On-chain data confirms that older Bitcoin (BTC) whales are selling BTC tokens to traditional institutional investors as the first-born cryptocurrency continues to gain interest on Wall Street.

Ki Young Ju, founder and CEO of CryptoQuant, highlighted this phenomenon in a recent analysis, drawing attention to a comparative analysis of Bitcoin supply and demand across old and new whale addresses.

This data suggests that the Bitcoin network is experiencing a surge in demand from emerging whale entities, coinciding with increased sales activity among established whale addresses.

This observed pattern could indicate that older addresses are looking to capitalize on profits from their Bitcoin holdings, especially during the current price discovery phase where BTC has soared above $73,000. there is.

This indicator reveals that the current pattern has been observed in the market for the past two cycles. Notably, this trend appeared in his early 2017 coinciding with the beginning of his 2017 bull cycle. Since then, Bitcoin has skyrocketed from $966 in January 2017 to a high of $19,666 in December 2017.

The bull market at the time lasted 332 days with significant ownership changes. Market participants, especially the bullish investors who entered in 2017, resumed this pattern in the 2021 bull market, selling BTC to new whale entities over a period of 136 days.

Data shows that a new population of whale entities is emerging during the current bull market. However, an interesting departure from this pattern is that these new whales are primarily comprised of traditional institutional investors who have shown strong interest in BTC.

This is largely due to the approval and success of the Spot Bitcoin ETF. These investment products introduced BTC to Wall Street. Bitcoin spot ETFs have been experiencing capital outflows, but this week they recorded inflows for two consecutive days, indicating renewed interest.

Bitcoin has room for further growth

On the other hand, continued ownership transitions have historically coincided with market peak periods. As a result, this indicator shows that Bitcoin may still have significant room for growth as new accumulation trends are minimal at the time of reporting.

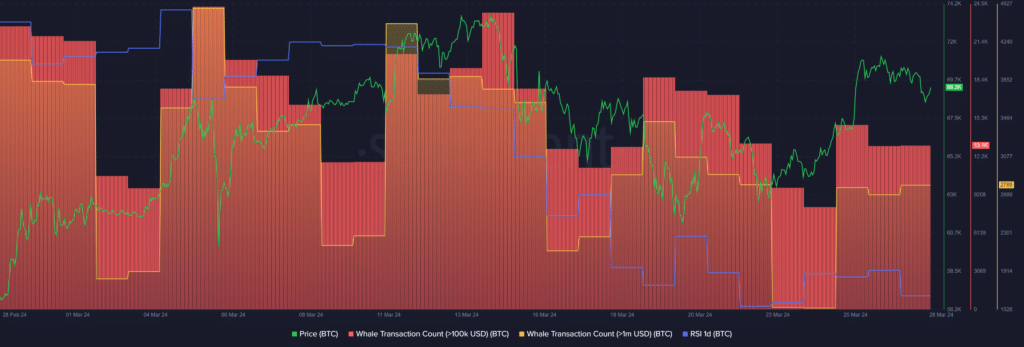

Furthermore, even though Bitcoin's current position is above the $70,000 mark, its daily relative strength index (RSI) is 45, meaning the cryptocurrency is still well below overbought levels. is shown. This reaffirms the idea that this asset has plenty of potential to rise further.

The number of whale transactions consisting of at least $100,000 worth of BTC has hovered around 13,100 over the past two days, according to data provided by Santiment.

The number of transactions consisting of at least $1 million worth of BTC increased by 3.8%, with the number of unique transactions per day increasing from 2,691 to 2,789.

Due to high whale activity at the moment, Bitcoin may enter a slightly volatile zone.

Bitcoin is currently trading at $70,759, up 1.61% in the past 24 hours. The crypto asset has risen over 4% in the last week as it attempts to recoup losses from the past few days.