Binance, one of the leading crypto exchanges by trading volume, announced on February 6th, Aragon (ANT), Multichain (MULTI), VAI (VAI), and Privacy Coin Monero (XMR) on February 20th. announced that it would be delisted.

According to the statement, Binance will suspend all trading of their respective trading pairs, including ANT/BTC, MULTI/USDT, USDT/VAI, BNB, BTC, ETH, and XMR against USDT. Once the delisting takes effect, all related outstanding orders will also remain canceled.

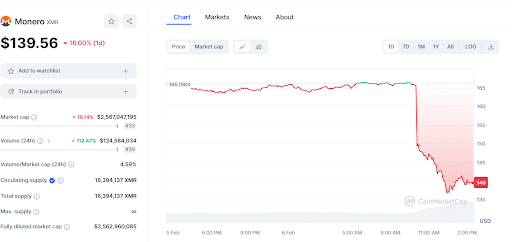

Of the four cryptocurrencies, Monero, which emphasizes anonymity, and Multichain, a cross-chain asset transfer protocol, recorded significant double-digit declines after Binance's announcement. XMR fell 17% in the past 24 hours to trade at $139.51.

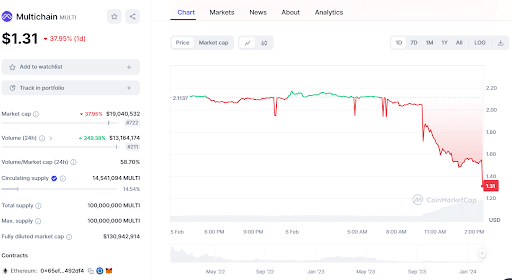

After the news broke, MULTI also fell more than 29% to its stock price of $1.31, according to data from CoinMarketCap.

Both tokens have also seen a significant increase in trading volumes, indicating that traders are rapidly selling or transferring their holdings in response. XMR trading volume surged 77% to $102 million, while MULTI trading volume surged nearly 190% in 24 hours.

Interestingly, this isn't the first time privacy coins have faced tough times recently. In early December 2023, leading rival exchange OKX announced that it would suspend deposits in XMR and Zcash and would completely delist both from March 2024 onwards. Dash and Horizen were also removed as they did not meet publication standards.

The increased regulatory focus on private cryptocurrencies is prompting major companies to limit their exposure. For Monero holders, the recent delisting of Binance is another blow that could impact mainstream status and adoption.