This Friday, the spotlight will be on Deribit, the leading crypto derivatives exchange as it gears up for a notable event in trading history. Notably, the exchange is poised to witness the expiration of over $9.5 billion in Bitcoin options open interest.

For context, Open interest refers to the total number of outstanding derivative contracts, such as futures and options, that are not settled or closed. It represents the number of contracts held by market participants at the end of each trading day.

This surge in open interest recorded by Deribit reflects an increase in market participants and indicates increased liquidity, making it a notable milestone in the crypto derivatives industry.

record building height

In particular, this event is significant in two ways. It underlines the growing interest in Bitcoin as an asset class and highlights the growing “sophistication” of the crypto market.The reason for that is Open interest also serves as an important indicator of market health and trader sentiment.

As such, the record open interest expiring on Deribit suggests an “active” trading environment as more investors tap into complex financial instruments such as options.

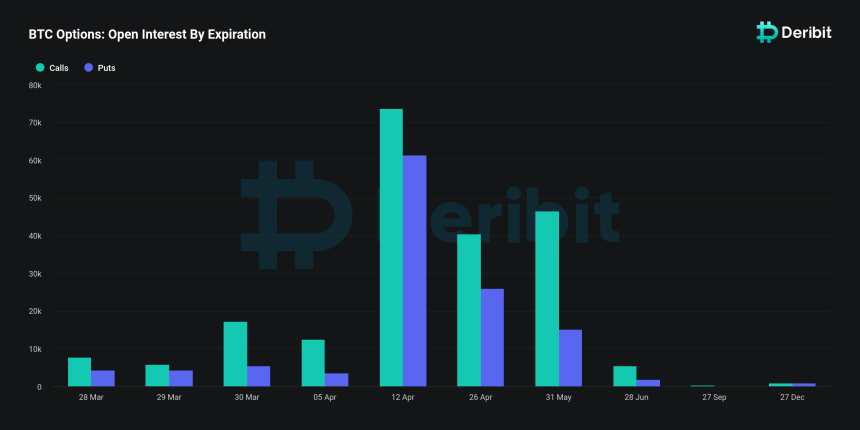

The exchange is set to have its largest option expiration date ever, with $9.5 billion worth of Bitcoin options set to expire at the end of this month, according to Deribit data. This number represents a significant portion of the exchange's $26.3 billion in total options open interest, about 40%.

The size of this expiry event was higher than the previous month, with total end-of-month expirations for January and February being $3.74 billion and $3.72 billion, respectively. This trend indicates a significant increase in market activity and investor engagement on the platform.

Impact of Bitcoin expiration date

The upcoming expiration date will have a noticeable impact on the market, especially considering Bitcoin's current price trend.

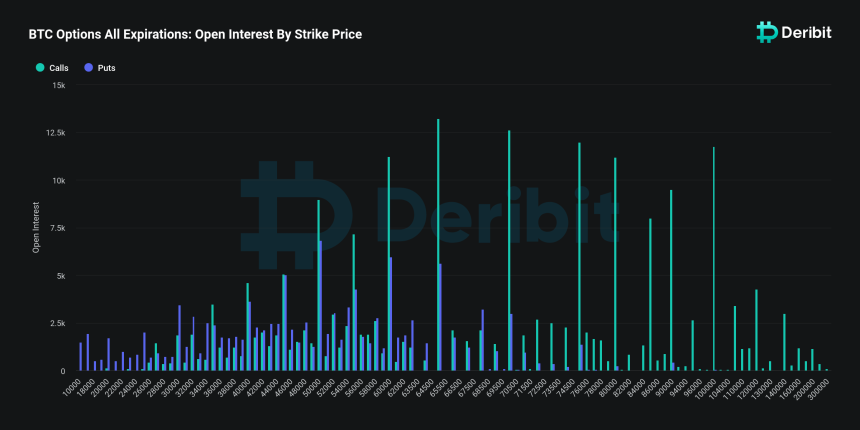

According to analysts at Deribit, Bitcoin's spot price remains below $70,000, with an estimated $3.9 billion of open interest expected to expire “in the money.” This represents a lucrative opportunity for option contract holders.

The “maximum pain” price represents the strike price at which the most options would expire worthless, thereby causing the greatest economic loss to the option holder, and is identified as $50,000.

According to the analysts, this scenario suggests that a significant number of traders stand to benefit from current market conditions and could lead to “increased buying activity” if these options are exercised. It is said that there is

Additionally, Deribit analysts speculate that high levels of “in-the-money expiration” could exert upward pressure on Bitcoin prices and amplify market volatility. . They believe the market is witnessing high activity as traders “hedge positions” or “speculate on future price movements”, which could impact Bitcoin's price trajectory in the short term. He added that there is.

This occurred as Bitcoin was experiencing a slight retracement from recent highs above $73,000, with the price consolidating around $68,946 at the time of this writing.

Featured image from Unsplash, chart from TradingView