cycle will surprise a lot of people. In five years, he will be at $70,000 per Bitcoin, which is cheap.”

Meanwhile, futures and options buying remains slow due to the holiday, with traders waiting for further declines in BTC prices. CME BTC Futures Open Interest 0.32% decrease to $11.64 billion. Total open interest of BTC options Decrease from $32.31 billion to $21.52 billion.

BTC price has remained flat and is currently trading at $70,189. The 24-hour low and high prices are $69,076 and $70,513, respectively. Additionally, trading volumes have decreased by more than 25%.

Also read:

The published content may include the personal opinions of the author and may be subject to market conditions. Do your market research before investing in cryptocurrencies. The author or publication assumes no responsibility for your personal financial loss.

✓ Share: