An analyst reveals a simple strategy for buying and selling Bitcoin using historical patterns followed by two BTC on-chain indicators.

These Bitcoin On-Chain Indicators Historically Follow Certain Patterns

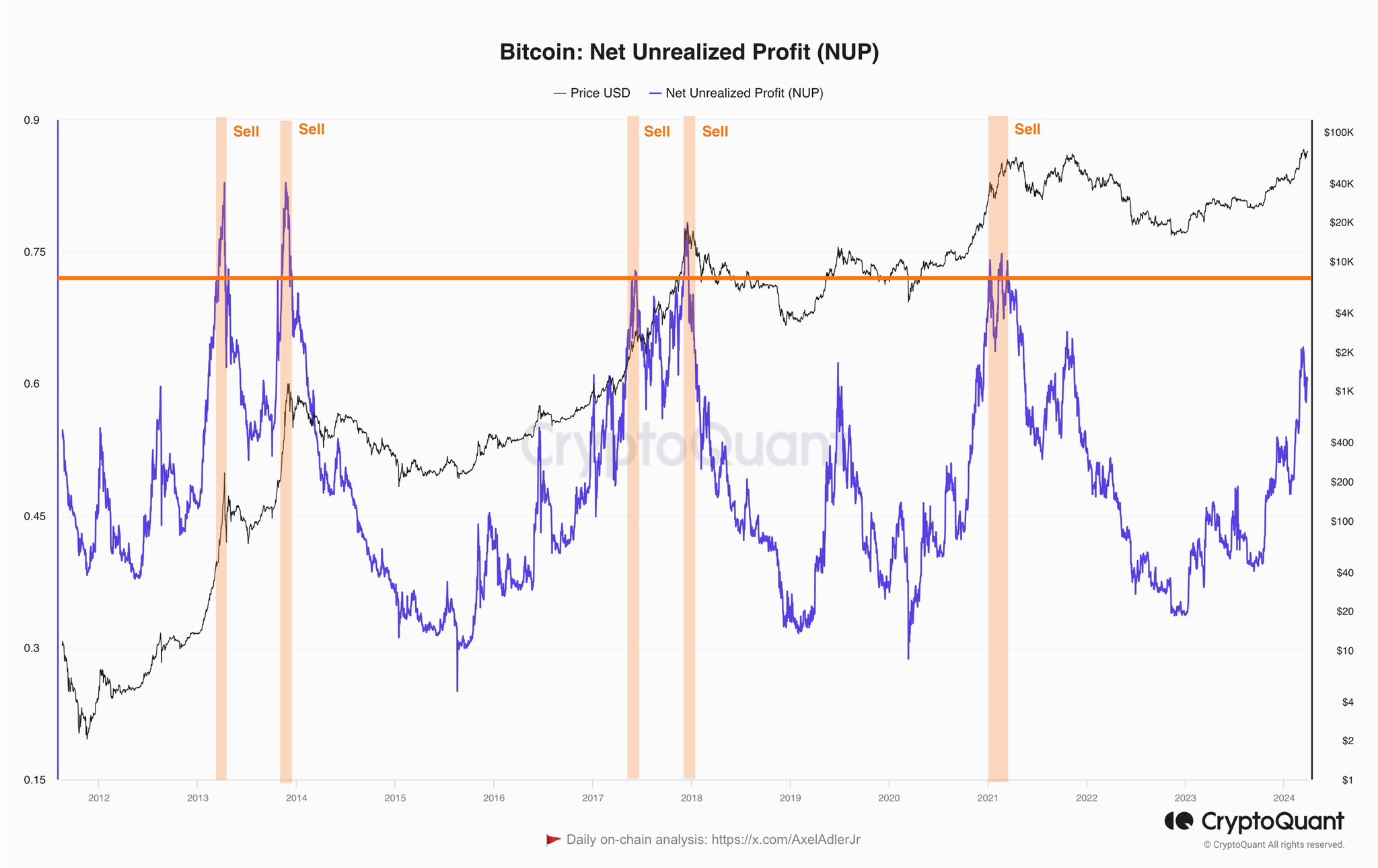

in post In X, Axel Adler Jr, author of CryptoQuant, explained a simple strategy for timing the buying and selling of Bitcoin. This strategy is based on trends seen historically in his two on-chain metrics for BTC: Net Unrealized Loss (NUL) and Net Unrealized Gain (NUP).

As the name suggests, these metrics track the total amount of unrealized losses and gains an investor currently has.

These indicators work by looking at the transaction history of each coin in circulation to see the last price it traded at. Assuming that the last transfer of each coin was the last time it changed hands, the price at that moment serves as the current cost basis.

If the previous price of a coin was lower than the current spot price of the cryptocurrency, then the coin is currently profitable. NUP subtracts these two to calculate the exact unrealized gain on the coin.

Similarly, NUL does the same for coins whose cost basis exceeds the most recent value of the asset. These indicators sum this value across supply and divide that sum by the current market capitalization.

First of all, this is a chart shared by an analyst at NUL that reveals the pattern that the indicator has followed throughout Bitcoin's history.

The value of the metric seems to have been heading down in recent days | Source: @AxelAdlerJr on X

Bitcoin NUL appears to have historically risen above the 0.5 level when asset prices hovered around bear market lows. According to Axel, indicators in this area will be the timing for additional purchases.

Recently, the indicator has been fluctuating around the zero mark, meaning that investors are experiencing unrealized losses. This is not surprising given that cryptocurrencies have hit new all-time highs (ATH). Naturally, once the ATH is set, 100% of the supply becomes profit.

Similar to the NUL pattern, NUP has been above the 0.7 level during major peaks in the past, suggesting that it could be a good opportunity to sell when the indicator is in this zone.

Looks like the value of the indicator has been climbing up recently | Source: @AxelAdlerJr on X

As seen in the chart, NUP has been rising along with Bitcoin's recent rally. Still, so far this indicator has not exceeded the seemingly important level of 0.7, which may mean that the market is not yet in an overheated state where selling is ideal, at least according to this strategy. It suggests that.

However, the graphs of the two indicators show that neither shows the exact upper or lower limits of wealth. This was especially evident in his NUP data, where the indicator was suggesting a “sell” during a high that was only half of the bull market.

That being said, historically you would have made a profit if you bought during the point flagged by the NUL and then sold at the overheated NUP value. In that sense, this would really be a “simple” strategy for this asset.

However, it remains to be seen whether these patterns will continue to hold in the current Bitcoin cycle.

BTC price

At the time of this writing, Bitcoin is trading around $69,400, down 2% in the past 24 hours.

The price of the asset appears to have been moving sideways recently | Source: BTCUSD on TradingView

Featured image of Kanchanara on Unsplash.com, CryptoQuant.com, Charts on TradingView.com