- XMR has fallen by almost 10% in the past 24 hours.

- The coin's funding interest rate turned negative for the first time in two months.

Monero [XMR] The stock price fell about 10% in the past 24 hours following OKX's decision to delist 20 trading pairs, including a prominent privacy coin.

In a Dec. 29 announcement, the major exchange said it had decided to delist the trading pair because the crypto asset “does not meet our listing criteria.”

Other assets affected by this move include Kusama. [KSM]flow [FLOW]just [JST]kyber network crystal [KNC]Aragon [ANT]fusion [FSN]ZK Space [ZKS]capo [CAPO]power pool [CVP],dash [DASH]Zcache [ZEC]Horizen [ZEN].

Demand for XMR decreases

At the time of writing, XMR was trading at $165.48. According to the data, in the past 24 hours he recorded a 6% price decline, making this coin his third among the most loss-loss assets during that period. coin market cap.

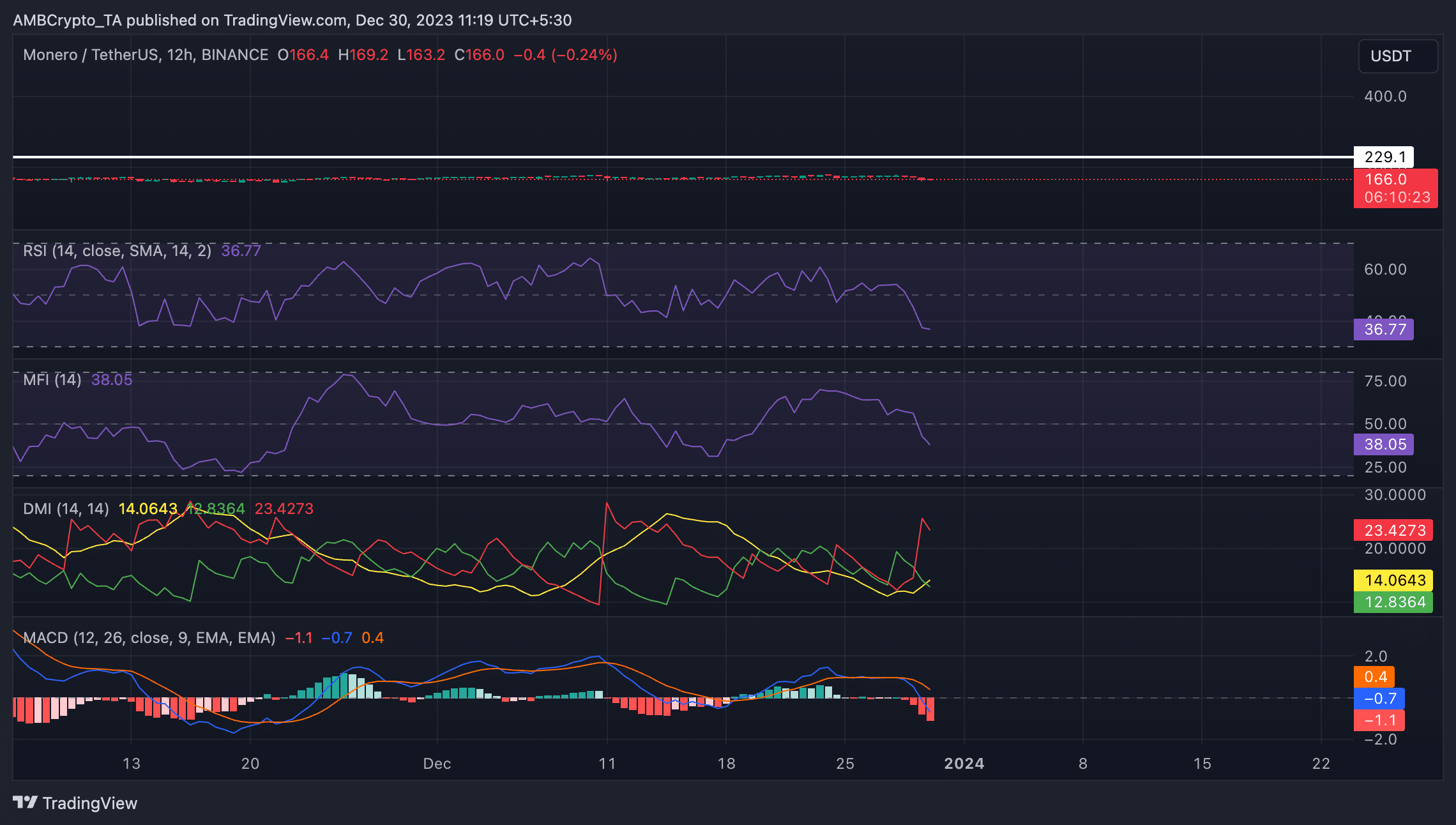

As observed in the price performance within the 12-hour chart, the decline in the value of XMR was due to reduced accumulation among traders. At the time of writing, the key momentum indicators were fixed below their respective center lines.

Source: XMR/USD on TradingView

For example, the relative strength index (RSI) for XMR was 36.77. Also, the value of Money Flow Index (MFI) was 38.05.

These indicators showed that the coin’s decline outweighed its accumulation as traders exited their XMR holdings in light of OKX movements.

XMR Directional Movement Index (DMI) measurements show that the negative directional index (red) is higher than the positive directional index (green), confirming the bearish sentiment.

In an uptrend with a value of 23.42 at the time of writing, the XMR negative directional index showed that the bears are in control of the 12-hour chart.

Additionally, XMR's MACD line was below zero below the trend line at the time of writing. When his MACD line for an asset breaks below the trend line and below zero, it is generally interpreted as a bearish signal.

Many traders consider this crossover below zero to be a sell signal, as it suggests that downward momentum may continue.

Short traders take advantage of it

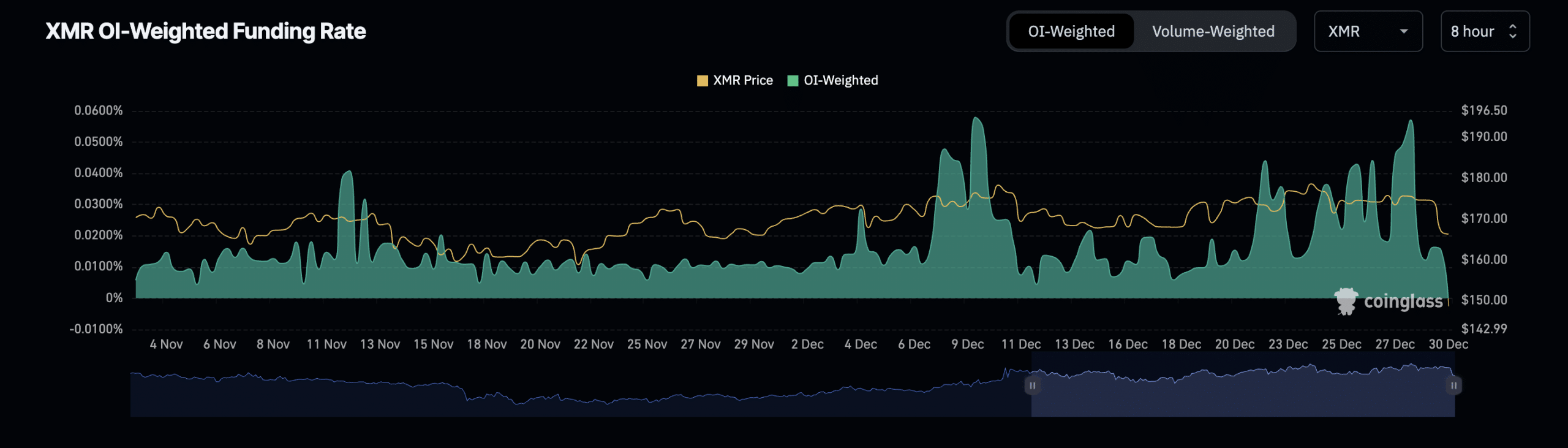

Short traders in the XMR futures market are re-entering the market as prices continue to fall.

According to data from Coinglass, the coin derivatives market saw a 109% increase in trading volume and a 23% increase in open interest over the past 24 hours.

read monero [XMR] Price prediction for 2023-24

However, for the first time since October 30th, the funding rate of the coin across exchanges became negative.

Source: Coinglass

If the funding rate of an asset is negative, it means that short position holders are paying fees to long position holders. This suggests that the majority of traders believe that the price will drop in the future.