After Binance's eventful announcement, the price of Monero, the leading privacy token, plummeted. In this analysis of his XMR, we consider whether Monero is destined for further declines.

A significant price drop for the Monero token has shaken the XMR market with Binance's announcement yesterday after it revealed plans to remove the popular dark web cryptocurrency from public trading on the exchange.

The decision comes in the wake of Monero's refusal to comply with increasing KYC requirements with the advent of stricter crypto regulations in the West, something that XMR has circumvented as a popular privacy-oriented token. Trying to.

Are you considering $600? $XMR? pic.twitter.com/n2AquWnTiP

— SirJaɱzAlot (@MgkMshrmBrkfst) February 6, 2024

Despite the decline, sentiment in the crypto community remains surprisingly bullish, with traders seeing XMR's continued commitment to privacy as bullish for the continued future use of XMR as a currency. It has been commented on as a persuasive fundamental factor.

XMR Price Analysis: Can Monero recover from Binance delisting?

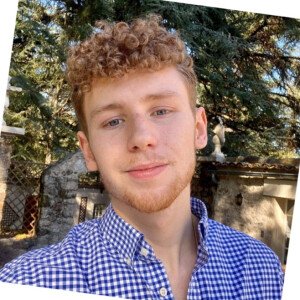

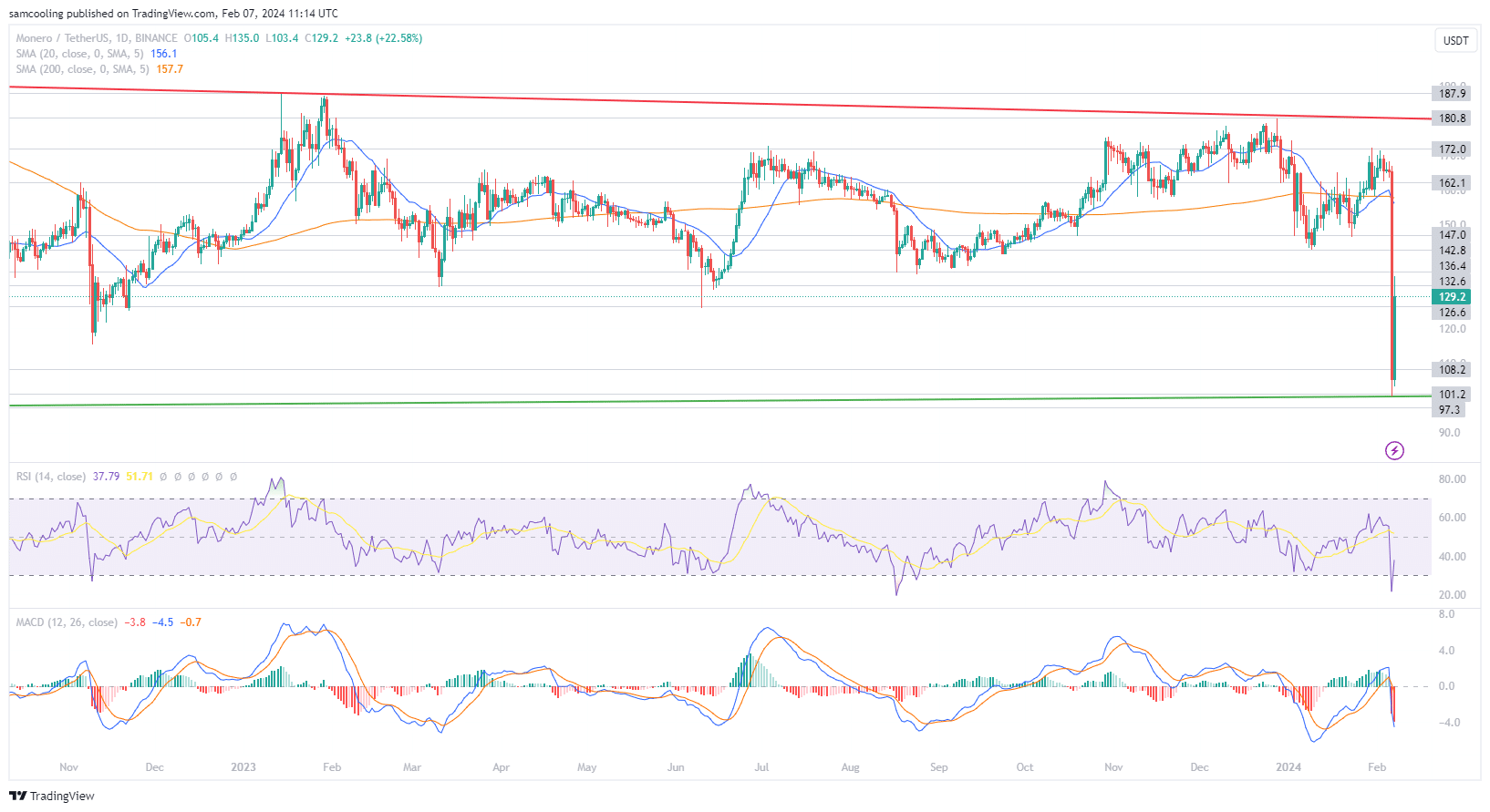

Monero token is currently trading at a market price of $127.1 (representing +20.49% 24-hour change) as XMR price rebounds from aggressive dumping moves.

This follows yesterday's devastating -39% drop in XMR prices due to significant support at the moving averages amidst a massive market panic that caught bedrock support near the $101 lower trend line. This follows a sell-off.

Currently trading above $126.60, the historic support level that had precedents in June 2023 and November 2022, XMR price appears to be past the worst of the dumping.

Monero (XMR) is eyeing a recovery as the market stabilizes, with investors targeting the 20-day moving average (DMA) of $156.10.

The resilience shown during the recent selloff suggests a potential rebound for XMR from the lower trend line, driven by optimistic indicators. The Relative Strength Index (RSI) has fallen to a bullish 36.57, indicating that the price may rebound from the oversold condition.

However, the Moving Average Convergence Divergence (MACD) at -4.0 indicates a significant loss of momentum, raising concerns in contrast to the positive outlook on the RSI.

In summary, while the initial price decline may have stopped, Monero's road to recovery is fraught with challenges. The lack of trading volume from Binance could significantly test the short-term price fluctuations of XMR.

On the upside, XMR is targeting a recovery move towards the higher support at $136.40 (potentially +6.4%).

While there is downside risk, XMR could be targeting a fall to the lower support at $126.60 (-1.25% chance).

Therefore, XMR price analysis gives Monero a risk-to-reward ratio of 5.13, making it a strong entry with a recovery in the short term.

But while the Monero token moves into recovery mode, more strategic moves are emerging ahead of April's Bitcoin halving event, with viral momentum driving Bitcoin Minetrix pre-sale growth. Masu.

Alternatives to XMR Price Analysis? New Bitcoin Cloud Mining Project BTCMTX Surpasses $10.3 Million

Dive into the revolutionary world of Bitcoin Minetrix and its pioneering stake-to-mining system – soaring pre-sale topping +$10,391,923 The latest stage 24 is just starting.

Offering an attractive 75% staking APY, Bitcoin Minetrix provides a platform where users can buy, stake, and watch their rewards start accumulating.

Never before has the essence of passive income been so accessible in the world of cryptocurrencies.

With Bitcoin Minetrix's approach, gone are the days of struggling with large initial capital and complicated mining contract procedures.

Aiming for $13 million: Bitcoin Minetrix crosses $10.39 million – momentum to outperform XMR price analysis

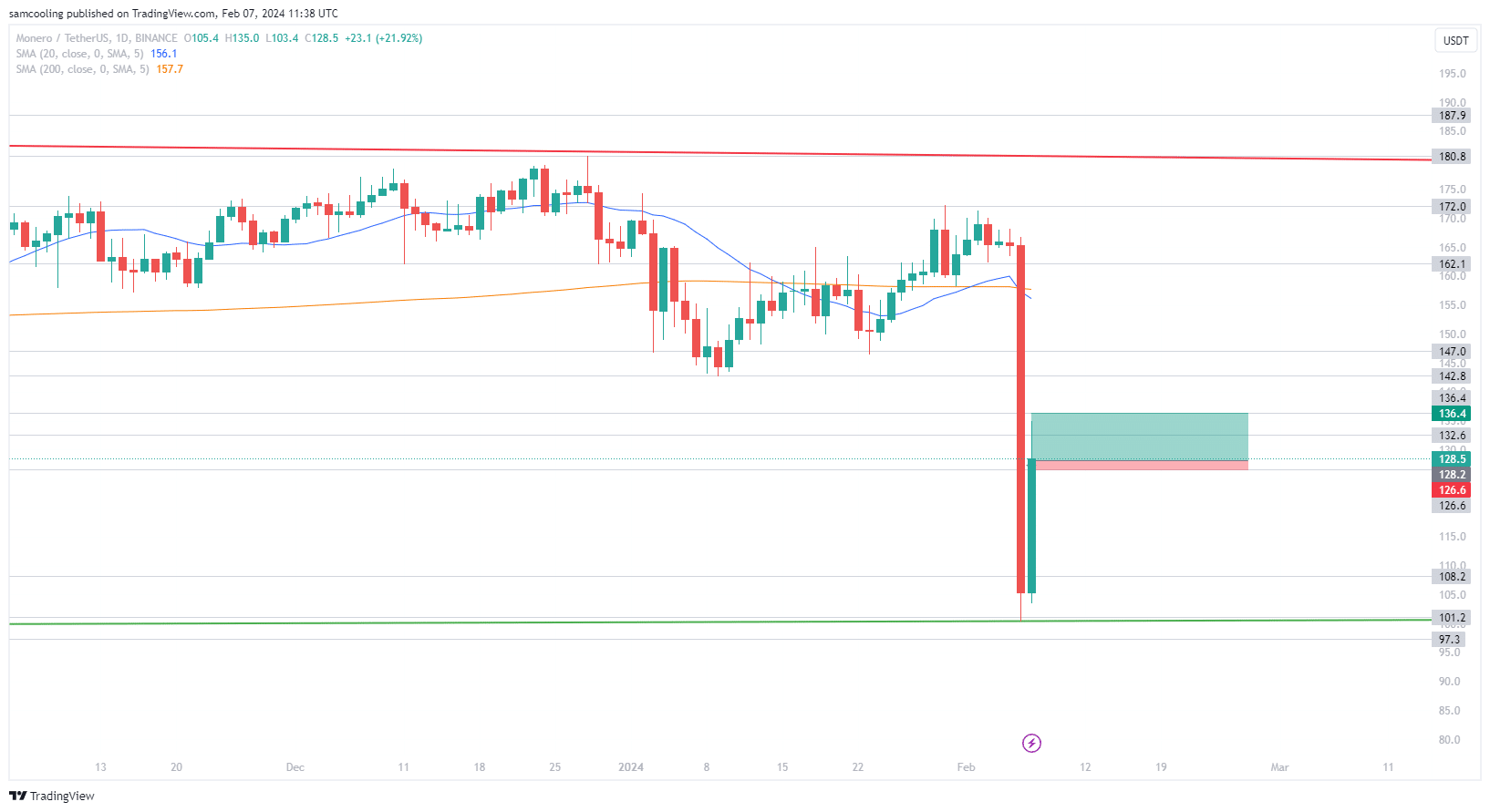

Since the 2021 bull run, Bitcoin mining has experienced something of a renaissance in network growth, defying expectations.

Bitcoin's hash rate (a measure of the total amount of computing power used to mine a Bitcoin block) has risen to an incredible all-time high of 525 Exahash per second (EH/S).

Significant growth in the Bitcoin mining sector is being driven by the expansion of Marathon Digital and Riot Platforms.

Marathon, the world's largest Bitcoin miner, reported an average hash rate of 14.2 EH/s in Q3 2023, an increase of 500% year-on-year and accounted for approximately 4% of all network hashes. This ability allowed them to mine approximately 1,153 BTC (equivalent to USD 42.2 million) every month.

Riot Platforms achieved a new record hash rate of 10.9 EH/s and mined approximately 368 BTC per month, worth $13.3 million. Riot expects to scale its operations to 20.2 EH/s by summer 2024.

However, record Bitcoin network hash rates have raised concerns that while improving the network's security and profitability for miners, it is moving away from Satoshi Nakamoto's original vision of decentralization.

Bitcoin mining in 2023 will be the most centralized in its short 15-year history.

Why has Bitcoin mining become so centralized?

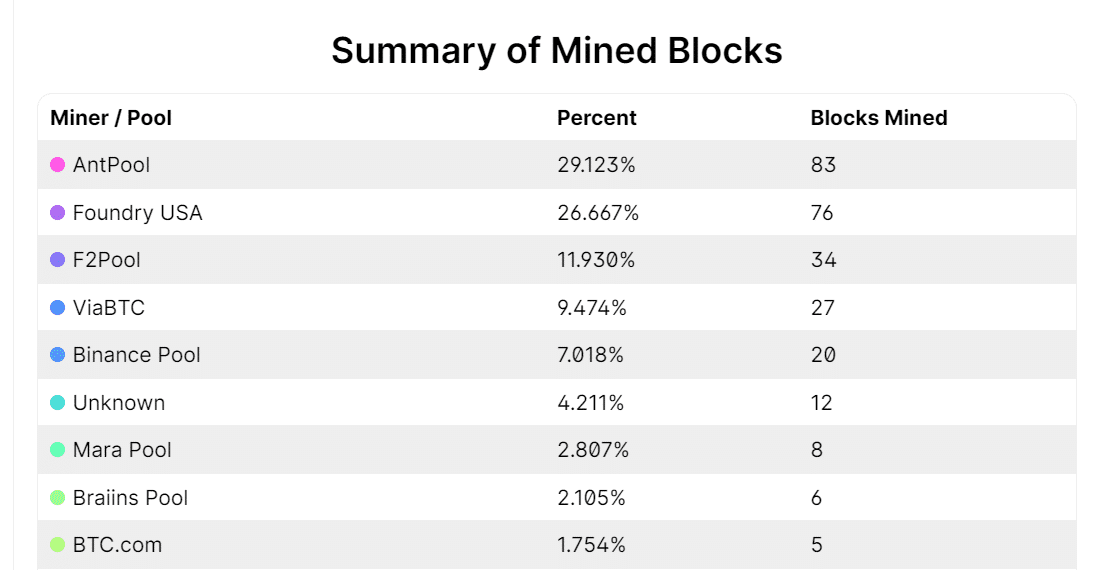

A closer look at the summary of blocks mined in the past 48 hours reveals that an astonishing 55.79% of all Bitcoin block rewards are going to just two Bitcoin mining pools.

AntPool had the largest share with 83 blocks (29.123%) mined, while the second largest mining pool Foundry USA mined 76 blocks (26.667%).

This is far below the number of blocks mined even by third place F2Pool (34 blocks mined, approximately 11.93%), highlighting the growing challenge of increasing centralization of mining.

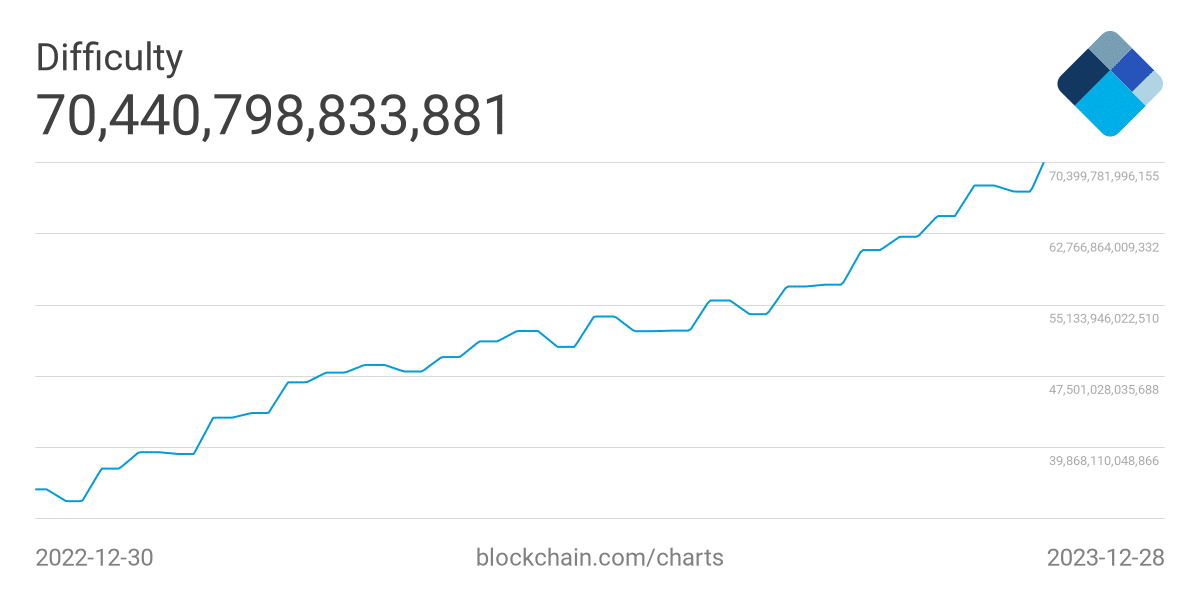

This increased network activity and increased centralization of mining power is clearly reflected in the resulting all-time high in Bitcoin mining difficulty.

Currently, that number is 70,440,798,833,881. It has never been more difficult for individual participants to engage in profitable Bitcoin mining.

This challenge of increasing network difficulty, caused by increased competition and centralization of mining power, creates the need for new solutions for retail investors to participate in Bitcoin mining. This aims to both decentralize the network and maintain Bitcoin as a beneficial activity for individuals.

Bitcoin Minetrix was launched to provide secure and transparent Bitcoin mining rewards to individual investors through an innovative decentralized Bitcoin cloud mining approach.

Key highlights of the ruling regarding the superiority of BTCMTX over Monero tokens:

- A distinct edge in the market: In an industry with numerous cloud mining platforms, Bitcoin Minetrix has carved out a unique niche for itself. This initiative introduces the first-ever tokenized Bitcoin cloud mining, featuring an automated system designed for cloud-based Bitcoin mining. This sets a new standard in the industry.

- Safety first with the Ethereum blockchain: Bitcoin Minetrix runs on the proven and trusted Ethereum blockchain. This ensures maximum security and reliability, allows users to avoid risks associated with external mining pools, and provides a safeguard against potentially fraudulent cloud mining services.

- Defending true decentralization: At its core, Bitcoin Minetrix supports the ethos of decentralization. In an era where centralization often introduces vulnerabilities, Bitcoin Minetrix breaks the mold and redistributes mining profits from large corporations to individual retail investors through a new Stake-to-Mine system.

- Take advantage of the Bitcoin halving opportunity: Perfectly poised to take full advantage of the upcoming Bitcoin halving, Bitcoin Mytrix presents a golden opportunity for investors. While an impending halving may seem daunting to miners due to reduced block rewards, historically, such events have driven up Bitcoin's value. Bitcoin Minetrix provides a platform for investors to take advantage of this potential surge without the associated capital risk.

- BTCMTX Presale Opportunity: The ongoing BTCMTX presale has already generated significant interest, with over $9.1 million raised towards the $9.5 million goal.at competitive price Just $0.0133 per tokenearly investors have a unique opportunity to be at the forefront of this staking-to-mining evolution.

Conclusion: Don't miss BTCMTX

In short, Bitcoin Minetrix will redefine the Bitcoin landscape. The innovative methodology, strict security measures and huge potential of the stake-to-mining mechanism beckon as a lucrative opportunity for early investors.

Join the BTCMTX presale now and secure your place in this transformational journey.

Buy BTCMTX here

Disclaimer: Cryptocurrency is a high-risk asset class. This article is for informational purposes only and does not constitute investment advice. You could lose all your capital.